Managing insurance policies used to take time, paperwork, and multiple visits to the office. Today, things are different. With the LIC Customer Portal, policyholders can access their policy details, make payments, track claims, and handle most tasks online with just a few clicks. This portal is designed to make insurance management simple, accessible, and stress-free.

This guide explains how the LIC Customer Portal Login works, its key features, and the benefits it brings to policyholders. Whether you’re registering for the first time or simply want to understand the portal better, this guide will help you get comfortable with everything it offers.

What Is the LIC Customer Portal?

The LIC Customer Portal is an online platform created for policyholders to manage their LIC policies independently. It brings policy information, service requests, payment options, and important documents under one digital roof.

Instead of visiting the branch for every query, users can simply log in and get the information they need instantly. It’s convenient, secure, and available anytime, making insurance management much easier.

How the LIC Customer Portal Login Works

Using the portal is straightforward. Here’s how it generally works:

1. Registration

Before logging in for the first time, a policyholder must register. During registration, users provide their basic details and at least one policy number to validate their identity.

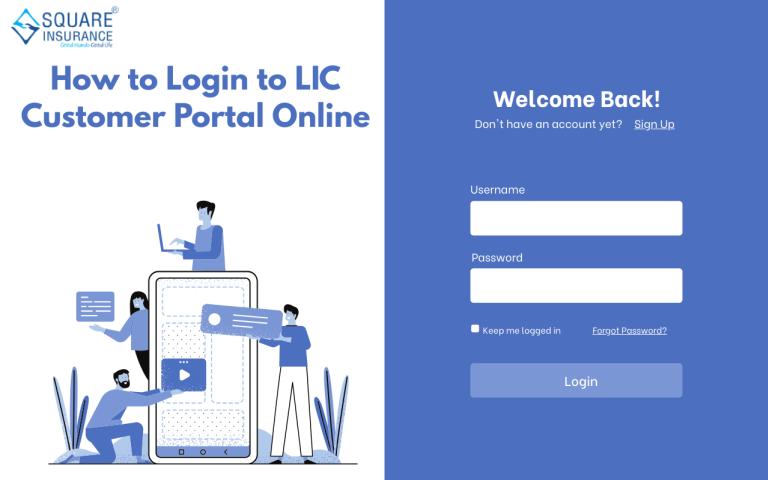

2. Creating Login Credentials

Once registered, users set up a username and password that will be used to access the portal.

3. Logging In

After the account is created, users can log in whenever they want using their credentials. The dashboard shows all linked policies and available services.

4. Accessing Services

The portal displays options such as premium payments, claim status checks, document downloads, and more. Users can access any service based on what they need.

The entire process is designed to be user-friendly, even for those who aren’t comfortable with technology.

Key Features of the LIC Customer Portal

The portal comes with a wide set of features that make policy management smoother and more organized. Some of the most important ones include:

1. Complete Policy Overview

Policyholders can view all their active and inactive policies in one place. The portal shows important details such as:

- Policy status

- Premium amount

- Next premium due date

- Maturity date

- Bonus information

This helps users stay aware of their insurance portfolio at all times.

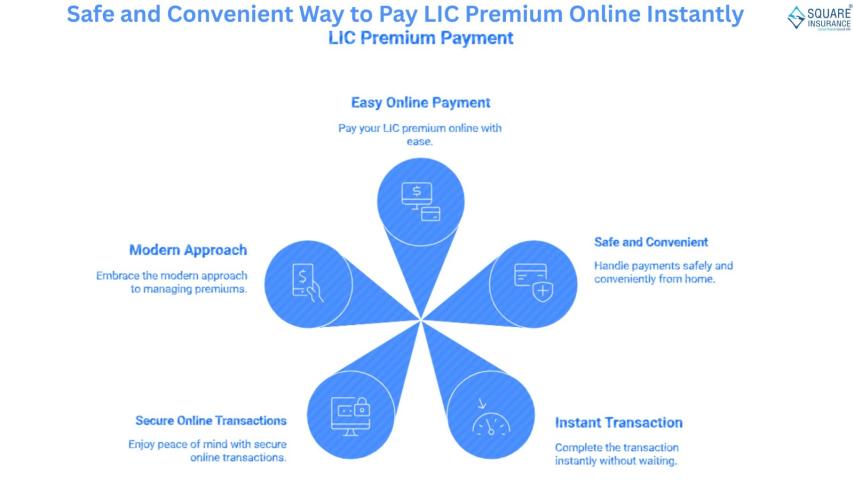

2. Online Premium Payments

The portal makes premium payments quick and convenient. Users can pay their dues instantly without visiting the branch or handling physical receipts. Once the payment is complete, the receipt is available for download immediately.

3. Access to Policy Documents

Users can download:

- Premium receipts

- Policy schedule

- Claim forms

- Benefit illustrations

Having documents available digitally is extremely helpful when planning finances or filing claims.

4. Claim Status Tracking

The portal keeps users informed about the progress of their claims. This feature saves time and reduces the stress of repeated follow-ups. Users can log in anytime and check where their claim stands and what steps are pending.

5. Premium Calendar & Alerts

The portal provides reminders and schedules for upcoming premiums. These alerts help ensure policyholders avoid missing payments and keep their policies active.

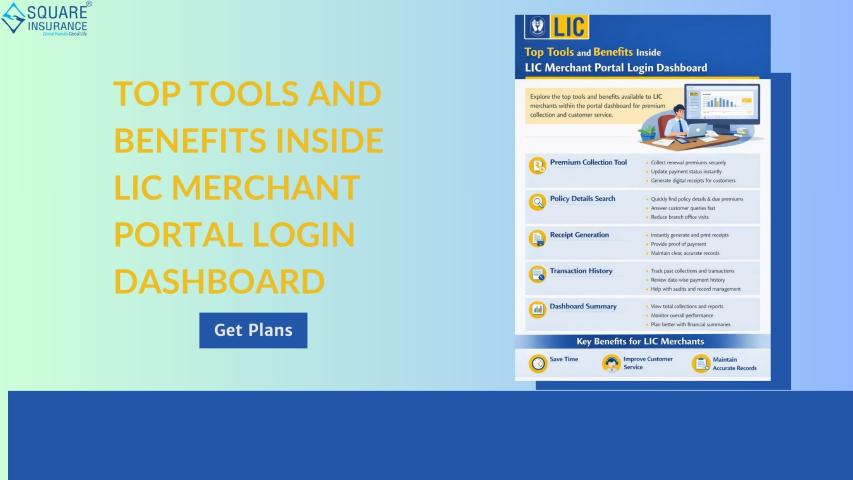

6. Service Requests

Many service requests can be made directly from the portal, such as:

- Updating personal details

- Changing contact information

- Requesting policy loans

- Submitting forms digitally

This reduces the need for branch visits and speeds up the entire process.

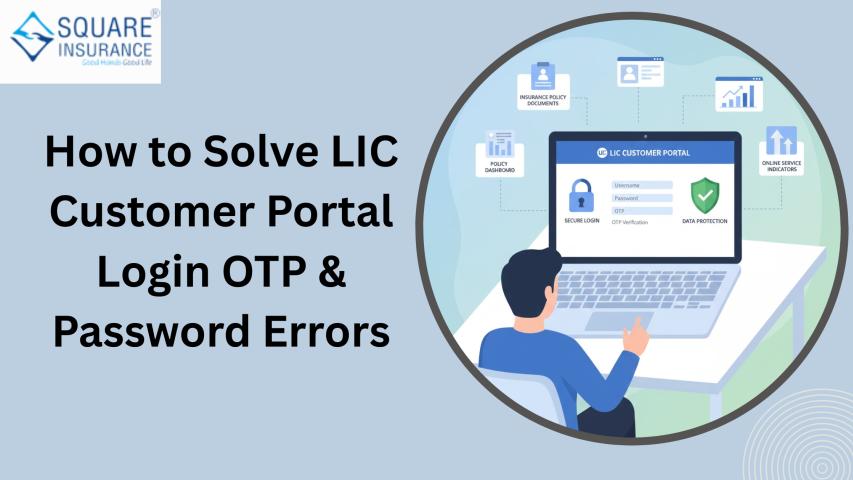

7. Secure Access and Data Protection

The portal uses secure login methods and encrypted processes to safeguard user information. With password protection and OTP-based verification, policyholders can manage their policies with confidence.

Top Benefits of Using the LIC Customer Portal

Using the portal brings several advantages that make policy management far easier than before. Here are some of the major benefits:

1. Saves Time and Effort

The biggest benefit is convenience. Instead of waiting in queues or traveling to the branch, you can get everything done from home—any time you want.

2. Instant Access to Information

The portal provides real-time updates. Whether you want to check policy status or payment history, the information is always available within seconds.

3. Reduces Dependence on Paperwork

Documents are stored digitally, making them easy to download and safe from damage or loss. You no longer need to store piles of papers or search for receipts.

4. Helps You Stay Organized

With alerts, schedules, and digital tracking, policyholders can manage multiple policies more easily. It ensures you never miss a premium or lose track of important dates.

5. Enhances Transparency

The portal gives policyholders full visibility of their policies, claims, and transactions. This transparency builds trust and confidence in the insurance process.

6. Available 24/7

Unlike branch offices with limited working hours, the portal is accessible around the clock. Whether it’s early morning or late at night, you can manage your policies whenever it suits you.

7. Safe and User-Friendly

The platform is designed to be simple and secure, making it suitable even for users who are new to online platforms. All essential services are presented in a clean, easy-to-navigate layout.

Conclusion

The LIC Customer Portal is a valuable tool for policyholders who want an easier, faster, and more convenient way to manage their insurance policies. With features like online payments, claim tracking, digital documents, reminders, and secure access, it brings everything together in one place.

Whether you’re a long-time policyholder or someone just getting started, using the LIC Customer Portal can make your insurance experience smoother and far more efficient. It reduces effort, increases transparency, and helps you stay in control of your financial planning.