Building a startup is a thrilling but challenging journey, and focusing solely on your core product or service may limit your growth potential. By exploring alternative revenue streams, you can..

An Employment Income Verification AI Agent is designed to automatically validate a person’s employment status and income details using structured and unstructured data sources. It reduces manual verification time, minimizes..

The start of a new financial year brings new responsibilities, and one of the most important is filing your Income Tax Return (ITR). For the financial year 2024-25, the process..

Whether you're a salaried individual, freelancer, or business owner, income tax return filing and company registration are essential steps toward financial stability and legal compliance. If you're looking to file..

Filing income tax and GST returns is a legal responsibility for every eligible individual and business in India. But for many, the process can feel complicated or time-consuming. With the..

Startups in India are the backbone of innovation and economic growth. Recognizing this, the Indian government introduced Section 80-IAC under the Income Tax Act to give DPIIT-recognized startups a powerful..

Clicks don’t pay the bills — conversions do.

But what if you could make every click smarter? More intentional. More valuable.

In this post, we explore how to transform casual..

Filing your ITR? Here’s why you shouldn’t wait till the last minuteFiling your income tax return is one of those things that’s easy to delay — until it’s suddenly urgent...

Introduction:Filing your Income Tax Return (ITR) isn’t just a legal requirement—it’s a smart financial move. Whether you're a salaried individual, freelancer, or business owner, the ability to file income tax..

The crypto is humming like a virtual gold rush, and you are piling your winnings on a Bitcoin trade or DeFi harvest. However, the shadow of the taxman is always..

Tax deductions are an important tool for businesses in the United States, helping to lower taxable income and reduce overall tax liabilities. For startups, understanding which expenses are deductible can..

In today’s competitive business environment, digital marketing is no longer optional—it is essential for sustainable revenue growth. Companies that strategically leverage digital channels can attract qualified leads, nurture prospects, convert..

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers,..

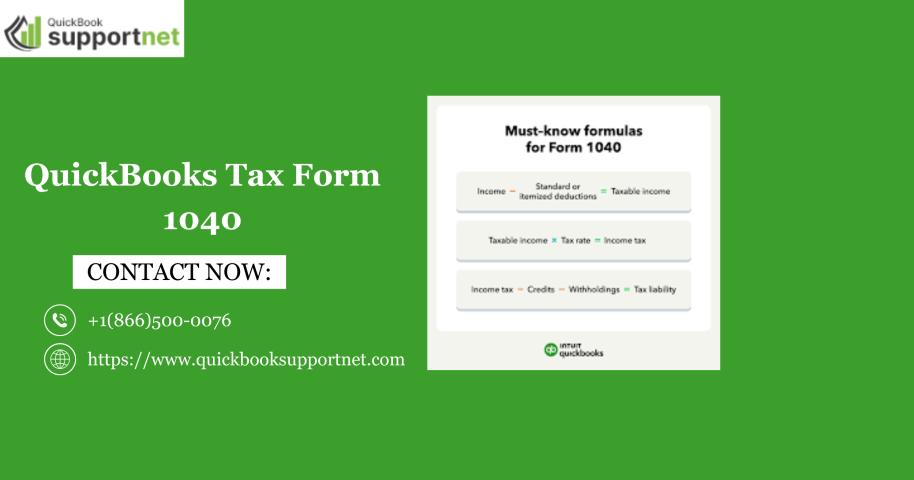

Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and..

Ever wondered how your accountant manages your tax so efficiently?

This Tax Agent Portal Guide breaks down how the portal works and why it helps accountants lodge accurately and on..

Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation..

Taxation is one of the trickiest aspects of running a business. It’s not just about calculating numbers — it’s about interpreting laws, staying compliant, and making sure no one pays..

In today’s fast-growing business environment, every entrepreneur needs a trusted partner who can simplify legal compliance, financial planning, and day-to-day accounting activities. BCPL Gujarat (Bizsmart Consultancy) stands out as a..