Payroll in India is a complex function because employers must handle salaries, variable pay, attendance, leave rules, deductions, and constantly changing statutory norms every single month. For SMEs running on..

Running a business is hard. However SMB payroll often becomes harder than it should be. Every month, small and mid-sized businesses fight the same battle: calculating salaries, handling deductions, managing..

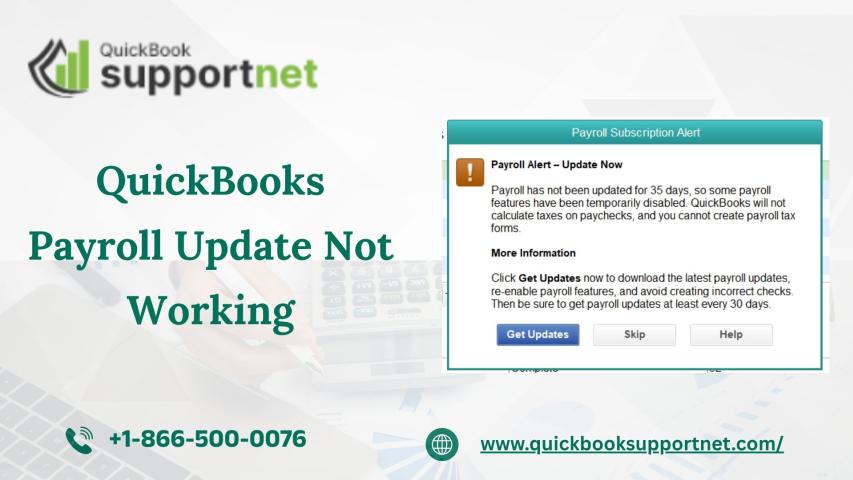

Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation..

Audits are no longer rare, reactive events. Instead, they are frequent, data-driven, and increasingly automated. Consequently, businesses that rely on spreadsheets or fragmented payroll processes expose themselves to unnecessary risk...

Managing payroll efficiently is critical for any business, and QuickBooks is a popular tool designed to make this process seamless. However, one common problem that businesses face is QuickBooks Payroll..

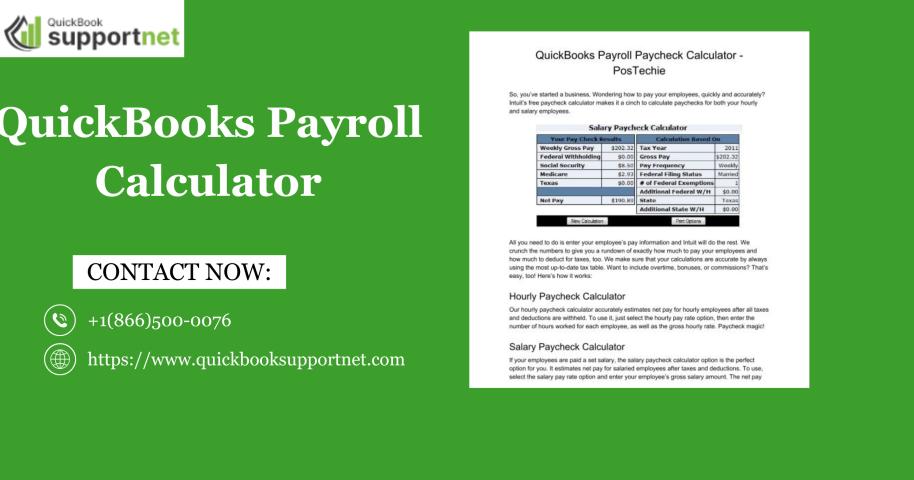

Managing payroll can feel overwhelming, but with the QuickBooks Payroll Calculator (also known as the quickbooks paycheck calculator or payroll calculator quickbooks), you can simplify the process. Whether you’re calculating..

If you are encountering issues where your QuickBooks Payroll Update Not Working, you’re not alone. Many users rely on QuickBooks for accurate payroll management, but errors in updates can disrupt..

Managing payroll is one of the most critical tasks for any business, and encountering a QuickBooks Payroll Update Error can disrupt your workflow, causing delays in employee payments and accounting..

You may be stuck with a plethora of issues when sending payroll data or direct deposit paychecks. One common one is the QuickBooks Payroll internet connection error that comes up..

As a financial business in modern times, your customers expect money to move as fast as their messages. Even a single delay can shift them towards alternative options. And you..

Enterprise software is the key to the functioning of organizations and their expansion, as well as the safety of their online space. Software systems will serve effectively with high reliability..

When AI first started coming into recruitment, we entered one of the industry’s most contentious debates: Will recruiting technologies like AI replace human recruiters? As we move through 2025, the..

Software-as-a-Service (SaaS) has evolved from a simple cloud delivery model into a central pillar of enterprise innovation. For large corporations managing complex global operations, SaaS platforms offer agility, security, and..

Finding and hiring the right people is really hard, it’s like running another business. You get a lot of resumes that you don’t even know where to start, the interviews..

Most projects don’t fail mid-way—they fail before they start because teams skip the software project discovery phase. Discovery aligns business goals with technical realities, clarifies scope and risks, and sets..

In today’s digital age, network marketing businesses can no longer rely on spreadsheets, manual tracking, or fragmented tools. That’s where network marketing software steps in the backbone solution that automates,..

Network marketing has changed a lot over the past decade. Gone are the days of living room presentations and endless paperwork. Today, digital funnels, social media, and smart tools are..

In 2025, software is more than code it’s the digital backbone of business, the bridge to customers, and the engine behind innovation. Companies of all sizes rely on technology not..