Insurance plays a vital role in financial protection by safeguarding individuals and families from unexpected events such as medical emergencies, accidents, disability, or the loss of an earning member. Life,..

Corporate leaders often focus their attention on revenue growth, innovation, and operational efficiency, but one of the most underestimated pillars of sustainable success is insurance. Far from being a mere..

Launching a startup means navigating uncertainty, tight budgets, and constant pressure to grow. Amid the hustle of product development, hiring, and fundraising, insurance is often overlooked—until it's too late.Risk Is..

The unified architecture of modern underwriting platforms transforms isolated data into actionable business insights. Insurance organizations who implement insurance underwriting software gain the capability to deliver personalized services that align..

Car insurance is more than just a legal requirement—it is a critical tool for protecting yourself, your vehicle, and the passengers who travel with you. Among the wide range of..

Buying car insurance is an essential

part of responsible vehicle ownership. In India, the car insurance market has

grown rapidly, offering multiple options for comprehensive and third-party

coverage. However, choosing..

Star Health Insurance refers to health insurance plans offered by Star Health and Allied Insurance Company, one of India’s leading standalone health insurance providers. Established in 2006, the company focuses..

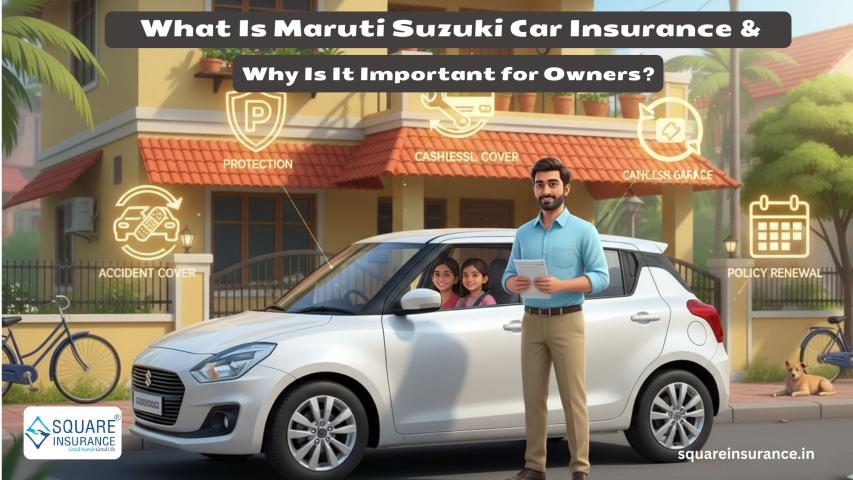

Maruti Suzuki is one of the most

trusted car brands in India. From small hatchbacks to family cars and compact

SUVs, Maruti Suzuki vehicles are known for their mileage, easy..

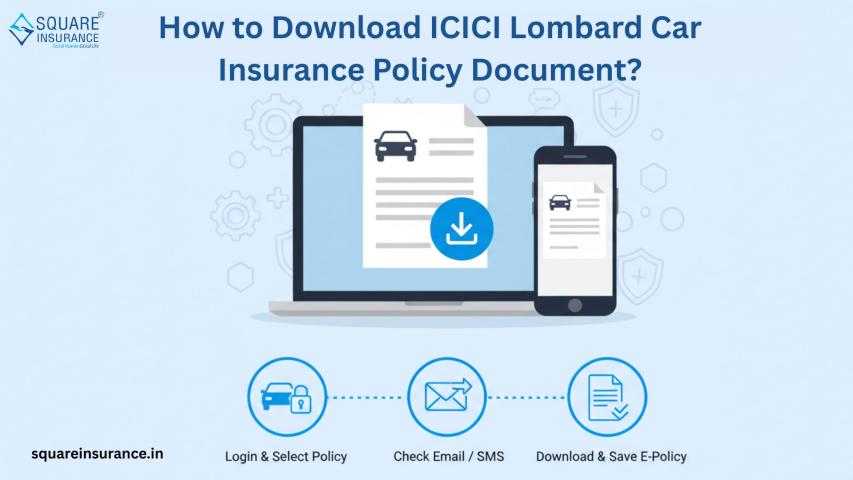

With the rapid shift toward digital

insurance services in India, accessing your car insurance policy online has

become simple and convenient. Whether you need a soft copy for traffic

verification,..

Car insurance is an essential part

of owning a vehicle in India. It provides financial protection against

accidents, theft, natural disasters, and third-party liabilities. Once you

purchase a policy, the..

Regulatory compliance becomes seamless with built-in workflow checks. Insurance claims adjuster software maintains unalterable digital audit trails, documenting every decision and action taken during claims processing. This automatic documentation eliminates..

Claims processing success depends on customer trust. Policyholders expect clear explanations when filing claims, especially during stressful situations. Explainable AI insurance claims processing software delivers this transparency while maintaining processing..

Automation makes every claim processing step more efficient from the first notice of loss to final payment. The automated claims processing insurance solutions handle routine cases without human intervention. This..

The right claims automation solution delivers advantages that extend beyond basic efficiency improvements. Fraud detection capabilities in automated claims processing solutions improve significantly when advanced algorithms analyze claim patterns. Staff..

Insurance companies should approach claims automation as a strategic investment rather than just a technology upgrade. Those who assess their specific requirements before insurance claims processing automation solution implementation achieve..

Revolutionize payer operations with AI-powered healthcare claims management software that enhances claims accuracy, minimizes denials, and accelerates settlements — delivering a seamless experience for payers while reducing administrative burdens.Streamline claims..

The future of global insurance depends on how effectively companies can navigate regulatory differences across borders. Claims processing automation represents a strategic necessity for insurers with international ambitions. Companies that..

Several insurance firms continue to manage legacy insurance claims processing software in their digital infrastructure. Such insurers can modernize these systems by enabling integrations with AI agents. These agents can..