During Q3 2025, Isoprene Rubber Prices across the global market showed a mixed and mostly stable trend. While the overall global market recorded a modest change of around 1–2%, price movements varied noticeably by region. Some markets experienced slight growth supported by steady demand, while others faced price declines due to weaker buying activity and excess supply.

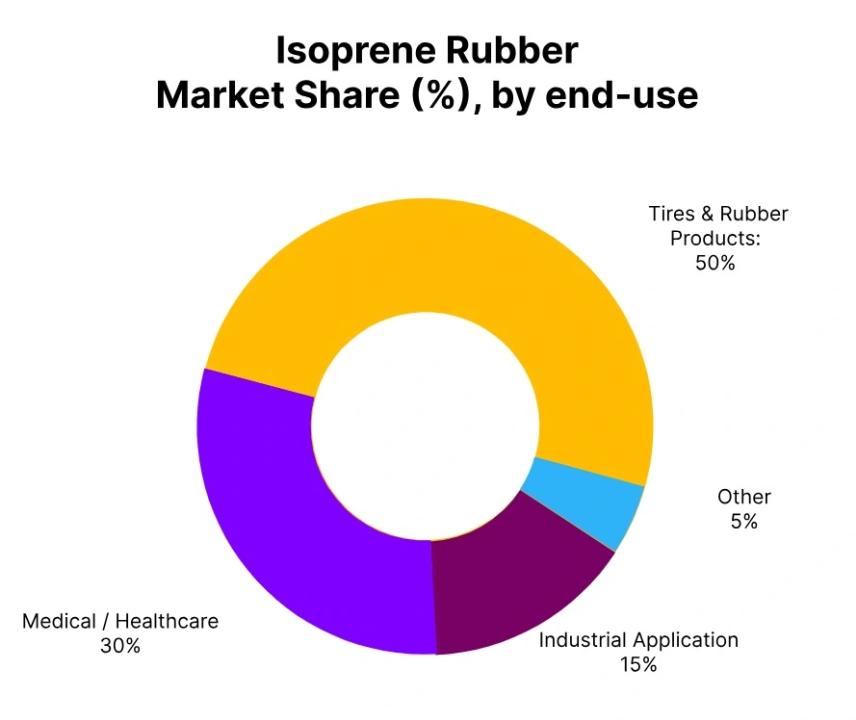

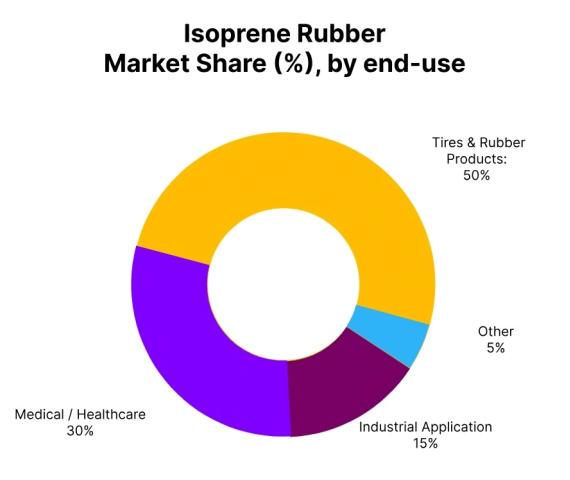

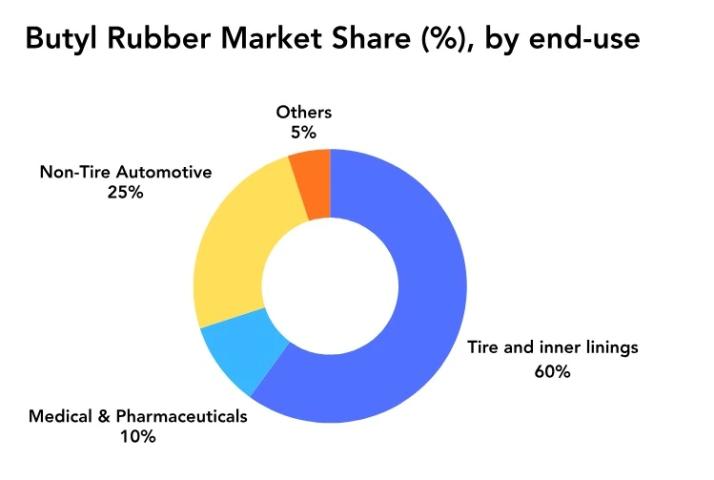

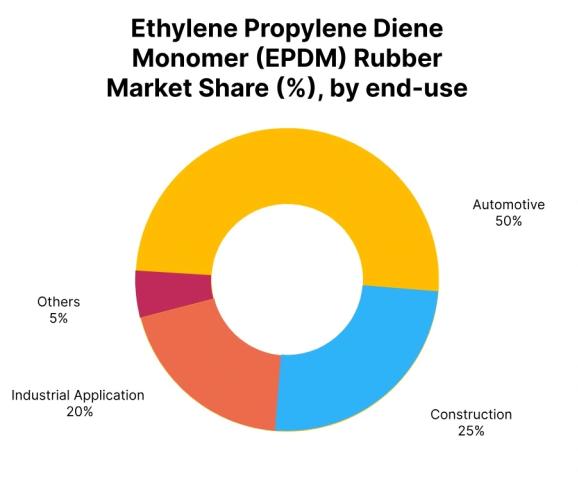

Isoprene Rubber is widely used in tire manufacturing, automotive components, medical products, and mechanical rubber goods. Because it is closely linked to the automotive and industrial sectors, any change in activity in these industries directly impacts pricing. In Q3 2025, stable consumption in some regions helped support prices, while slow demand and cautious buying behavior weighed on others.

Across Asia-Pacific, including China, India, and Japan, demand remained fairly steady from automotive and industrial sectors. This helped maintain a balanced supply-demand situation and prevented sharp price drops in most areas. North America saw a largely stable market, supported by consistent demand from automotive and adhesive applications. In Europe, prices remained mostly steady, although fluctuations in feedstock costs and moderate trading activity created some pressure.

Overall, the Isoprene Rubber market in Q3 2025 showed resilience. While not strongly bullish, the market avoided sharp declines at the global level, reflecting balanced fundamentals and stable raw material trends.

Russia Market Overview

In Russia, Isoprene Rubber Prices moved in the opposite direction compared to the global average. During Q3 2025, export prices from Novorossiysk declined by around 2.06%. This downward trend was largely driven by weaker demand from automotive and industrial sectors, particularly tire manufacturing and mechanical rubber goods production.

Ample domestic supply and slow export activity added further pressure to prices. Buyers remained cautious, and trading volumes were relatively low. In September 2025, prices fell by an additional 2.5% compared to August, reflecting thin market activity and conservative downstream purchasing.

Please Submit Your Query For Isoprene Rubber Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

The near-term outlook for Russia remains soft. With feedstock availability remaining firm and demand expected to stay moderate, Isoprene Rubber Prices in the region are likely to remain under pressure in the coming months.

Japan Market Conditions

Japan experienced a noticeable decline in Isoprene Rubber Prices during Q3 2025. Export prices from Tokyo dropped by around 3.8%, mainly due to sluggish demand from automotive and industrial manufacturing sectors. Tire production and rubber goods manufacturing remained subdued, limiting consumption.

Supply availability remained adequate, but downstream buying activity was limited. Export demand also weakened, adding to market softness. In September 2025, prices declined by another 3.7%, as buyers continued to procure cautiously.

Looking ahead, the Japanese market may continue to face mild pressure. While feedstock prices remain stable and demand may gradually recover, the short-term outlook suggests limited upside for Isoprene Rubber Prices.

India Market Trends

India’s Isoprene Rubber Prices showed relatively mild movement compared to other regions. During Q3 2025, import prices at Nhava Sheva declined by just 0.3%. Decent demand from automotive and industrial sectors helped prevent a sharper drop.

Sufficient supply from Russian exporters and stable feedstock costs contributed to a balanced market. However, buyers remained cautious, purchasing mainly on a need basis. In September 2025, prices fell more noticeably by around 1.8%, driven by lower import volumes and limited spot trading.

Despite this decline, the overall outlook for India remains relatively stable. While gentle downward pressure may continue, strong end-use industries could help limit further price weakness.

Thailand Market Overview

Thailand saw a sharper decline in Isoprene Rubber Prices during Q3 2025. Import prices at Laem Chabang dropped by approximately 3.7%. Weak demand from automotive and industrial manufacturing sectors was a key factor behind the decline.

Tire manufacturing activity slowed, and downstream buyers reduced procurement volumes. Ample domestic supply and weaker export activity also contributed to price pressure. In September 2025, prices declined by another 3.6%, reflecting continued subdued market sentiment.

The outlook for Thailand remains challenging. Without a clear recovery in end-use demand, Isoprene Rubber Prices are expected to stay weak in the near term.

Italy Market Performance

Italy experienced one of the steeper declines in Isoprene Rubber Prices among European markets. During Q3 2025, import prices at Genoa fell by around 3.9%. Poor demand from automotive and industrial sectors, especially tire and rubber product manufacturers, weighed heavily on the market.

Sufficient import supply from Japan further pressured prices. Buyers adopted a defensive purchasing strategy, limiting spot transactions. In September 2025, prices fell by another 4.1%, highlighting continued market softness.

The near-term outlook for Italy remains muted. Unless demand from key industries improves, Isoprene Rubber Prices are likely to remain under pressure.

Broader Market Perspective

Across regions, Isoprene Rubber Prices in Q3 2025 reflected a market shaped by balanced supply, cautious demand, and stable feedstock trends. While some regions experienced mild growth or stability, others saw noticeable declines due to excess supply and weak downstream activity.

The automotive sector remained the primary driver of demand, and any slowdown in vehicle production or tire manufacturing quickly affected prices. Industrial manufacturing trends also played a significant role in shaping regional market movements.

As the market moved into September 2025, price trends generally softened further in several regions. This indicated that while the global Isoprene Rubber market remained resilient, it faced ongoing challenges from cautious buying behavior and uneven regional demand.

Overall Outlook

Looking ahead, Isoprene Rubber Prices are expected to remain stable to slightly weak in the near term. Regions with balanced supply and steady industrial demand may see limited price movements, while markets facing oversupply and weak exports could continue to experience downward pressure.

Much will depend on the pace of recovery in the automotive and industrial sectors, as well as feedstock price stability. Until stronger demand returns, the global Isoprene Rubber market is likely to remain cautious, with buyers and sellers closely monitoring market signals before making long-term commitments.

Overall, Q3 2025 demonstrated that while the Isoprene Rubber market remains fundamentally stable, regional dynamics continue to play a critical role in shaping price trends across the globe.

Please Submit Your Query For Isoprene Rubber Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/