Imagine being able to buy a piece of a skyscraper in New York, a share of fine art, or even a slice of your favorite sports team—all from your phone, in minutes, with the security of blockchain.

That’s the promise of asset tokenization, and in 2025 it’s no longer just a futuristic idea. It’s happening now, and it’s changing the way money and markets work.

In this guide, we’ll cover:

-

What tokenization actually means (in plain English)

-

Why it’s taking off in 2025

-

Real examples you can understand

-

Benefits (and risks) you should know

-

Common FAQs

-

Where this is all heading by 2030

So, what is asset tokenization?

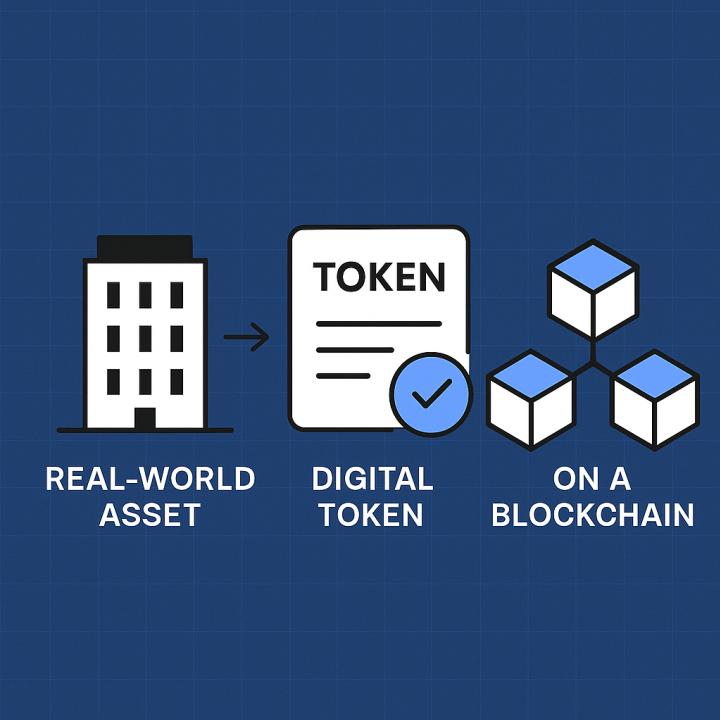

At its core, asset tokenization is turning real-world things into digital tokens on a blockchain.

-

The “thing” could be money, government bonds, real estate, or artwork.

-

The “token” is like a digital receipt or certificate of ownership that proves you own part (or all) of that thing.

Think of it like slicing up a pizza. The pizza is the real-world asset (say, a $10 million building). Each slice represents a token. Instead of one person buying the whole pizza, thousands of investors can buy slices.

Because the tokens live on a blockchain, they’re:

-

Traceable (you can see who owns what)

-

Transferable (easy to move between people, subject to rules)

-

Programmable (dividends or rent payments can be distributed automatically)

This is different from cryptocurrencies like Bitcoin, which are digital assets in themselves. With tokenization, the value comes from something real behind the token.

Why 2025 is the breakout year

For years, tokenization was mostly hype. Banks did experiments, startups promised revolutions, and regulators scratched their heads. But the puzzle pieces are finally clicking into place.

Here’s why 2025 is the turning point:

1. Big names are now leading

When BlackRock—the world’s largest asset manager—launched a tokenized money market fund called BUIDL, the finance world took notice. This wasn’t a startup testing an idea; it was a $10 trillion giant putting real assets on-chain.

Not long after, Franklin Templeton expanded its tokenized money funds across the U.S. and Europe. They even added features like daily interest payouts directly to your wallet.

This signaled: tokenization isn’t just theory. It’s a real product for real investors.

2. The numbers are finally moving

In 2023, tokenized assets were barely a blip. Fast forward to mid-2025, and over $7 billion in tokenized U.S. Treasuries and money market funds are live on blockchains.

Compared to global finance ($100 trillion+ in bonds alone), that’s tiny. But growth is rapid, and in financial markets, adoption often starts slow—then snowballs.

3. Regulators are getting clearer

For institutions, regulation is everything. And now, several regions are giving green lights:

-

Europe’s MiCA law sets clear rules for digital assets.

-

The UK published a roadmap for tokenized investment funds.

-

Hong Kong’s SFC is issuing licenses for tokenized securities.

This clarity makes it easier for big players to launch real products without fear of breaking rules.

4. Tokenization solves real pain points

The reason adoption is growing isn’t just hype. Tokenization fixes actual problems:

-

Settlement delays (trades taking 2 days) → now near-instant.

-

Limited access (private funds with $5M minimums) → now fractionalized.

-

Lack of transparency (opaque registries) → now visible on-chain.

Real-world examples

To make it real, let’s look at where tokenization is already being used:

🏦 Cash and Treasuries on-chain

Instead of keeping idle cash in a bank, companies can hold tokenized money market funds or Treasury bills. These earn yield while still moving instantly like digital cash. Crypto companies, in particular, love this because it replaces slow wire transfers with tokens that can be pledged as collateral in seconds.

🏢 Real estate

A $50 million building can be split into 50,000 tokens worth $1,000 each. That means smaller investors—who could never buy an entire office tower—can now own a piece of it. Token holders may also receive rent income or a share of profits when the property sells.

🎨 Art and collectibles

In 2021, a company tokenized shares of a Basquiat painting, letting thousands of people co-own it. The same model applies to rare cars, sneakers, or even sports memorabilia.

📈 Private equity and venture funds

Traditionally, investing in private equity required millions and a 10-year lockup. With tokenization, funds can lower minimums and even create secondary markets where investors sell early.

🌱 Green assets & carbon credits

Carbon credits and renewable energy projects are being tokenized too. This creates transparency and allows corporations to trade sustainability-linked tokens more efficiently.

Why it matters: benefits you can feel

Let’s break down the 7 biggest advantages of tokenization, with simple examples:

-

Faster settlement

-

Today: Selling a bond → wait 2–3 business days to settle.

-

With tokenization: Settlement can be instant, even at midnight on a weekend.

-

Lower barriers

Instead of needing $1M to enter a private equity fund, you might only need $1,000 worth of tokens.

-

Programmable money

Tokens can “auto-execute” things like paying dividends or enforcing compliance. Example: a tokenized bond could automatically pay interest into your wallet every month.

-

Transparency

Blockchains show a clear, real-time record of who owns what. This cuts down on fraud and makes auditing easier.

-

Liquidity for illiquid assets

Normally, selling your share in a private company or a building is nearly impossible. With tokenization, you could trade your slice on an approved marketplace, creating secondary liquidity.

-

Global access

Tokens don’t care about time zones. An investor in London and one in Singapore can transact instantly, without waiting for Wall Street to open.

-

Efficiency and cost savings

By cutting out intermediaries (like transfer agents and paper registries), tokenization can reduce fees and speed up back-office processes.

But let’s be real: risks exist

Of course, tokenization isn’t magic. There are real challenges:

-

Liquidity illusion: Just because an asset is tokenized doesn’t mean buyers will appear. A $1,000 slice of a skyscraper may still sit unsold.

-

Regulation mismatches: Rules differ across countries. A token legal in Singapore may not be in the U.S.

-

Custody risk: If you lose access to your wallet or keys, you could lose your tokens. Institutions use custodians, but that adds complexity.

-

Tech bugs: A flawed smart contract could freeze assets. In 2022, a bug in a DeFi protocol locked millions—this risk still exists.

-

Privacy: Public blockchains show everything, which isn’t always ideal for investors who value confidentiality.

FAQs about tokenization

👉 Is tokenization the same as cryptocurrency?

Not really. Bitcoin has no underlying asset. Tokenized assets represent real-world things—like cash, bonds, or property—backing the digital token.

👉 Can I invest in tokenized assets right now?

Yes, but it depends where you live. Some tokenized funds are open to retail investors; others are only for institutions or accredited investors.

👉 Will everything get tokenized?

Probably not. Some assets (like commodities or equities) already trade efficiently. But for things like private markets, real estate, and funds, tokenization solves big pain points.

👉 Is it safe?

It’s as safe as the rules, custody, and tech around it. Regulation is improving, but investors still need to do due diligence.

The road ahead: 2030 vision

So where is this going? Experts predict:

-

Mainstream adoption of tokenized funds – Your brokerage app may one day offer tokenized mutual funds alongside traditional ones.

-

Private markets open up – Tokenization could let more everyday investors buy into startup equity, art, or infrastructure projects.

-

Faster payments and settlement – As tokenized deposits and central bank digital currencies (CBDCs) roll out, money and assets could move on the same rails instantly.

-

Interoperability standards – Different blockchains and countries will start “talking” to each other, making transfers seamless.

-

New asset classes – Think tokenized data, AI model rights, or even music royalties.

Final thoughts

Tokenization is reshaping finance in 2025 not by creating something new, but by making old assets smarter, faster, and more accessible.

The transition won’t be perfect. There will be risks, regulation hurdles, and bumps along the way. But when giants like BlackRock and Franklin Templeton are already rolling out tokenized funds—and regulators are warming up—it’s clear we’re heading toward a future where real-world assets live on digital rails.

The last decade was about crypto speculation. This decade might be about bringing the real economy on-chain—and that could change investing forever.