Introduction

Car

insurance renewal is an essential task for every vehicle owner.

It ensures continuous protection against accidents, theft, natural calamities,

and legal liabilities. Despite its importance, many car owners find the car insurance renewal

process confusing or time-consuming. Fortunately, with digital solutions and

structured guidance, car

insurance renewal can be hassle-free, quick, and efficient.

This comprehensive step-by-step guide will help you navigate the car insurance renewal

process smoothly, save money, and ensure your vehicle remains fully

protected.

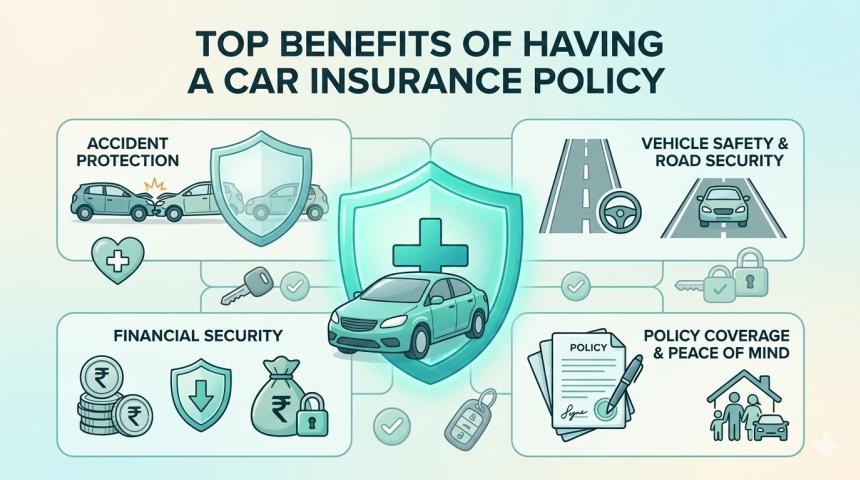

Why Timely Car Insurance Renewal

Matters

A car insurance policy provides

financial security in case of unforeseen events, and lapsing coverage can

expose you to unnecessary risks. Here’s why timely renewal is critical:

- Legal Compliance: Driving without valid insurance is against the law and

can attract fines or penalties.

- Continuous Coverage: Renewing on time ensures that you are protected

against accidents or damages that occur after your policy expiry.

- No Claim Bonus Retention: Timely renewal preserves your No Claim Bonus (NCB),

which can significantly reduce your premium.

- Avoid Higher Premiums: Policies renewed after expiry may attract additional

charges or increased premiums.

Step

1: Review Your Existing Policy

Before starting the renewal process,

carefully review your current car insurance policy:

- Check the expiry

date to avoid lapsing.

- Review coverage

limits and ensure they still meet your needs.

- Examine add-ons

like zero depreciation, roadside assistance, engine protection, or

consumables cover.

- Note the Insured

Declared Value (IDV) of your car, which determines claim

settlements in case of damage or theft.

Understanding your current coverage

will help you decide whether to renew the same plan or make adjustments.

Step

2: Compare Insurance Options

Renewing car insurance online allows

you to compare multiple insurers and policies efficiently. Factors to consider

include:

- Premium Amounts: Compare quotes to find the most cost-effective option.

- Coverage Inclusions &

Exclusions: Ensure the policy covers risks

relevant to your vehicle and driving habits.

- Claim Settlement Ratio: Choose insurers with high claim settlement rates for

smoother claims processing.

- Add-Ons & Benefits: Evaluate if optional add-ons provide value for your specific

vehicle and needs.

Comparison helps you avoid

overpaying and ensures you get maximum coverage benefits.

Step

3: Choose the Right Coverage

Based on your review and comparison,

decide on the type of coverage:

- Third-Party Liability: Mandatory in India, covers damage or injury caused to

others.

- Comprehensive Cover: Provides protection against both third-party liability

and own vehicle damages due to accidents, natural disasters, theft, or

fire.

- Add-On Covers: Optional enhancements that increase your policy’s

value and protection.

Selecting the right coverage

tailored to your needs ensures optimal protection without unnecessary expense.

Step

4: Gather Required Documents

Having the correct documents ready

can make the renewal process smooth and quick. Typically, you’ll need:

- Vehicle Registration Certificate (RC)

- Previous insurance policy copy

- Driving license

- Identity proof and address proof (if required)

- Car photographs (mainly for older or expired policies)

Digital copies of these documents

are sufficient for online renewal, reducing the need for physical submissions.

Step

5: Renew Car Insurance Online

The easiest and most convenient

method is to renew your car insurance online. Here’s a simple process:

- Visit a trusted insurance portal or your insurer’s

official website.

- Enter your vehicle

registration number and policy details.

- Choose your desired

coverage type and add-ons.

- Compare the premium with other options if needed.

- Make a secure

online payment using net banking, UPI, or credit/debit card.

- Receive your renewal

confirmation and policy document instantly via email.

Online renewal saves time, avoids

paperwork, and provides transparency in premium calculations.

Step

6: Confirm Policy Details

After renewal, always verify the

policy documents to ensure accuracy:

- Policyholder’s name and contact details

- Vehicle registration number and car model

- Coverage type, add-ons, and IDV

- Policy period and renewal date

Errors in the policy can create

issues during claims, so immediate correction is crucial.

Step

7: Set Reminders for Future Renewal

To avoid lapses in the future:

- Set calendar reminders before the policy expiry date.

- Enable notifications from your insurer or insurance

portal.

- Consider renewing at least 15–30 days before expiry to

avoid delays.

This proactive approach ensures

uninterrupted coverage and protects your No Claim Bonus.

Tips

for a Hassle-Free Car Insurance Renewal

- Compare Before You Renew: Don’t automatically renew the same policy. Comparison

can save money.

- Review Add-Ons: Only choose necessary add-ons to avoid inflating your

premium.

- Check for Discounts: Look for loyalty benefits or special online offers.

- Maintain a Good Driving

Record: No claims in previous years

can earn you a discount on premium.

- Use Trusted Platforms: Ensure your renewal is done via official or verified

portals for safety.

Conclusion

Renewing your car insurance doesn’t

have to be stressful. By reviewing your current policy, comparing options,

selecting the right coverage, and completing the process online, you can ensure

a seamless, hassle-free experience. Timely renewal protects you from legal

penalties, maintains your No Claim Bonus, and ensures your vehicle is

continuously safeguarded against risks.

To simplify your car insurance

renewal and get the best coverage at the most competitive premiums, SquareInsurance offers a user-friendly platform to compare, customize, and renew

car insurance online with complete peace of mind.

Frequently

Asked Questions (FAQs)

Q1. Can I renew my car insurance

after it expires?

Yes, but you may incur a higher premium and need a car inspection. Timely

renewal is recommended to avoid policy lapse.

Q2. How long does online car

insurance renewal take?

Most online renewals take less than 10 minutes, with instant policy

confirmation via email.

Q3. Will I lose my No Claim Bonus if

I renew late?

Late renewal can affect your NCB. Renewing on time ensures you retain your

benefits.

Q4. Can I change coverage while

renewing?

Yes, you can modify coverage, IDV, and add-ons based on your current needs.

Q5. Is online renewal safe and

legal?

Yes, renewing car insurance online through verified platforms is completely

secure and legally valid.