The DPGME Price Trend is an important topic for industries that rely on high-performance solvents and glycol ethers. DPGME, or dipropylene glycol monomethyl ether, is commonly used in paints, coatings, cleaners, inks, and electronics manufacturing. Because it is closely linked with industrial activity, its pricing behavior often reflects broader market conditions. Looking at the price trend helps buyers and sellers understand how the market moves over time rather than focusing only on short-term changes.

In simple daily terms, prices change when production costs, demand, or supply conditions shift. The DPGME Price Trend shows how these factors come together and shape the market in a steady and understandable way.

Key Factors Influencing Market Movement

One of the main drivers behind the DPGME Price Trend is raw material availability. DPGME is produced from petrochemical-based inputs, and changes in feedstock supply can affect production costs. When raw materials become expensive or less available, manufacturers may adjust output, which eventually influences pricing levels.

Energy costs also play a major role. Producing chemical solvents requires stable energy supply, and higher fuel or electricity prices can increase operating expenses. Over time, these cost changes are reflected in DPGME Prices as producers try to balance profitability with market demand.

Role of Industrial Demand

Industrial demand strongly shapes both the DPGME Price Trend and overall market behavior. Sectors such as construction, automotive, and electronics rely on DPGME for its excellent solvency and performance. When these industries experience growth, demand for DPGME increases naturally.

Higher demand can put pressure on supply, especially if production capacity remains unchanged. This situation often leads to firm or rising DPGME Prices. During slower economic periods, demand may soften, which can bring stability or mild corrections in the price trend.

Understanding DPGME Prices in Daily Business

DPGME Prices are not just numbers on a chart; they directly affect purchasing decisions and production planning. For manufacturers, even small price changes can impact budgets when buying large volumes. For distributors, pricing affects inventory strategies and customer relationships.

When the market is balanced, DPGME Prices tend to move within a predictable range. This stability allows businesses to plan ahead with confidence. Sudden changes usually occur only when unexpected events disturb supply or demand.

Supply Chain and Production Conditions

Supply chain efficiency has a strong influence on the DPGME Price Trend. Smooth logistics, reliable transportation, and consistent plant operations help maintain steady supply. When everything runs well, prices remain relatively stable.

However, supply chain disruptions such as shipping delays, maintenance shutdowns, or regional production issues can tighten availability. These situations may cause short-term increases in DPGME Prices as buyers try to secure material and sellers manage limited supply.

Regional Market Differences

The DPGME Price Trend can differ from one region to another. Areas with strong local production often experience more stable pricing because supply is closer to demand. In contrast, regions that depend heavily on imports may see more price variation.

Transportation costs, currency fluctuations, and local regulations all contribute to regional differences in DPGME Prices. Environmental and safety standards can also affect production costs, which may gradually influence the price trend in specific markets.

Market Cycles and Long-Term Trends

Like many chemical products, the DPGME Price Trend often follows market cycles. During periods of economic growth, industrial output increases, supporting higher demand and firmer prices. During slower phases, prices may level out as demand eases.

Long-term trends are especially useful for decision-making. Instead of reacting to short-term fluctuations, businesses that track the broader DPGME Price Trend can understand whether the market is generally strengthening or stabilizing. This long-term view reduces uncertainty and supports smarter planning.

Impact of Technology and Efficiency

Advances in production technology can positively influence the DPGME Price Trend over time. Improved efficiency helps reduce waste, control energy use, and increase output consistency. These improvements allow producers to manage costs more effectively, even when external pressures exist.

While technology upgrades require investment, they usually support long-term stability rather than immediate price reductions. Over time, efficiency gains help create a more balanced market for DPGME Prices.

How Businesses Use Price Insights

For buyers, understanding the DPGME Price Trend helps with timing purchases and managing costs. Instead of reacting to sudden changes, businesses can align procurement strategies with expected market movements. This approach supports better budgeting and risk management.

Suppliers also benefit from monitoring DPGME Prices closely. Clear insight into pricing conditions helps them plan production schedules, manage inventories, and maintain steady relationships with customers.

Conclusion

The DPGME Price Trend reflects a combination of raw material costs, energy prices, industrial demand, and supply chain conditions. While short-term changes are part of normal market behavior, long-term trends provide valuable clarity. By understanding both the DPGME Price Trend and DPGME Prices, businesses can make informed decisions with greater confidence. Overall, this awareness supports stability and efficiency across industries that depend on this versatile solvent.

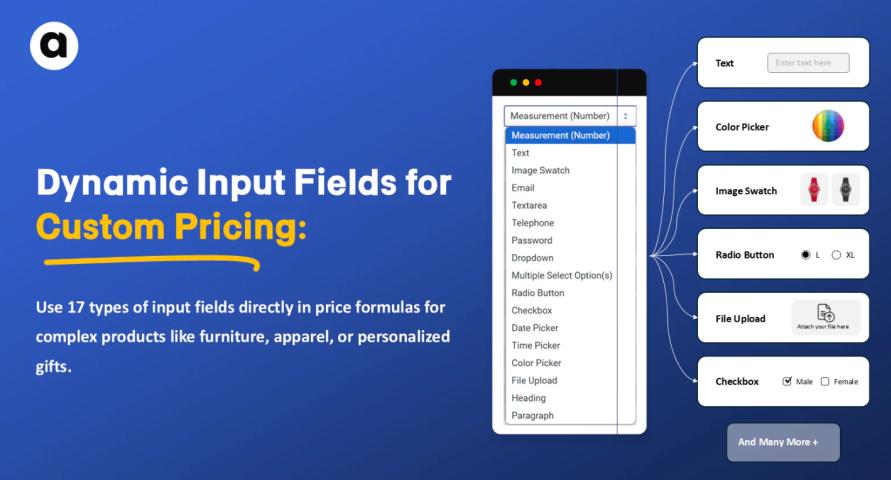

About Price-Watch™

Price-Watch™ is an India-based, independent price reporting agency (PRA) that provides real-time price forecasts and data-driven insights into global raw material markets. It specializes in tracking prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand–supply dynamics. Price-Watch™ reporting goes beyond prices to include grade-level insights, applications, and country-level demand intelligence you can trust. Powered by AI forecasting and over a decade of historical data, the Price-Watch™ platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions and turn market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

Linkedin: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/