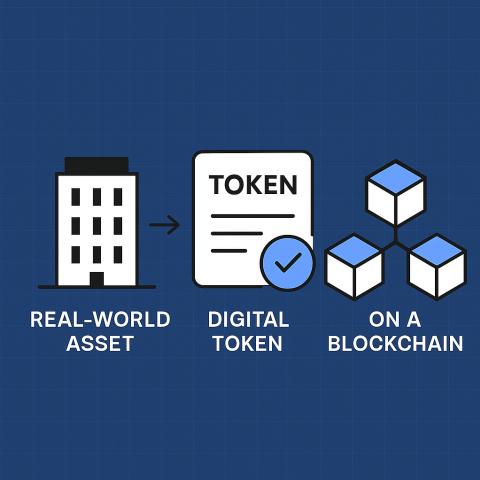

A Real World Asset Tokenization Development Company creates blockchain-based systems that convert physical and financial assets into digital tokens. Each token represents verified ownership or a share of value in the underlying asset.

This process—called tokenization—allows assets such as property, gold, bonds, or carbon credits to be traded digitally with complete transparency and security. These companies combine technology, regulation, and finance to make real-world assets liquid and accessible to global investors.

This complete guide explains what these companies do, how the tokenization process works, the benefits it brings, and how businesses can choose the right development partner.

1. What Is a Real World Asset Tokenization Development Company?

A Real World Asset Tokenization Development Company builds digital systems that connect real-world assets with blockchain technology. The company’s role is to create a secure platform where businesses can issue tokens backed by tangible assets.

Each token corresponds to real, verifiable ownership or a defined value. Through this process, investors can purchase or trade these tokens online, allowing assets that were once illiquid to move freely between participants.

This approach modernizes traditional asset management, giving businesses better access to liquidity and investors more transparency and control.

2. Why Businesses Need Tokenization in 2025

As industries continue to digitalize, businesses face growing pressure to modernize how they manage ownership and raise capital. Tokenization provides a practical way to achieve this.

A Real World Asset Tokenization Company helps businesses move from paper-based ownership to digital recordkeeping on blockchain. This brings instant verification, traceable transactions, and simplified compliance.

Tokenization allows companies to:

-

Sell fractional ownership of valuable assets.

-

Attract investors from different regions.

-

Create liquidity for traditionally illiquid assets.

-

Automate processes through smart contracts.

With financial technology maturing, tokenization has become a reliable and transparent tool for growth.

3. How a Tokenization Company Brings Assets to the Blockchain

The tokenization process involves converting an asset’s value or ownership rights into digital tokens stored on a blockchain. A RWA Tokenization Development Company manages this transition step by step, ensuring both legal and technical accuracy.

Step 1: Asset Evaluation

The company identifies and verifies the asset’s ownership, documentation, and market value. This step ensures only legitimate assets enter the digital ecosystem.

Step 2: Legal Structuring

A legal model defines how each token represents the asset—whether as equity, debt, or utility. This gives every token a recognized status under financial laws.

Step 3: Token Creation

Developers use blockchain technology to create digital tokens that carry unique identification data.

Step 4: Smart Contract Development

Smart contracts automate ownership transfers, dividend distribution, and compliance management.

Step 5: Investor Verification

Compliance systems such as KYC and AML are built into the platform to verify users and prevent fraud.

Step 6: Platform Deployment

Finally, the platform is launched, allowing investors to buy, sell, or trade tokens securely.

This structured process combines technology, trust, and compliance to bring real assets onto blockchain networks safely.

4. Core Features of a Real World Asset Tokenization Development Company

A professional Real World Asset Tokenization Development Company develops platforms built on strong technical and financial foundations.

Key features include:

-

Multi-Asset Support: Tokenizing assets such as real estate, commodities, debt, or equities.

-

Cross-Chain Integration: Supporting blockchains like Ethereum, Polygon, or Solana.

-

Automated Smart Contracts: Handling ownership, transactions, and payouts digitally.

-

Compliance Frameworks: Integrating KYC/AML for legal protection.

-

Custody Partnerships: Backing tokens with verified physical or financial assets.

-

Investor Dashboards: Giving users real-time access to portfolio data and transaction history.

These features help businesses create secure and transparent tokenized ecosystems ready for global participation.

5. How a Tokenization Company Maintains Compliance and Security

A reliable Real World Asset Tokenization Company prioritizes regulatory compliance and data security. These are the foundations of any legitimate tokenization project.

Compliance

The company integrates regulatory frameworks at every stage. KYC and AML verification systems confirm investor identity, while smart contracts follow regional laws related to digital assets and securities.

Security

Technical safety is equally vital. Companies use encryption, multi-signature wallets, and independent audits to protect both user data and digital tokens.

This combination builds trust between issuers, investors, and regulators, allowing tokenization to function as a secure financial system.

6. Benefits of Working with a Tokenization Development Partner

Hiring a Real World Asset Tokenization Development Company provides businesses with long-term advantages that go beyond technology.

1. Improved Liquidity

Tokenization enables businesses to trade assets instantly, removing long settlement periods.

2. Fractional Ownership

Investors can buy smaller shares of large assets, increasing accessibility and participation.

3. Transparency

All transactions are recorded on blockchain, providing permanent proof of ownership.

4. Lower Costs

Smart contracts replace intermediaries, reducing fees and administrative delays.

5. Global Investment Access

Digital platforms connect businesses with investors from different countries.

6. Automation

Processes like income distribution or asset resale happen automatically, improving efficiency.

These benefits help both businesses and investors operate in a more open and scalable financial environment.

7. How Tokenization Improves Liquidity and Market Efficiency

Traditional markets are limited by time, geography, and paperwork. Tokenization removes these limits by digitizing value.

A RWA Tokenization Development Company creates platforms that allow assets to be divided into smaller units, each represented by a token. These tokens can be bought or sold at any time, creating a liquid and continuous market.

Liquidity improves both investor confidence and business flexibility. For investors, it means easier entry and exit. For businesses, it means faster fundraising and capital access.

8. Real-World Applications of Tokenization

Tokenization has expanded across industries, proving its value beyond finance.

Real Estate

Developers tokenize properties, allowing investors to buy small portions of high-value assets.

Commodities

Companies tokenize metals, oil, or agricultural goods, making trade more transparent.

Private Equity

Startups and firms tokenize shares to attract digital investors.

Debt Instruments

Lenders issue tokenized loans or bonds for faster settlements.

Green Assets

Renewable energy projects tokenize carbon credits to fund sustainability initiatives.

These use cases show that tokenization can modernize nearly any asset class with measurable benefits.

9. The Role of Smart Contracts in Asset Tokenization

Smart contracts are the backbone of every tokenization platform. A Real World Asset Tokenization Company uses them to manage digital ownership and automate transactions.

These contracts are self-executing programs written on blockchain. They handle:

-

Ownership transfers when tokens are sold or traded.

-

Automatic dividend or rent payments to token holders.

-

Regulatory checks during each transaction.

By replacing manual processes, smart contracts increase speed, accuracy, and security — making digital finance both transparent and dependable.

10. Technology Stack Used by Tokenization Companies

A RWA Tokenization Development Company combines multiple technologies to build a scalable system.

The typical tech stack includes:

-

Blockchain Protocols: Ethereum, Solana, or BNB Chain for token creation.

-

Smart Contract Languages: Solidity and Rust for automated coding.

-

APIs: Connecting blockchain to web applications and payment gateways.

-

Cloud Infrastructure: Secure storage for verified asset data.

-

Compliance Tools: Integrated KYC and AML systems.

This mix allows businesses to manage large numbers of investors and transactions without compromising security or speed.

11. Why Security Defines the Best Tokenization Companies

Security is the core value of every Real World Asset Tokenization Company. Since tokenized systems handle financial assets, even minor risks can cause major losses.

To maintain confidence, companies conduct regular audits, penetration testing, and real-time monitoring. Token transactions are protected through multi-layer encryption and blockchain’s immutable structure.

Secure custody partnerships further protect real assets that back the tokens, ensuring that every digital unit remains authentic and verified.

12. Global Trends in Real World Asset Tokenization

By 2025, tokenization has become an integral part of the global financial market. Governments, enterprises, and investors are adopting this model for transparency and efficiency.

Some major trends include:

-

Increased institutional investment in tokenized assets.

-

Governments exploring tokenized bonds and securities.

-

Growth in green finance through tokenized carbon markets.

-

Cross-chain interoperability between blockchain networks.

-

Use of artificial intelligence for automated asset evaluation.

These trends show how tokenization is shaping the next generation of finance worldwide.

13. How to Choose the Right Tokenization Development Company

Selecting the right Real World Asset Tokenization Development Company can determine the success of your project. Businesses should evaluate companies carefully before partnering.

Consider the following factors:

-

Technical Expertise: The company should have proven blockchain development experience.

-

Legal Understanding: Ability to create compliant frameworks for tokenized assets.

-

Security Standards: Regular audits and encrypted data systems.

-

Scalable Platforms: Ability to handle growing investors and asset types.

-

Communication Clarity: Transparent reporting and project updates.

Choosing a partner with these qualities ensures your project runs smoothly and meets legal and market expectations.

14. How Tokenization Companies Support Business Growth

A professional Real World Asset Tokenization Development Company helps businesses go beyond digitization by creating new financial opportunities.

Through blockchain integration, businesses can access investors worldwide, expand funding options, and introduce more flexible ownership models.

The platforms they build give businesses a competitive edge — faster transactions, secure management, and transparent performance tracking — all within one digital ecosystem.

15. The Future of Tokenization in Digital Finance

The future of tokenization points toward a more open and connected global economy.

As blockchain regulations stabilize and digital assets gain legal clarity, more industries will turn to tokenization for ownership management. Financial institutions are expected to collaborate with tokenization firms to introduce regulated digital securities and hybrid markets.

In this new era, the Real World Asset Tokenization Development Company will remain a central partner in building trusted systems that bridge traditional and digital finance.

16. Conclusion: Building the Future with Tokenization

A Real World Asset Tokenization Development Company helps businesses digitize assets, increase liquidity, and attract global investors securely. By combining blockchain technology with legal and financial structure, these companies make asset ownership faster, more transparent, and more inclusive. Empower Your Business with Secure & Compliant RWA Tokenization Solutions!

As digital finance expands, working with a trusted tokenization partner can help your business stay ahead. Tokenization is no longer a concept — it’s the foundation for how real-world value will move in the future.