The global virtual cards market is experiencing unprecedented growth, fueled by the acceleration of digital transactions, corporate digitization, and the rising demand for secure, seamless payment solutions. Virtual cards unique digital payment instruments generating one-time or limited-use card numbers—are increasingly becoming the preferred choice for businesses and consumers who value efficiency and protection in online payments.

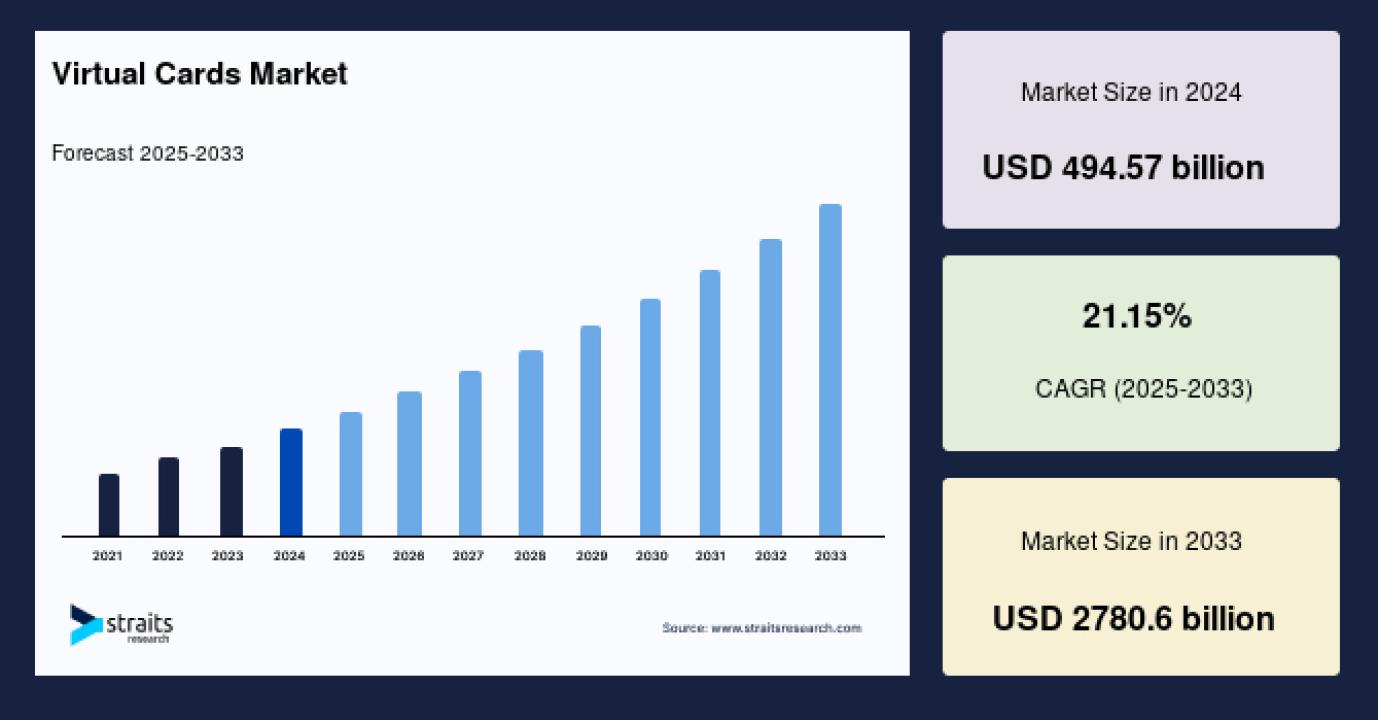

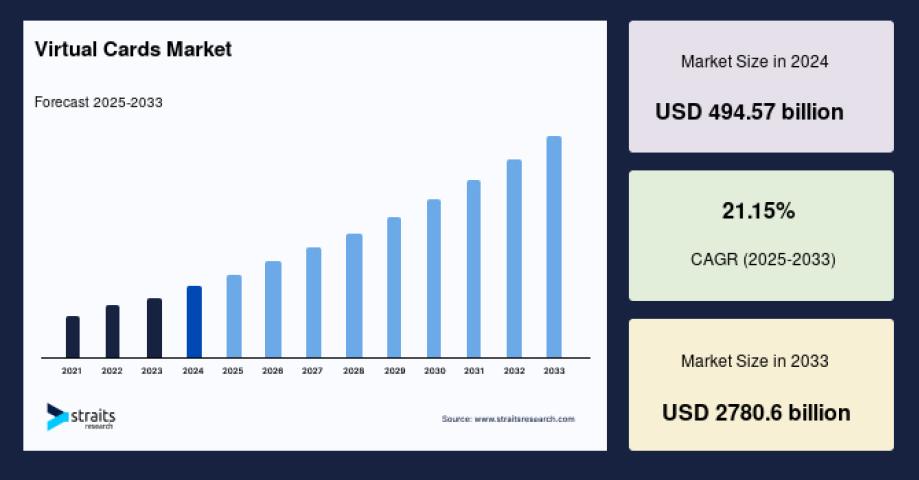

According to Straits Research, the market was valued at USD 494.57 billion in 2024 and is projected to rise from USD 599.17 billion in 2025 to an impressive USD 2,780.6 billion by 2033, registering a robust CAGR of 21.15% (2025–2033). This surge underscores the market’s pivotal role in shaping the next era of digital finance.

📄 Request Sample Report: Virtual Cards Market Sample

Introduction to the Virtual Cards Market

A virtual card, often referred to as a digital card, is an electronic payment tool used for online transactions and purchases. Unlike traditional plastic cards, virtual cards provide flexible, highly controlled spending mechanisms by generating unique numbers for each use. This advanced security significantly reduces fraud risks while offering convenience for both individuals and enterprises.

With smartphone penetration, the proliferation of e-commerce, and consumer preference for touchless payments, virtual cards are quickly becoming integral to everyday financial activity.

Market Drivers

The global virtual cards market is expanding rapidly due to several key growth drivers:

Rising Electronic Transactions: Growing volumes of e-commerce and digital banking are accelerating adoption.

Enhanced Security: Single-use or limited-use card numbers drastically reduce fraud.

Cost Savings for Businesses: Lower administrative and transaction costs make virtual cards highly attractive for corporations.

Touchless Payments: Increasing popularity of mobile-first, contactless transactions.

Strong Investment Flow: Venture capital and fintech innovation are driving the development of next-gen solutions.

Market Challenges

Despite strong growth, the virtual cards industry faces certain hurdles:

Preference for Physical Cards: Some consumer segments still favor plastic cards, especially for in-person transactions.

Limited Acceptance: Certain merchant categories require physical card presentation.

Security Risks: Smartphone theft could potentially expose virtual cards to unauthorized use.

However, the rapid adoption of digital wallets, tokenization, and multi-factor authentication is expected to mitigate these risks and foster stronger adoption.

Market Segmentation

The virtual cards market is segmented by end use, card type, and region, highlighting its broad applicability:

1. By End Use

Business Use: Dominates the market as enterprises adopt corporate virtual cards for expense control, fraud reduction, and streamlined cash flow management.

Consumer Use: Individuals increasingly prefer virtual cards for secure e-commerce and subscription-based services, valuing enhanced privacy.

2. By Card Type

B2B Virtual Cards: Largest segment, widely used for accounts payable automation, business travel, and vendor payments.

Single-Use Cards: Gaining traction across industries for high-security, one-time transactions.

3. By Region

North America: Leads the market due to a mature fintech ecosystem, strong e-commerce, and early adoption of virtual payment technologies.

Asia-Pacific: Fastest-growing region, driven by high smartphone usage and large-scale digital transformation programs, especially in China and India.

Europe: Strong adoption, supported by advanced digital banking and regulatory frameworks like PSD2.

Latin America, Middle East & Africa: Steadily expanding as digital banking and mobile payments grow.

Key Players Analysis

The virtual cards market is highly competitive, with global players leveraging R&D and partnerships to drive innovation. Major companies include:

JPMorgan Chase – Leading issuer of virtual cards in North America.

Billtrust, Inc. – Specializes in B2B payment solutions.

Stripe – Popular digital payments leader expanding into virtual card offerings.

Mastercard, Visa, American Express, Citigroup – Global payment giants integrating virtual cards into their product portfolios.

Marqeta, Airwallex, Adyen, Revolut – Fintech disruptors reshaping the market with agile, API-driven solutions.

These players are continuously expanding capabilities through AI, blockchain integration, and embedded finance solutions, ensuring long-term competitiveness.

Growth Opportunities

The rapid adoption of B2B virtual cards, in particular, presents immense opportunities. Enterprises benefit from:

Better expense management

Simplified vendor payments

Reduced fraud exposure

Improved real-time tracking

Additionally, the rise of cross-border e-commerce and digital-first banking creates new avenues for virtual card adoption globally. Strategic investments and collaborations are expected to further accelerate growth.

💳 Buy Now Report: Virtual Cards Market Purchase Link

Conclusion

The virtual cards market stands at the forefront of the digital finance revolution, with a projected CAGR of 21.15% between 2025 and 2033. As consumers and enterprises continue to prioritize security, efficiency, and flexibility, virtual cards will increasingly replace traditional payment methods in the online economy.

With the combined push from fintech innovation, digital banking adoption, and corporate digitization, this market is poised for transformative expansion—reshaping the way businesses and individuals transact worldwide.