Introduction

Global supply chain finance is massive—worth over $7 trillion annually according to McKinsey (2023). Yet, despite its scale, businesses across industries still face late payments, high credit risks, and inefficient documentation. The World Bank even notes that 80% of global trade still depends on paper-based processes, making transparency and liquidity major challenges.

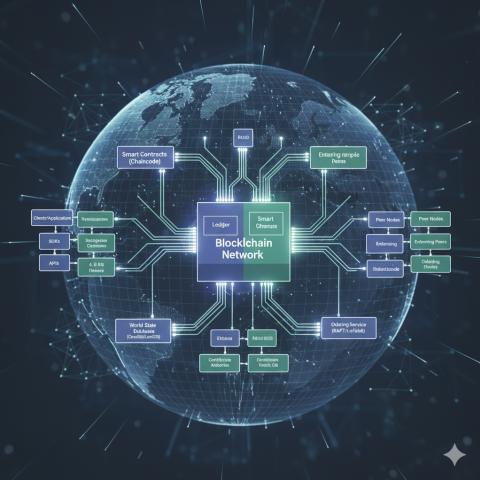

This is where Spydra, a blockchain-powered platform, steps in to disrupt the old ways. By combining asset tokenization with blockchain innovation, Spydra enhances supply chain finance, enabling faster payments, improved transparency, and stronger trust between stakeholders.

In this article, we’ll explore what supply chain finance means, how asset tokenization works, and the role Spydra plays in shaping a future-ready ecosystem for global trade.

What is Supply Chain Finance?

Supply Chain Finance (SCF) refers to technology-driven solutions that optimize cash flow for both buyers and suppliers. Instead of waiting 30, 60, or even 120 days for invoices to clear, suppliers can receive early payments while buyers get extended payment terms.

Why does it matter?

-

$1.7 trillion trade finance gap exists globally (Asian Development Bank, 2022).

-

Small and medium enterprises (SMEs) are the hardest hit, with 45% of SME trade finance requests rejected by banks.

-

SCF closes this gap by giving suppliers faster access to working capital.

In short, supply chain finance creates a win-win situation—suppliers get liquidity, and buyers preserve their cash flow.

What is Asset Tokenization?

Now, let’s break down the buzzword: asset tokenization.

In simple terms, asset tokenization is the process of converting physical or financial assets—like invoices, purchase orders, or even raw materials—into digital tokens on a blockchain. Each token represents a verified piece of ownership, which can then be traded, financed, or used as collateral.

Benefits of Tokenization in Finance:

-

Increased Liquidity: Invoices or receivables can be instantly converted into tradable tokens.

-

Transparency: Every transaction is recorded on an immutable blockchain ledger.

-

Efficiency: Cuts down paperwork and middlemen, speeding up payment cycles.

-

Accessibility: Even SMEs can now access finance that was previously locked to large enterprises.

By combining tokenization with supply chain finance, platforms like Spydra create a new digital economy of trade assets.

How Spydra Leverages Blockchain for Supply Chain Finance

Spydra integrates blockchain technology with asset tokenization to solve key pain points in supply chain finance. Let’s break down how:

1. Transparent and Trustworthy Transactions

-

Blockchain ensures that every invoice or purchase order is tamper-proof and auditable.

-

Buyers, suppliers, and financiers can all view the same single source of truth, eliminating disputes.

👉 For example: A $500,000 invoice tokenized on Spydra becomes a digital asset. Both the supplier and financier can verify its authenticity instantly, without waiting for manual validation.

2. Liquidity on Demand through Tokenization

-

Spydra converts supply chain assets into tokens that can be financed almost instantly.

-

This enables SMEs to access working capital within hours, not weeks.

💡 Stat: According to PwC, tokenization could unlock $1.4 trillion in global liquidity by 2030.

3. Reduced Risk for Financial Institutions

-

Smart contracts automate payments and enforce terms, reducing the chance of defaults.

-

Lenders get a real-time view of trade transactions, lowering credit risk.

Banks and fintechs are more likely to support SMEs when risks are transparent and minimized.

4. Cost Savings and Faster Settlements

-

By cutting out intermediaries, Spydra reduces processing costs.

-

Blockchain enables cross-border payments without the usual delays or hidden fees.

A Deloitte study found that blockchain in supply chains could cut operating costs by up to 30%.

Real-World Use Cases of Spydra in Supply Chain Finance

-

Manufacturing Sector: Suppliers of raw materials can tokenize invoices to receive early payments, ensuring they never run out of working capital.

-

Retail Chains: Large retailers can optimize their payment cycles while giving suppliers faster settlements.

-

Export-Import Businesses: Tokenized purchase orders allow exporters to secure financing before goods even ship, closing the trade finance gap.

-

SMEs: The biggest beneficiaries—SMEs gain access to financing options that were once only available to Fortune 500 companies.

Why Blockchain Innovation is a Game-Changer for Supply Chains

The combination of blockchain and supply chain finance is more than just a tech upgrade—it’s a paradigm shift.

-

Speed: What took weeks (invoice validation, approvals) now happens in minutes.

-

Security: Immutable blockchain records prevent fraud and duplicate financing.

-

Inclusivity: SMEs, startups, and small exporters finally gain fair access to finance.

-

Scalability: As blockchain adoption rises, the global supply chain finance market—already projected to reach $10 trillion by 2028—will grow even faster.

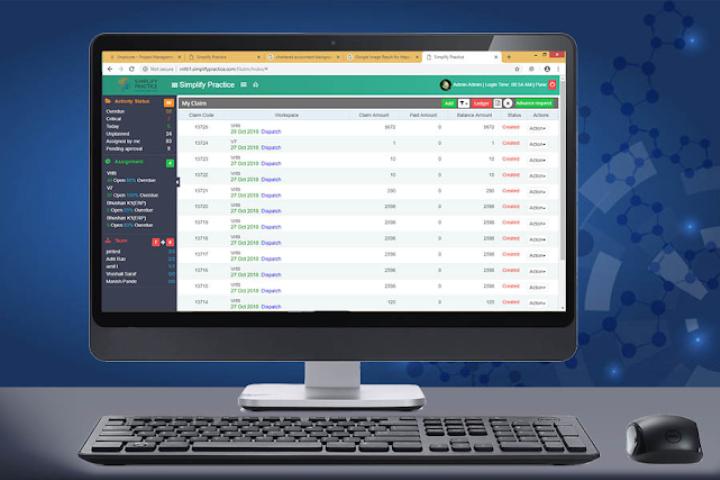

How Businesses Can Leverage Spydra

For companies looking to gain a competitive edge, adopting Spydra’s blockchain-powered SCF platform is a no-brainer. Here’s how to start:

-

Digitize Assets: Convert invoices, purchase orders, and receivables into blockchain tokens.

-

Enable Smart Contracts: Automate payment terms and settlements.

-

Partner with Financiers: Give banks and investors access to transparent, tokenized assets.

-

Scale Globally: Leverage blockchain for cross-border supply chain finance.

Key Takeaways

-

Supply Chain Finance solves the liquidity crunch in global trade.

-

Asset Tokenization transforms invoices and receivables into liquid digital tokens.

-

Spydra leverages blockchain innovation to enhance trust, reduce risk, and improve efficiency in SCF.

-

By 2030, tokenization could add $1.4 trillion in liquidity, directly benefiting SMEs and global trade networks.

FAQs

Q1: How does Spydra differ from traditional supply chain finance platforms?

Spydra uses blockchain and tokenization, making transactions faster, transparent, and less risky compared to paper-based, manual systems.

Q2: Can small businesses really benefit from blockchain in SCF?

Yes—SMEs gain early access to financing, lower costs, and trust-based transactions that were previously out of reach.

Q3: Is asset tokenization safe for financial institutions?

Absolutely. Since tokens are backed by real, verifiable assets and stored on an immutable blockchain, risks are significantly reduced.

Q4: Does blockchain make supply chain finance cheaper?

Yes, by cutting out middlemen, reducing fraud, and automating processes, operational costs drop by up to 30%.

Wrapping It Up

The future of supply chain finance lies in blockchain innovation and asset tokenization. Spydra stands at the forefront of this shift, offering a platform that enhances liquidity, boosts trust, and enables faster settlements across global supply chains.

For businesses struggling with delayed payments, high risks, or restricted access to credit, adopting solutions like Spydra isn’t just an option—it’s a competitive advantage.