The used truck market is witnessing robust expansion, fueled by increasing demand for affordable commercial vehicles and continuous growth of logistics, e-commerce, and infrastructure sectors worldwide. With volatile raw material prices and a growing preference for cost-effective fleet solutions, the sector is expected to maintain a steady upward trajectory over the next decade as per Straits Research.

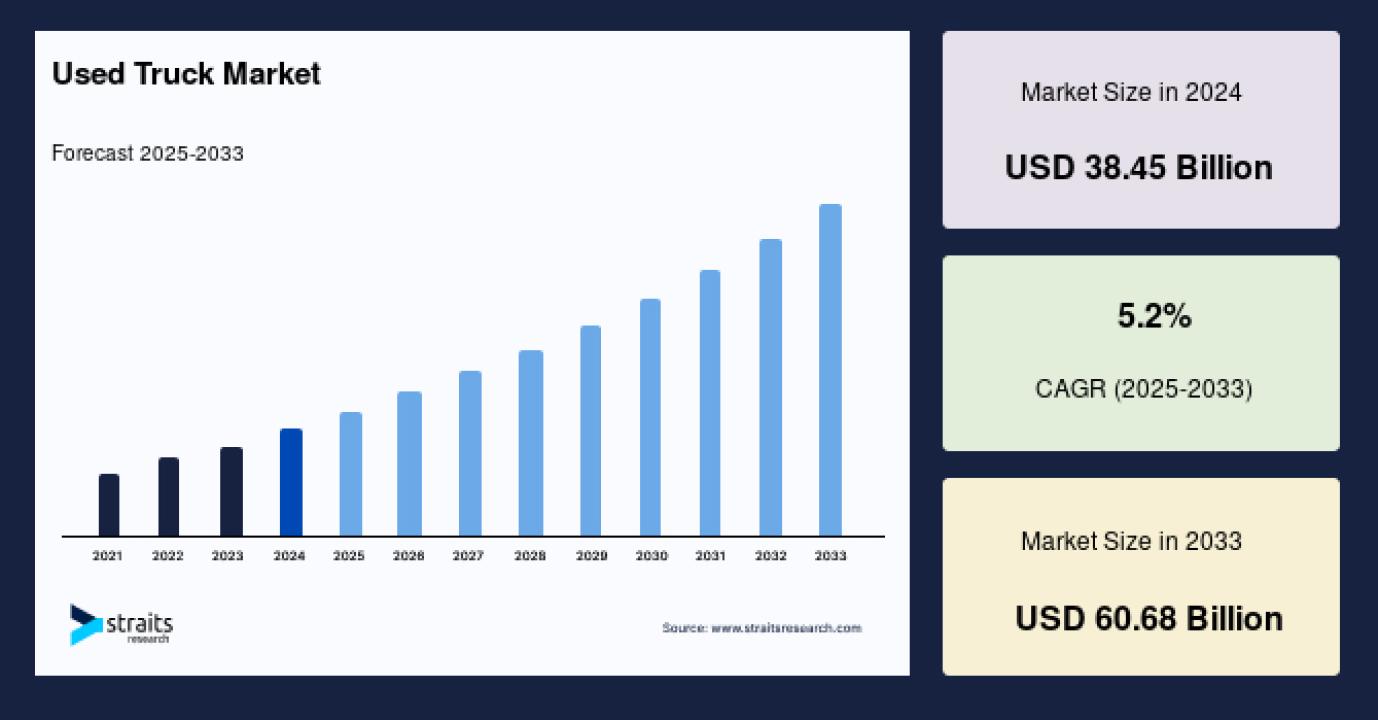

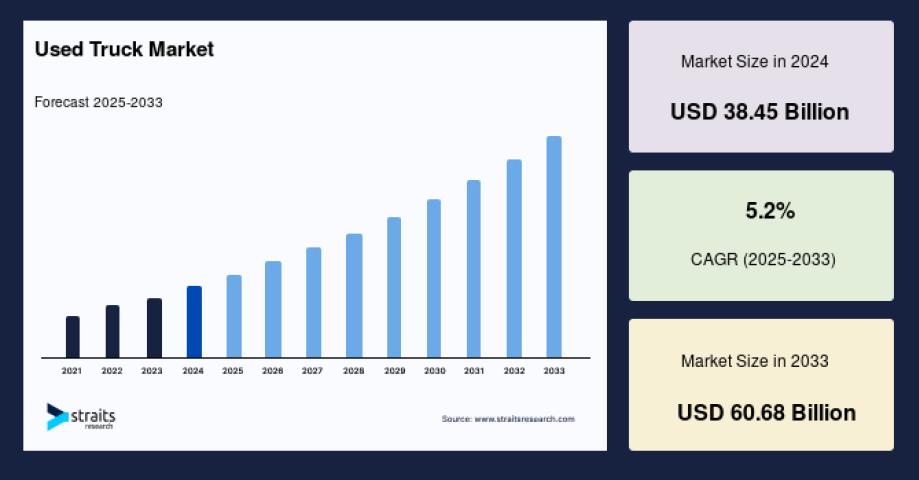

Market Size 2024 – USD 38.45 billion

Market Size 2025 – USD 40.45 billion

Market Size 2033 – USD 60.68 billion

CAGR (2025-2033) – 5.2%

Request Sample - https://straitsresearch.com/report/used-truck-market/request-sample

Market Drivers

Continued growth in logistics and goods transportation remains a major driver for the global used truck market as more companies seek reliable and economical solutions for fleet expansion . E-commerce adoption, especially in developing countries, has accelerated the demand for trucks, boosting sales in the used vehicle segment. Rising operational costs for new trucks, elevated depreciation rates, and expanding small business activity are pivotal factors propelling market growth. Straits Research indicates significant interest from small and medium logistics providers who prefer second-hand trucks to optimize expenses and streamline operations .

Key Challenges

Despite strong growth, the market faces notable challenges including inconsistent availability of certified pre-owned vehicles and regulatory complexities surrounding emission norms and cross-border transport policies. Fluctuating fuel prices, maintenance concerns, and insufficient transparency in vehicle history records can also affect the decision-making process for buyers. Straits Research highlights that adoption is sometimes restricted by stringent policies and variable resale values, particularly in countries with advanced emission regulations.

Market Segmentation

The used truck market, as detailed by Straits Research, is segmented based on truck type, application, sales channel, and region:

By Truck Type:

Light-duty Trucks

Medium-duty Trucks

Heavy-duty Trucks

Heavy-duty trucks account for the largest market share, driven by their extensive use in construction, mining, and cross-regional freight transport .

By Application:

Logistics

Construction

Mining

Agriculture

Logistics holds a dominant position, supported by the continuing boom in global trade and e-commerce fulfillment networks. Construction and mining sectors follow closely, requiring reliable heavy-duty trucks for daily operations .

By Sales Channel:

Online Dealers

Offline Dealers

Online channels are gaining rapid traction due to broader reach, convenience, and enhanced transparency in vehicle documentation and condition assessment. Offline dealerships, however, still maintain substantial market presence, particularly in regions where digitalization is nascent .

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Asia-Pacific emerges as the fastest-growing regional market, attributed to burgeoning infrastructure activities and rapid expansion in emerging economies. North America and Europe also represent lucrative markets due to high fleet renewals and regulatory compliance requirements .

Buy Now this report - https://straitsresearch.com/buy-now/used-truck-market

Top Players Analysis

According to Straits Research, the competitive landscape of the global used truck market includes several established companies actively expanding their dealer networks and investing in digital platforms for sales:

Volvo Group – Renowned for robust global network and certified truck programs .

Daimler AG (Mercedes-Benz Trucks) – Strong sales in Europe and North America, focusing on premium used truck offerings .

Scania AB – Advanced refurbishment centers and wide presence in Europe/Asia-Pacific .

PACCAR Inc (Kenworth, Peterbilt, DAF) – Leading North American and European used truck solutions .

MAN Truck & Bus – Comprehensive after-sales service ecosystem and quality assurance .

Tata Motors – Expanding reach in India and Asia-Pacific, with increasing focus on used vehicle networks .

Ashok Leyland – Rapidly growing dealer network in South Asia and investment in used vehicle infrastructure .

Navistar International – Diverse portfolio in North American used truck market .

Hino Motors – Strong positioning in the light and medium duty used truck segment .

Isuzu Motors – Prominent share in Asia-Pacific’s pre-owned commercial sector .

Each of these players is refining their product validation, warranty offers, and digital support services to enhance customer confidence and transaction transparency .

Market Size and Forecast Insights

With the global used truck market valued at USD 38.45 billion in 2024 and projected to reach USD 60.68 billion by 2033, the market illustrates consistent annual growth, underpinned by a robust CAGR of 5.2% from 2025 to 2033 . Rapid infrastructure development and intensified logistics demand are set to sustain this momentum throughout the forecast period.

Conclusion

The used truck market offers attractive opportunities for fleet operators and logistics enterprises seeking reliable, cost-effective vehicle solutions. With multi-channel sales expansion, digitization of the transaction process, and surging demand from construction, mining, and logistics, the sector is well-poised for dynamic growth. Regulatory complexities, vehicle certification, and fuel price volatility remain core challenges, but top manufacturers and dealers are leveraging digital platforms and warranty programs to mitigate risks and elevate customer experience . Straits Research’s in-depth quantitative evaluation provides clear guidance for decision makers to strategically invest in the used truck market.

ROI/Decision Making Line

Straits Research’s actionable data insights empower fleet managers and logistics leaders to make informed, cost-effective investment decisions and maximize ROI in a dynamic market landscape.