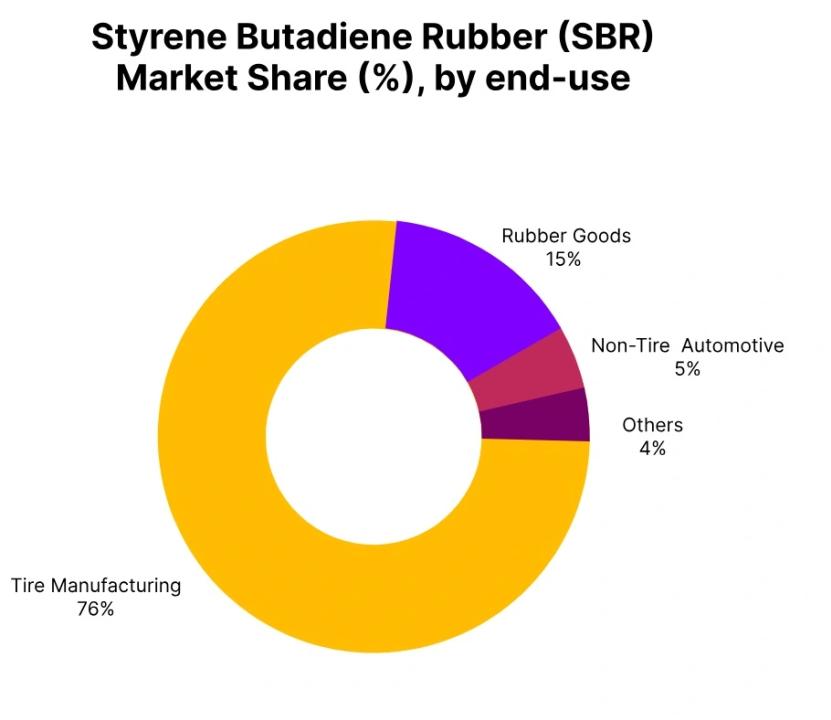

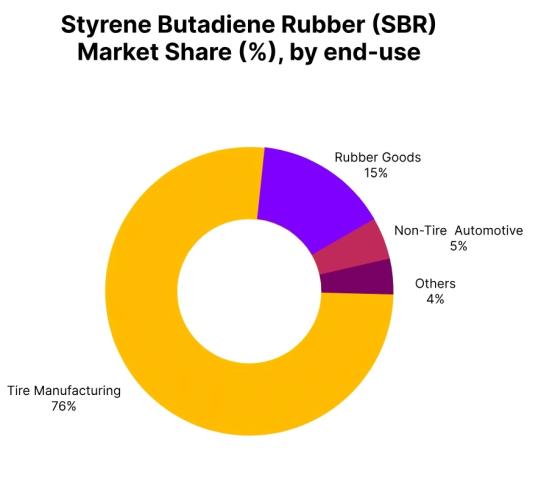

The SBR price trend during the third quarter of 2025 reflected a market that remained largely resilient despite regional differences in demand, supply, and cost pressures. Styrene Butadiene Rubber (SBR), a key material used widely in tire manufacturing, automotive components, belts, hoses, and industrial rubber products, continued to follow the overall health of the automotive and industrial sectors. Across global markets, SBR Prices showed moderate movement, with most regions recording changes within a narrow range.

Globally, SBR Prices moved upward by around 1–2% during Q3 2025. This modest growth was mainly supported by stable demand from automotive manufacturing, especially tire production, and steady raw material availability. While some regions experienced price gains due to healthy consumption, others faced downward pressure caused by weaker demand, refinery disruptions, or logistical challenges. Overall, the market remained balanced, avoiding extreme volatility.

Asia-Pacific Market Overview

The Asia-Pacific region played a major role in shaping the global SBR price trend in Q3 2025. Countries such as Japan, South Korea, Indonesia, Thailand, China, and India showed varying market behavior depending on local demand conditions and supply chain dynamics.

In South Korea, SBR Prices increased by around 1.4% during the quarter. Demand from automotive and industrial manufacturing remained steady, as SBR continued to be widely used in tires, belts, and hoses. Stable refinery operations, manageable raw material costs for styrene and butadiene, and smooth shipping conditions helped support this upward trend. In September, prices rose slightly again, reflecting ongoing strength in automotive demand.

Japan also saw a positive SBR price trend for most of Q3 2025, with prices rising by approximately 2%. Strong demand from tire manufacturers and industrial users supported the market. However, toward the end of the quarter, prices dropped by over 3% in September due to adjustments in raw material costs and some refinery and logistics challenges. Despite this short-term decline, Japan’s market remained fundamentally strong, supported by consistent end-use demand.

In Indonesia, SBR Prices followed a clear upward path during the quarter, increasing by around 1.4%. Strong automotive production and steady industrial activity kept demand firm. Stable raw material pricing and efficient shipping logistics allowed suppliers to meet market needs without disruption. Prices continued to rise slightly in September, indicating sustained demand.

Thailand also recorded a quarterly increase of about 2% in SBR Prices, supported by automotive and industrial demand. Tire manufacturing remained a key driver. However, September saw a sharp monthly decline, suggesting temporary supply or demand adjustments. Even so, the broader outlook remained positive, with automotive demand continuing to underpin the market.

On the other hand, China experienced a different trend. SBR Prices declined by around 3% during Q3 2025, mainly due to slower demand from automotive and industrial manufacturing sectors. Fluctuating raw material costs, refinery adjustments, and logistics disruptions added pressure. However, September brought a slight rebound, indicating that the market may be stabilizing as supply chains adjust and demand slowly recovers.

India also faced a challenging quarter, with SBR Prices falling by approximately 2%. Weak demand from automotive and industrial sectors, combined with volatile raw material costs and some production and logistics issues, weighed on prices. By September, prices stabilized, suggesting that the worst of the decline may have passed, although recovery will depend on improved demand from end-use industries.

Europe Market Dynamics

The European SBR price trend in Q3 2025 was mixed, reflecting uneven demand and ongoing economic pressures.

In Poland, SBR Prices increased by around 1.1% during the quarter. Stable demand from automotive and industrial sectors supported the market, while smooth refinery operations and limited shipping disruptions helped maintain supply stability. Prices continued to edge up slightly in September, indicating steady market conditions.

In contrast, Germany experienced a downward SBR price trend, with prices falling by around 3% during Q3 2025. Weak demand from automotive and industrial sectors played a major role in this decline. Fluctuating raw material costs, lower refinery throughput, and logistics disruptions further pressured prices. By September, prices showed signs of stabilization, suggesting that demand may be leveling out, although challenges remain.

Overall, Europe’s SBR market reflected cautious buying behavior and uneven industrial activity. While some countries managed small gains, others struggled with demand softness and cost pressures.

North America Market Overview

In the United States, the SBR price trend remained relatively stable with a slight upward bias during Q3 2025. Demand from tire manufacturing and industrial applications remained consistent, supporting prices. Despite fluctuations in raw material costs, refinery operations remained stable, and shipping logistics faced minimal disruption.

In September, SBR Prices edged slightly higher, reflecting continued strength in automotive demand. The U.S. market benefited from balanced supply chains and steady consumption, making it one of the more stable regions globally during the quarter.

Africa and South America Insights

In South Africa, SBR Prices increased by around 1% during Q3 2025. Continued demand from automotive and industrial sectors supported this growth. Stable refinery operations and relatively smooth logistics helped maintain supply consistency. September saw minimal price movement, indicating a stable market outlook.

Although South America was not deeply detailed across multiple countries, markets connected to global trade flows reflected similar patterns: steady demand, cautious buying, and limited price volatility tied closely to automotive sector performance.

Key Factors Influencing the SBR Price Trend

Several common factors shaped the global SBR price trend in Q3 2025:

Automotive demand remained the primary driver, especially tire manufacturing.

Raw material costs for styrene and butadiene influenced price direction, particularly in regions facing volatility.

Refinery throughput affected supply availability, especially in China, Germany, and India.

Shipping and logistics conditions played a role in regional price differences.

Cautious buying behavior limited sharp price movements despite stable demand.

Market Outlook

Looking ahead, SBR Prices are expected to remain generally stable with moderate fluctuations. Regions with strong automotive production and stable supply chains may see mild price support, while markets facing weaker demand or logistical challenges could continue to experience pressure. Overall, the SBR market is likely to remain balanced, closely following trends in the global automotive and industrial sectors.

In summary, Q3 2025 showed that the SBR market remains resilient. While regional differences were clear, the global SBR price trend reflected stability, adaptability, and strong dependence on end-use demand, especially from the automotive industry.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/