The global Device as a Service (DaaS) Market is expanding rapidly as enterprises shift from traditional device ownership models to subscription-based service offerings, driven by the digital transformation wave and the need for operational flexibility. DaaS solutions provide organizations with hardware, software, and management services bundled in a single subscription, allowing businesses to reduce upfront capital expenditure, optimize IT resources, and enhance workforce productivity with up-to-date devices.

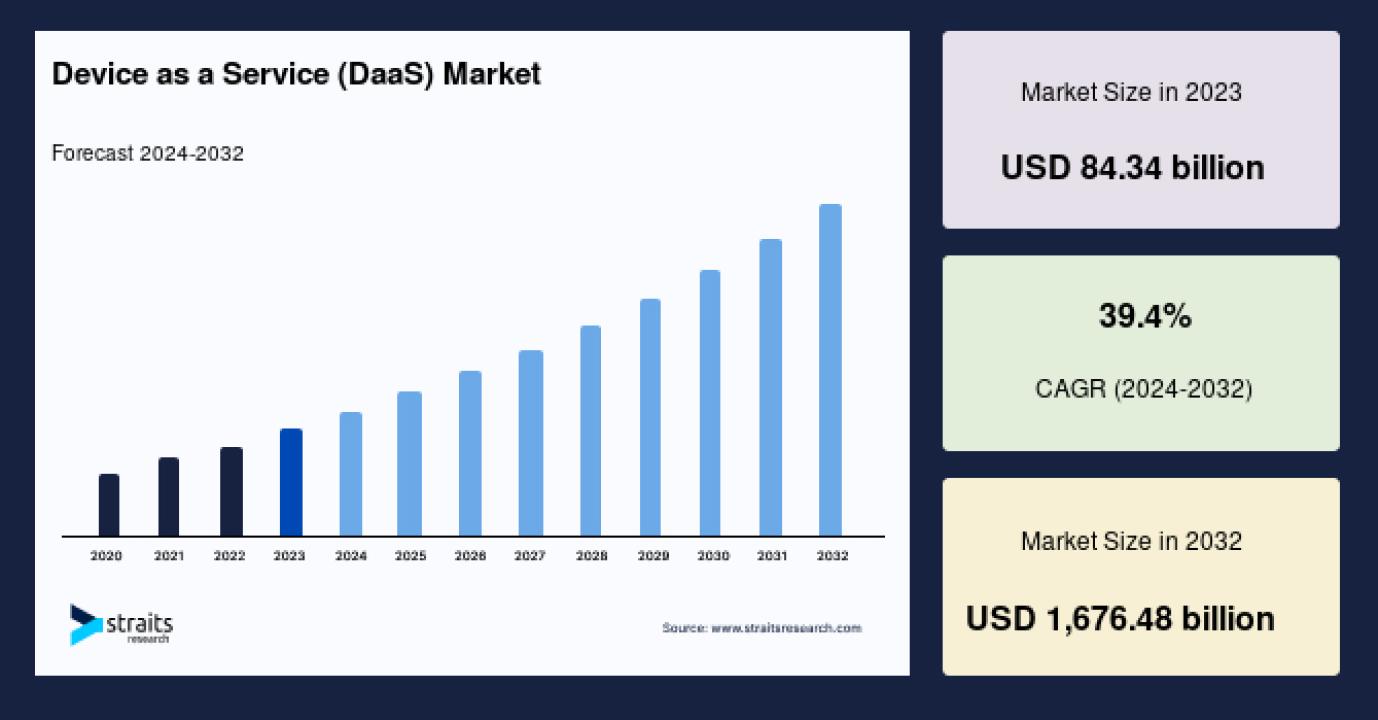

Market Size 2023 — USD 28.47 billion

Market Size 2024 — USD 34.19 billion

Market Size 2032 — USD 102.83 billion

CAGR (2024–2032) — 14.8%

For a detailed report with in-depth analysis and forecasts, request your sample here: https://straitsresearch.com/report/device-as-a-service-market/request-sample

Market Drivers

The primary driver for DaaS market growth is the increasing demand for flexible and scalable IT infrastructure that keeps pace with rapidly evolving technology needs. Many organizations, especially SMEs and large enterprises, prefer OpEx models that avoid heavy upfront hardware investments and allow predictable budgeting.

The COVID-19 pandemic accelerated the adoption of remote work, boosting demand for efficient device provisioning and management solutions. DaaS enables seamless remote device deployment, updates, and lifecycle management without burdensome IT overhead, improving workforce agility.

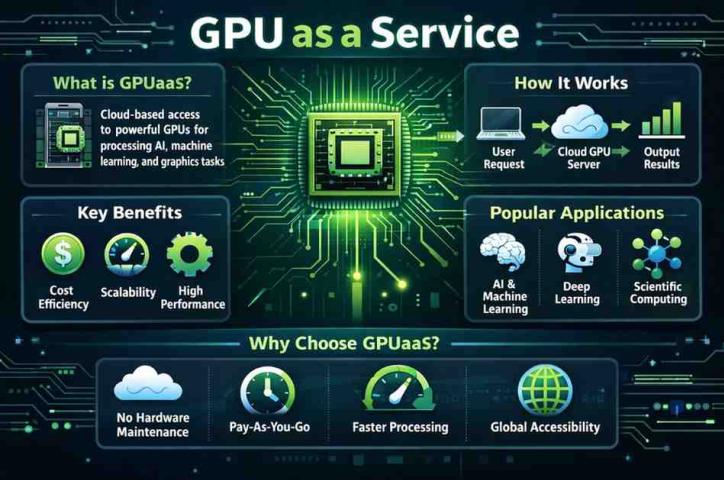

Technological advancements in cloud computing, AI, and analytics integrated within DaaS platforms provide enhanced asset tracking, predictive maintenance, and security management, further incentivizing adoption.

Enterprises are also motivated by the need to address security risks related to endpoint devices. DaaS providers offer comprehensive device security, including encryption, remote wipe, and compliance monitoring, minimizing data breach exposure.

Market Challenges

Despite the benefits, some barriers restrict DaaS adoption. High dependency on service providers for critical hardware functions raises concerns about service reliability, data privacy, and vendor lock-in.

Complex integration with existing IT infrastructure and proprietary systems, especially in large organizations, adds to implementation challenges. Compatibility issues can affect service quality.

While OpEx reduces initial capital requirements, over long device lifecycles, subscription fees may become costlier than traditional ownership, especially if usage is not optimized.

Concerns about data security and end-of-life device management persist despite provider assurances.

Market Segments

The DaaS market segmentation is based on device type, organization size, end-user industry, and region:

By Device Type:

- Desktops: Offer centralized computing with easier management, still preferred in corporate offices.

- Laptops: Most demanded segment due to mobility needs for remote and hybrid workforces.

- Smartphones & Tablets: Increasing penetration fueled by Bring Your Own Device (BYOD) policies and mobile workforce requirements.

- Others: Includes monitors, printers, and peripherals, but holds a smaller market share.

By Organization Size:

- Small and Medium Enterprises (SMEs): Largest growth segment benefiting from scalability, cost-effectiveness, and minimal IT staff requirements.

- Large Enterprises: Fastest-growing segment due to extensive IT asset portfolios and complex management needs.

By End-user Industry:

- IT and Telecom: Largest user base, driven by rapid tech upgrades and cloud adoption.

- BFSI: Strong demand for secure, compliant device management across branches and mobile employees.

- Healthcare: Increasing device requirements for patient data access and remote monitoring.

- Manufacturing and Retail: Adopting DaaS to improve operational efficiency and field workforce connectivity.

- Government and Education: Expanding their IT asset management capabilities with demand for secure procurement.

By Region:

- North America: Dominates market revenue with advanced IT adoption, service provider presence, and cloud infrastructure.

- Europe: Significant growth fueled by digital transformation policies and hybrid working models.

- Asia Pacific: Fastest growing region supported by high IT spending, urbanization, and SME expansion.

- Latin America, Middle East & Africa show emerging interest and growing investments.

For detailed segmentation data and purchase options, visit: https://straitsresearch.com/buy-now/device-as-a-service-market

Top Players Analysis

Leading vendors in the Device as a Service market include:

- HP Inc.

- Dell Technologies

- Lenovo Group Limited

- Cisco Systems, Inc.

- Microsoft Corporation

- IBM Corporation

- Apple Inc.

- CloudJumper LLC

- CDW Corporation

- Insight Enterprises, Inc.

These key players leverage vast global IT service capabilities combined with hardware excellence to deliver customized DaaS solutions. HP, Dell, and Lenovo dominate device sales and maintenance, while Microsoft, IBM, and Cisco complement offerings with cloud, security, and network services. Companies invest heavily in expanding managed service portfolios, cloud integration, AI analytics, and security features to provide end-to-end DaaS experiences globally.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQs)

What is the global Device as a Service market size in 2023 and forecast for 2032?

Market Size 2023 — USD 28.47 billion

Market Size 2024 — USD 34.19 billion

Market Size 2032 — USD 102.83 billion

CAGR (2024–2032) — 14.8%

What are the main drivers for DaaS market growth?

Remote work adoption, OpEx preference, operational flexibility, and enhanced security needs.

Which device types dominate the DaaS market?

Laptops lead, followed by desktops, smartphones, and tablets.

What challenges hinder DaaS adoption?

Service dependency, integration complexity, and cost concerns over time.

Which industries are major adopters of DaaS?

IT & Telecom, BFSI, healthcare, manufacturing, retail, government, and education sectors.