The Life Insurance Corporation of India (LIC) continues to modernize its

operations to support agents, merchants, and premium collection partners

through digital platforms. One such initiative is the LIC Merchant Portal,

which enables authorized merchants to collect LIC premiums digitally, manage

transactions, and track payments efficiently.

With increasing reliance on online premium collection and digital

compliance, understanding the LIC Merchant Portal login process and registration

in 2026 has become essential for LIC agents, CSC operators,

financial service providers, and authorized merchants.

This guide explains the complete login process, registration steps,

eligibility, benefits, security features, and how the portal supports smoother

insurance operations.

What Is the LIC Merchant Portal?

The LIC Merchant Portal is an online platform designed for authorized

merchants to facilitate premium collection for LIC policies. It allows merchants

to accept payments digitally, issue receipts instantly, and manage transaction

records securely.

The portal plays a vital role in improving transparency, reducing manual

errors, and enhancing customer trust in LIC’s premium payment ecosystem.

Who Can Register on the LIC Merchant Portal?

The LIC Merchant Portal is not open to the general public. Registration is

permitted only for approved entities, including:

·

Authorized LIC agents

·

Common Service Centre (CSC) operators

·

Banking correspondents

·

Financial service providers approved by LIC

·

Institutional or individual merchants authorized

for premium collection

Applicants must meet LIC’s compliance and documentation requirements before

gaining access.

LIC Merchant Portal Registration Process 2026

The registration process is structured to ensure security, compliance, and

accountability. Below is a simplified overview of how registration works:

Step 1: Eligibility Verification

Applicants must first ensure they are eligible and authorized to collect LIC

premiums. Authorization may come through LIC offices or approved partner

programs.

Step 2: Submission of Application

The merchant submits a registration request with required details such as

personal information, business credentials, and banking details for

settlements.

Step 3: Document Verification

LIC verifies submitted documents, including identity proof, address proof,

PAN, bank account details, and authorization letters.

Step 4: Merchant ID Creation

Once approved, LIC generates a unique Merchant ID and login credentials.

Step 5: Portal Access Activation

After activation, merchants can log in and begin collecting premiums through

the portal.

LIC Merchant Portal Login Process

The LIC Merchant Portal login process is designed to be

secure and user-friendly:

1. Enter

the registered Merchant ID

2. Input

the assigned username and password

3. Complete

authentication steps if required

4. Access

the merchant dashboard

For security reasons, merchants are advised to update passwords regularly

and avoid sharing login credentials.

Key Features of LIC Merchant Portal

1. Digital Premium Collection

Merchants can collect LIC premiums digitally, reducing cash handling and

manual errors.

2. Instant Receipt Generation

Receipts are generated instantly, improving transparency and customer

satisfaction.

3. Transaction Tracking

Merchants can view daily, weekly, or monthly transaction reports for better

reconciliation.

4. Secure Payment Processing

The portal follows strict security protocols to protect customer and

merchant data.

5. Settlement Management

Collected premiums are settled directly into the merchant’s registered bank

account as per LIC’s settlement cycle.

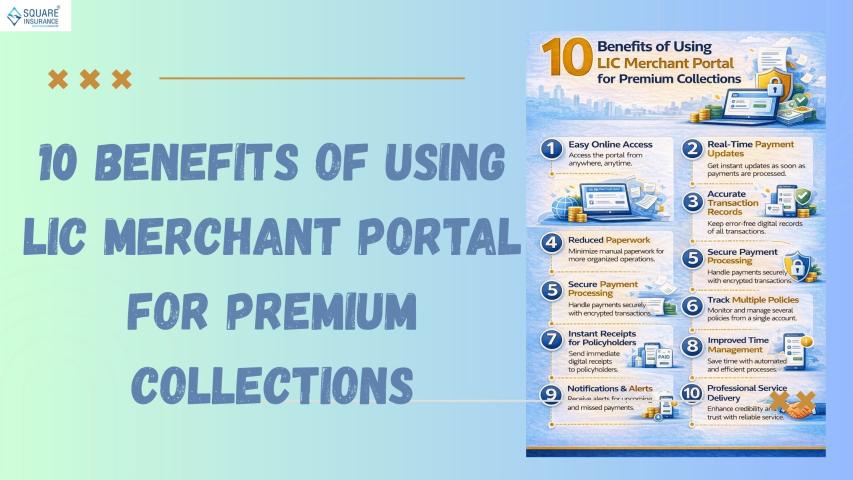

Benefits of Using LIC Merchant Portal

Improved Operational Efficiency

Digital premium collection significantly reduces paperwork and processing

time.

Enhanced Customer Trust

Instant receipts and transparent transactions increase customer confidence.

Better Record Management

Merchants can maintain accurate digital records for audits and compliance.

Compliance with Digital Norms

The portal aligns with regulatory requirements and LIC’s digital

transformation goals.

Common Login Issues and How to Resolve Them

Despite a robust system, merchants may occasionally face login issues.

Common problems include:

·

Incorrect login credentials

·

Password expiration

·

Account lock due to multiple failed attempts

Solutions:

·

Use the password reset option if credentials are

forgotten

·

Contact LIC support through official channels

for account unlocking

·

Ensure stable internet connectivity

Timely resolution helps avoid service interruptions.

Security Guidelines for Merchants

To maintain data security and compliance, merchants should follow best

practices:

·

Never share login credentials

·

Avoid logging in from public or unsecured

networks

·

Log out after each session

·

Regularly review transaction reports

·

Report suspicious activity immediately

These measures protect both merchants and policyholders.

Importance of LIC Merchant Portal in Insurance Operations

The LIC Merchant Portal plays a crucial role in strengthening India’s

insurance infrastructure. By enabling seamless premium collection, it ensures

uninterrupted policy coverage, timely renewals, and accurate record-keeping.

For insurers, agents, and merchants, digital platforms like this reduce

operational risks and improve service delivery, ultimately benefiting

policyholders.

Conclusion

The LIC

Merchant Portal login process and registration in 2026 reflect

LIC’s commitment to digital efficiency, transparency, and secure premium

collection. For authorized merchants, understanding how to register, log in,

and use the portal effectively is essential for smooth operations and

compliance.

As digital insurance services continue to grow, platforms like this simplify

premium management and enhance trust across the insurance ecosystem.

Organizations such as Square Insurance emphasize the

importance of secure digital tools and streamlined processes in delivering

reliable insurance services, ensuring better customer experiences and long-term

policy continuity.

Frequently Asked Questions

1. What is the LIC Merchant Portal used for?

It is used by authorized merchants to collect LIC premiums digitally and

manage transaction records.

2. Who is eligible to register on the LIC Merchant Portal?

Authorized LIC agents, CSC operators, banking correspondents, and approved

merchants can register.

3. Is LIC Merchant Portal registration free?

Registration charges, if any, depend on LIC’s merchant agreement terms.

4. What should I do if I forget my login password?

Use the password recovery option or contact LIC support through official

channels.

5. Is the LIC Merchant Portal secure?

Yes, it follows strict security protocols to protect merchant and customer

data.