Buying car insurance in 2026 is no longer just about fulfilling a legal requirement. When you buy car insurance today, evolving regulations, smarter vehicles, digital policy management, and more informed consumers have turned it into a critical financial decision that directly affects long-term costs and claim experience.

Whether you are purchasing insurance for a new car or renewing an existing policy, understanding the fine details before you buy car insurance can help you avoid underinsurance, claim rejections, and unnecessary premium outflow. This guide explains the most important things you should know before buying car insurance in 2026, helping you make a confident and well-informed decision.

1.

Understand the Types of Car Insurance Policies

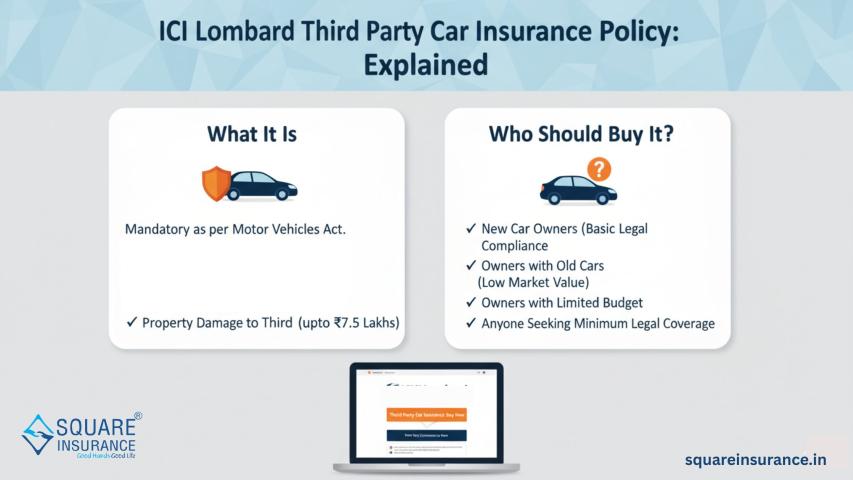

Before buying car insurance, it is

essential to know the difference between the available policy types.

- Third-Party Car Insurance: Covers damages or injuries caused to a third party. It

is mandatory by law but does not cover your own vehicle.

- Comprehensive Car Insurance: Covers third-party liabilities along with damage to

your own vehicle due to accidents, theft, fire, or natural calamities.

- Standalone Own Damage Policy: Covers damage to your own car and is usually purchased

when third-party insurance is bought separately.

In 2026, most vehicle owners prefer

comprehensive policies because of broader coverage and flexibility.

2.

Do Not Choose a Policy Based on Price Alone

One of the most common mistakes

buyers make is choosing the cheapest policy. A low premium often means limited

coverage, higher deductibles, or missing add-ons that matter during claims.

Instead of focusing only on cost,

evaluate:

- Coverage scope

- Claim settlement reputation

- Network garages

- Add-on benefits

- Deductibles and exclusions

A slightly higher premium can save

significant expenses during repairs or emergencies.

3.

Choose the Right Insured Declared Value (IDV)

IDV represents the maximum amount

your insurer will pay if your car is stolen or declared a total loss. Many

buyers opt for a lower IDV to reduce premium, but this can lead to financial

loss at the time of claim.

Before you buy car insurance in

2026:

- Ensure the IDV reflects your car’s correct market value

- Avoid under-declaring or over-declaring the value

- Balance premium affordability with realistic coverage

An accurate IDV ensures fair

compensation when it matters most.

4.

Evaluate Add-On Covers Carefully

Add-ons are optional benefits that

enhance your base policy. In 2026, add-ons have become more relevant due to

rising repair costs and advanced vehicle technology.

Some useful add-ons include:

- Zero Depreciation Cover

- Engine Protection Cover

- Roadside Assistance

- Return to Invoice Cover

- Consumables Cover

Choose add-ons based on your driving

habits, location, and vehicle age rather than opting for all of them blindly.

5.

Check the Claim Settlement Process

A policy is only as good as its

claim experience. Before buying car insurance, understand how claims are

handled.

Key things to check:

- Claim settlement ratio consistency

- Availability of cashless garages near your location

- Turnaround time for claims

- Transparency in documentation requirements

A smooth and timely claim process

reduces stress during already difficult situations.

6.

Disclose Accurate Vehicle and Personal Details

Providing incorrect information

while buying car insurance can lead to claim rejection later. In 2026, insurers

rely heavily on digital verification, making accuracy even more important.

Ensure you disclose:

- Correct registration details

- Vehicle modifications, if any

- Previous claim history

- Correct usage (private or commercial)

Honest disclosure builds trust and

ensures uninterrupted coverage.

7.

Understand Policy Exclusions Clearly

Many disputes arise because buyers

do not read policy exclusions. These are situations where the insurer will not

pay a claim.

Common exclusions include:

- Driving under the influence

- Wear and tear

- Mechanical or electrical breakdown

- Driving without a valid license

Knowing exclusions upfront helps set

realistic expectations and prevents unpleasant surprises.

8.

Consider No Claim Bonus (NCB) Benefits

If you have not made a claim in

previous policy years, you are eligible for a No Claim Bonus, which can

significantly reduce your premium.

Important points about NCB:

- It belongs to the policyholder, not the car

- It can be transferred when changing insurers

- It can reduce premiums substantially over time

Always ensure your NCB is correctly

reflected before you buy or renew car insurance.

9.

Online Purchase vs Offline Purchase

In 2026, most car insurance

purchases happen online due to convenience and transparency. Online platforms

allow easy comparison, instant policy issuance, and quick renewals.

However, the key is not where you

buy, but how well you understand what you are buying. Whether online or

offline, clarity of coverage matters more than the purchase mode.

10.

Review Policy Terms Every Year

Car insurance is not a one-time

decision. Your coverage needs may change due to:

- Vehicle aging

- Increased usage

- Relocation to a new city

- Changes in repair costs

Reviewing your policy annually

ensures it remains relevant and cost-effective.

Conclusion

Buying car insurance in 2026

requires more awareness than ever before. From choosing the right policy type

and IDV to understanding exclusions and add-ons, each decision directly impacts

your financial safety and claim experience.

This is where Square Insurance

plays a valuable role by helping car owners compare policies clearly,

understand coverage details, and choose insurance that truly fits their needs.

With the right guidance, buying car insurance becomes a confident and informed

decision rather than a confusing obligation.

The right policy does more than

protect your car—it protects your peace of mind.

Frequently

Asked Questions

1.

Is third-party insurance enough in 2026?

Third-party insurance meets legal

requirements but does not cover damage to your own vehicle. Comprehensive

insurance is recommended for better protection.

2.

Does buying car insurance online reduce premium?

Online purchases often eliminate

intermediary costs, but savings depend on coverage selection rather than the

purchase mode alone.

3.

How often should I review my car insurance policy?

You should review your policy every

year before renewal to ensure it matches your current needs.

4.

Can I change my insurer without losing benefits?

Yes, you can switch insurers while

retaining benefits like No Claim Bonus.

5.

Are add-ons necessary for new cars?

Some add-ons, such as zero

depreciation and engine protection, are particularly useful for new cars.

6.

What happens if I provide incorrect information while buying insurance?

Incorrect details can lead to claim

rejection or policy cancellation, so accuracy is essential.