Car insurance is an essential

financial safeguard, but many vehicle owners end up paying more than necessary

due to lack of awareness or outdated policy choices. The good news is that

saving money on car insurance does not require sacrificing coverage or protection.

With the right approach, you can significantly reduce your premium while

keeping your financial security intact.

This guide outlines 10 smart and

practical ways to save money on car insurance, helping you make informed

decisions that benefit both your budget and your peace of mind.

1.

Compare Insurance Plans Before Finalizing

Insurance premiums vary widely based

on risk assessment models, vehicle type, and personal driving history. Even for

identical coverage, prices can differ substantially between insurers.

Comparing multiple plans allows you

to:

- Identify competitively priced policies

- Understand coverage differences

- Avoid overpaying for similar benefits

Regular comparison ensures you’re

always getting value for money.

2.

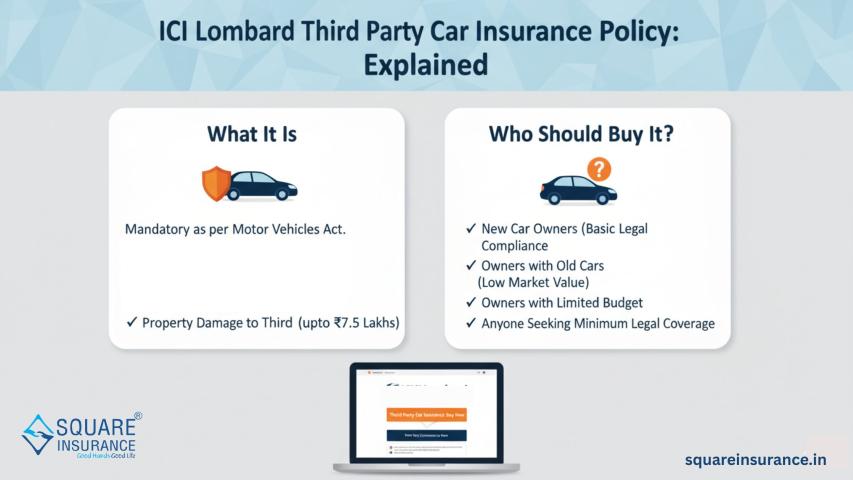

Select Coverage That Matches Your Vehicle’s Worth

Not every car needs maximum

coverage. If your vehicle is older or has a lower market value, paying high

premiums for comprehensive coverage may not be financially sensible.

Evaluate:

- Your car’s current resale value

- Repair costs versus premium expenses

- How frequently you use the vehicle

Right-sizing your coverage can lead

to immediate savings.

3.

Opt for a Higher Deductible

A deductible is the portion you pay

before the insurer covers a claim. Choosing a higher deductible reduces your

premium because you’re sharing more risk with the insurer.

This option works best if:

- You have a good driving record

- You rarely file claims

- You maintain emergency savings

It’s a cost-effective strategy for

responsible drivers.

4.

Maintain a Clean Driving Record

Safe driving plays a critical role

in keeping insurance costs low. Traffic violations and frequent claims signal

higher risk, leading to increased premiums.

Benefits of a clean record include:

- Lower base premiums

- No-claim bonuses

- Greater eligibility for insurer rewards

Defensive driving not only protects

lives but also reduces long-term costs.

5.

Take Full Advantage of Available Discounts

Insurance companies often provide

discounts that many policyholders overlook. These may include:

- Anti-theft or safety device discounts

- Low-mileage benefits

- Multi-policy or bundled coverage savings

- Loyalty or renewal discounts

Always request a full breakdown of

applicable discounts before purchasing or renewing a policy.

6.

Pay the Premium Annually Instead of Monthly

Paying premiums in monthly

installments often includes administrative or interest-related charges. Annual

payments typically eliminate these extra costs.

Advantages of annual payment:

- Lower overall premium

- No installment fees

- Simplified policy management

If budget allows, this option

delivers straightforward savings.

7.

Remove Add-Ons You Don’t Truly Need

Add-ons can enhance coverage, but

unnecessary ones increase premiums without offering real value.

Before selecting add-ons, consider:

- Your driving environment

- Existing manufacturer warranties

- Personal usage patterns

Removing non-essential extras can

noticeably reduce your insurance bill.

8.

Maintain a Healthy Credit Profile

In many regions, insurers consider

credit-based insurance scores when calculating premiums. A strong credit

profile reflects financial reliability and may lead to lower rates.

Helpful practices include:

- Paying bills on time

- Avoiding excessive debt

- Regularly monitoring credit reports

Though indirect, this factor can

influence insurance affordability.

9.

Choose Insurance-Friendly Vehicles

Vehicle type has a major impact on

insurance costs. Cars with strong safety ratings, lower repair costs, and lower

theft risk typically attract cheaper premiums.

When purchasing a car, consider:

- Safety features

- Availability of spare parts

- Repair and maintenance costs

Smart vehicle choices result in

long-term insurance savings.

10.

Review Your Policy Every Year

Your insurance needs evolve over

time. An annual review ensures your policy reflects your current situation.

Policy reviews help you:

- Update mileage and usage

- Remove outdated coverages

- Adjust deductibles and limits

This habit prevents unnecessary

overpayment.

Conclusion

Saving money on car insurance is

achievable with awareness, regular review, and informed decision-making. By

comparing plans, adjusting coverage thoughtfully, and eliminating unnecessary

costs, you can strike the right balance between affordability and protection.

Platforms like Square Insurance

simplify this process by enabling users to evaluate policies transparently and

select coverage that aligns with their budget and needs. A well-chosen policy

today can lead to consistent savings and reliable protection in the future.

Frequently

Asked Questions

1.

How can I reduce my car insurance premium immediately?

Comparing plans, increasing

deductibles, and removing unnecessary add-ons are the fastest ways to reduce

premiums.

2.

Is it safe to reduce car insurance coverage?

Yes, as long as coverage aligns with

your vehicle’s value and usage. Avoid cutting essential protections.

3.

Do online insurance policies cost less?

Online policies often reduce

operational costs, which may result in more competitive pricing.

4.

How does my driving record affect my premium?

A clean driving history lowers risk

perception and helps maintain lower insurance costs.

5.

Should I review my car insurance policy every year?

Yes. Annual reviews ensure your

policy stays relevant and cost-effective.