Owning a two wheeler offers freedom, convenience, and cost-effective mobility, especially in today’s fast-moving urban lifeAccidents, theft, natural calamities, and third-party liabilities can lead to unexpected financial stress.Legal compliance is another critical aspect every rider must follow.Having bike insurance ensures that these risks are managed effectively and responsibly.It not only protects your finances but also gives you peace of mind every time you ride.In this blog, we will explore the key benefits of two wheeler insurance and explain why it is an essential part of smart and safe bike ownership.

What Is Two Wheeler Insurance?

Two

wheeler insurance is a financial agreement between the bike owner and the

insurer that provides protection against losses arising from accidents, theft,

damage, or legal liabilities. Depending on the type of policy chosen, it can

cover third-party liabilities, own vehicle damage, or both.

With

rising traffic density and increasing repair costs, having the right insurance

cover is no longer optional—it is a necessity.

1. Mandatory Legal Protection

One of

the most important benefits of two wheeler insurance is that it helps you

comply with Indian motor laws. Riding without at least a third-party insurance

policy is illegal and can attract heavy fines or penalties.

Insurance

ensures:

- Compliance with traffic

regulations

- Protection from legal

consequences

- Stress-free riding during

traffic checks

Legal

compliance alone makes two wheeler insurance indispensable.

2. Financial Protection Against Accidents

Road

accidents can result in expensive repairs and medical expenses. Two wheeler

insurance covers repair costs for damages caused due to accidents, depending on

the policy type.

This

financial support:

- Reduces out-of-pocket

expenses

- Covers sudden repair costs

- Helps manage unexpected

financial burdens

Without

insurance, even minor accidents can disrupt your monthly budget.

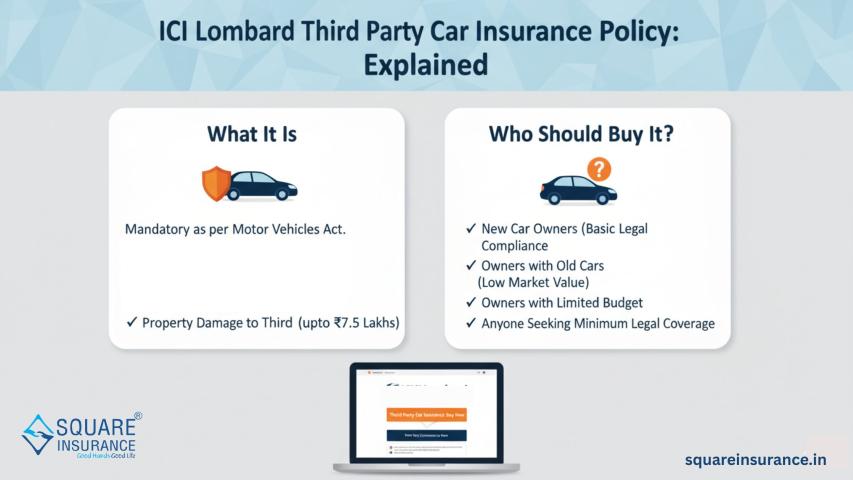

3. Coverage for Third-Party Liabilities

If your

bike causes injury, death, or property damage to a third party, the financial

liability can be significant. Two wheeler insurance covers these third-party

claims, which are otherwise difficult to manage personally.

Third-party

coverage:

- Protects you from legal

compensation claims

- Covers medical expenses or

property damage

- Ensures compliance with

legal obligations

This

benefit safeguards your financial stability in worst-case scenarios.

4. Protection Against Theft and Vandalism

Bike

theft is a common concern, especially in urban areas. A comprehensive two

wheeler insurance policy provides compensation if your bike is stolen or

damaged due to vandalism.

This

coverage:

- Reduces financial loss due

to theft

- Helps you replace or recover

part of your bike’s value

- Offers peace of mind when

parking in public places

Insurance

ensures you are not left stranded after an unfortunate incident.

5. Coverage Against Natural and Man-Made Disasters

Natural

calamities such as floods, earthquakes, storms, and fires can cause serious

damage to vehicles. Two wheeler insurance covers damages caused by such events.

Man-made

disasters like riots or strikes are also covered under comprehensive policies.

This protection ensures that your bike remains financially secure under

unpredictable circumstances.

6. Personal Accident Cover for Rider Safety

Most two

wheeler insurance policies include or offer a personal accident cover for the

owner-driver. This provides financial support in case of permanent disability

or death due to an accident.

Personal

accident benefits:

- Financial security for

family members

- Support during medical

emergencies

- Enhanced rider safety

coverage

This

feature highlights the human-centric value of insurance beyond vehicle

protection.

7. Add-On Covers for Enhanced Protection

Insurance

policies can be customized using add-on covers based on individual needs. These

add-ons provide extended protection beyond standard coverage.

Popular

add-ons include:

- Zero depreciation cover

- Engine protection

- Roadside assistance

- Consumables cover

Customization

ensures your policy aligns with your riding habits and local conditions.

8. Cashless Repair Facility

Many

insurance policies offer cashless repair services at network garages. This

means repair bills are settled directly by the insurer, reducing immediate

financial stress.

Benefits

include:

- Faster claim settlement

- Reduced paperwork

- No upfront payment at

garages

This

feature improves the overall claim experience for policyholders.

9. No Claim Bonus Benefits

If you do

not make any claims during the policy term, you earn a No Claim Bonus (NCB).

This bonus reduces your premium at the time of renewal.

NCB

rewards:

- Safe and responsible riding

- Long-term savings on

premiums

- Loyalty towards policy

continuity

Maintaining

claim-free years leads to significant cost benefits.

10. Peace of Mind and Stress-Free Riding

Perhaps

the most underrated benefit of two wheeler insurance is peace of mind. Knowing

that you are financially protected allows you to focus on riding responsibly

without constant worry.

Insurance

provides:

- Emotional reassurance

- Financial confidence

- A safety net during

emergencies

This

mental comfort is invaluable for every rider.

Importance of Choosing the Right Policy

Not all

insurance policies offer the same level of coverage. Choosing the right policy

involves understanding your bike’s value, usage pattern, and risk exposure.

A

well-informed choice ensures:

- Adequate coverage

- Optimal premium cost

- Smooth claim experience

Insurance

works best when aligned with your real-life needs.

Conclusion

Two

wheeler insurance is much more than a legal requirement-it is a vital financial

safeguard that protects riders against accidents, theft, liabilities, and

unforeseen disasters. From covering repair expenses to providing personal

accident benefits and peace of mind, the advantages of having a reliable

insurance policy are undeniable.

Choosing

the right insurer and coverage enhances the overall ownership experience.

Platforms like Square Insurance simplify the process by offering clear

policy insights, easy comparisons, and customer-focused guidance. With the

right two wheeler insurance in place, you can ride confidently, knowing that

both you and your bike are well protected.

Frequently Asked Questions

1. Is two wheeler insurance mandatory in India?

Yes, at least third-party two wheeler insurance is mandatory under Indian motor laws.2. What is the main benefit of comprehensive two wheeler insurance?

It covers both third-party liabilities and damage to your own bike.3. Can insurance cover natural disasters?

Yes, comprehensive policies cover damages caused by natural and man-made disasters.4. What is No Claim Bonus?

It is a reward given as a discount on renewal premium for claim-free policy years.5. Can I customize my two wheeler insurance policy?

Yes, add-on covers allow you to enhance protection based on your specific needs.