A fintech app development company is at the forefront of the financial sector, creating digital applications that are constantly evolving. They are not just making banking easier; they are creating new ways for people to interact with their money, from simple payments to complex investments. These companies are responsible for some of the biggest changes in finance, such as making services available on mobile phones and using new technologies to make things safer and more personal. They are focused on building solutions that are not only efficient but also open up new opportunities for both businesses and consumers.

Trends Shaping the Modern Fintech App Development Company

The financial world is constantly in motion, and a fintech app development company stays on top of new trends to build apps that meet the needs of today's users. These trends are changing what is possible in finance and creating new standards for what users expect.

The Rise of Embedded Finance

Embedded finance is the idea of putting financial services directly into non-financial apps. For example, a ride-sharing app might have a payment system built right in so a person can pay for their ride without opening a different app. This trend is a major focus for a fintech app development company.

Seamless Payments: Embedded finance makes paying for things much easier. It removes the need for a user to switch between apps to make a payment. This leads to a smoother experience and can increase customer loyalty.

Contextual Services: By putting financial services where they are most needed, a company can offer a user a loan or a payment plan at the exact moment they are about to make a purchase. This makes the service more useful and personal for the user.

The Push for Hyper-Personalization

Modern users expect services that are made for them. A fintech app development company is using data and AI to create financial apps that provide a hyper-personalized experience.

Smarter Financial Advice: Apps are using AI to analyze a user's spending habits and financial goals. The app can then provide personal advice on how to save money, where to invest, or how to stick to a budget. This is a level of personal attention that was once only available from a human financial advisor.

Tailored Product Recommendations: By looking at a user's behavior, an app can recommend financial products that fit their needs. It can suggest a specific savings account, a new credit card with better rewards, or an investment that matches their risk level.

Turn Your Fintech Idea into a Powerful App.

New Technologies and Their Role in Fintech Development

New technologies are the main drivers of innovation in the fintech sector. A fintech app development company uses these tools to build apps that are not just smarter but also more secure and efficient.

AI and Machine Learning in Financial Apps

AI and machine learning are making financial apps more intelligent. They are used for a variety of tasks that make apps better for both users and businesses.

Real-Time Fraud Detection: AI is very good at spotting things that are out of the ordinary. A fintech app development company builds apps that use AI to monitor transactions in real time. If the system sees a purchase that doesn't match a user's normal behavior, it can stop the transaction and alert the user. This adds a powerful layer of security and helps to prevent fraud before it happens.

Automated Processes: AI is also used to automate many tasks that were once done by people. This includes things like verifying a person's identity, processing a loan application, or providing customer support through a chatbot. This makes processes faster and reduces human error.

The Growing Use of Blockchain and DeFi

Blockchain technology, which is best known for cryptocurrencies, is being used to build more secure and transparent financial systems. Decentralized Finance (DeFi) is an emerging area that uses blockchain to remove the need for banks and other traditional financial institutions.

Secure and Transparent Transactions: Blockchain creates a shared, unchangeable record of transactions. This is very useful for keeping track of money and data in a way that is highly secure and transparent. A fintech app development company can use this to build apps that are more trustworthy and less open to fraud.

Peer-to-Peer Services: DeFi apps allow people to lend, borrow, and trade assets with each other without a middleman. This opens up new ways for people to get a loan or earn interest on their money.

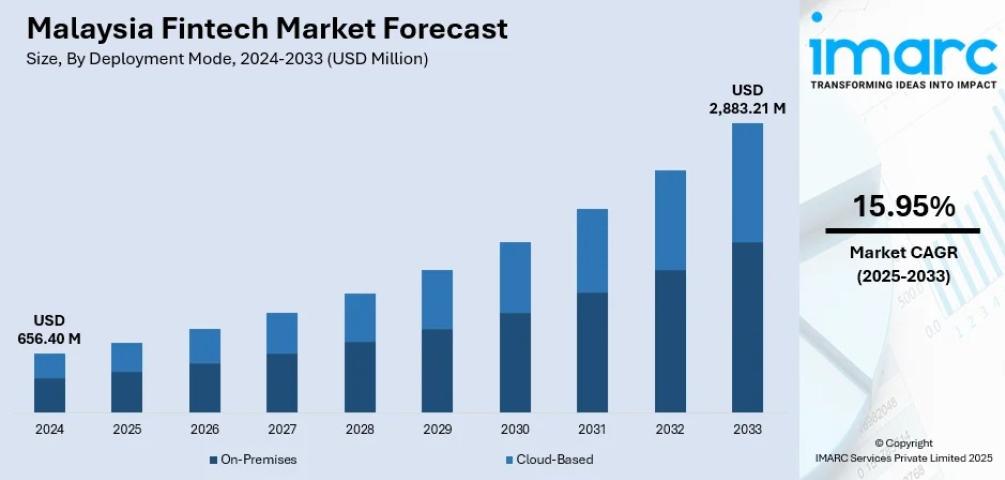

Future Opportunities for a Fintech App Development Company

The financial sector is still full of opportunities for a fintech app development company to create new products and services. These opportunities are focused on making finance more inclusive, ethical, and integrated into our daily lives.

Financial Inclusion and Access

A major opportunity is to serve people who are not currently part of the formal financial system.

Banking for Everyone: A fintech app development company is building apps that allow people in developing countries to access basic financial services, even if they do not have a bank account. Mobile money platforms and digital wallets give people a way to save, send, and receive money, which was not possible before.

Micro-Loans and Savings: These apps are making it easier for people to get a small loan or to save a little bit of money at a time. This helps people start a business, deal with an unexpected expense, or build a secure future.

Green Fintech and Sustainable Finance

There is a new and important trend to build apps that focus on environmental and social good. A fintech app development company is at the forefront of this trend.

Eco-Friendly Banking: Apps can help people track the environmental impact of their spending. They can show how much carbon a person’s purchases create and can suggest ways to reduce it. This helps people make better choices with their money and can have a positive effect on the planet.

Socially Responsible Investing: These apps make it easy for people to invest in companies that have a positive social or environmental impact. This allows people to align their investments with their personal values.