Introduction

The digital revolution has transformed the

insurance industry by simplifying administrative work and improving customer

service efficiency. Insurance agents and merchants now rely heavily on online

platforms to manage policy operations seamlessly. One such important digital

tool is the merchant portal provided by the leading insurance organization in

India.

For insurance agents and merchants who deal with

multiple clients daily, manual record management can be challenging. The LIC Merchant Portal Login solves this problem by offering a centralized dashboard

for policy administration and transaction monitoring.

This blog explains the top advantages of using

the LIC merchant portal for agents and merchants and why it is becoming an

essential tool for modern insurance business operations.

What is LIC Merchant Portal Login?

The LIC Merchant Portal Login is an official

online access system created for authorized partners to handle policy-related

services digitally. It allows agents, merchants, and collection representatives

to manage insurance business activities without visiting physical offices.

Through this portal, users can check policy

details, track premium payments, verify customer records, and monitor

commission transactions.

The platform reflects the organization's

commitment to digital transformation and customer-friendly service delivery.

Top Benefits of LIC Merchant Portal Login for

Agents and Merchants

1. Simplified Policy Administration

Managing multiple insurance policies manually

can lead to errors and time delays. The merchant portal provides a structured

dashboard where agents can view all customer policies in one place.

Agents can easily search policy numbers, check

renewal schedules, and monitor active policy records. This reduces dependency

on physical documentation and improves operational accuracy.

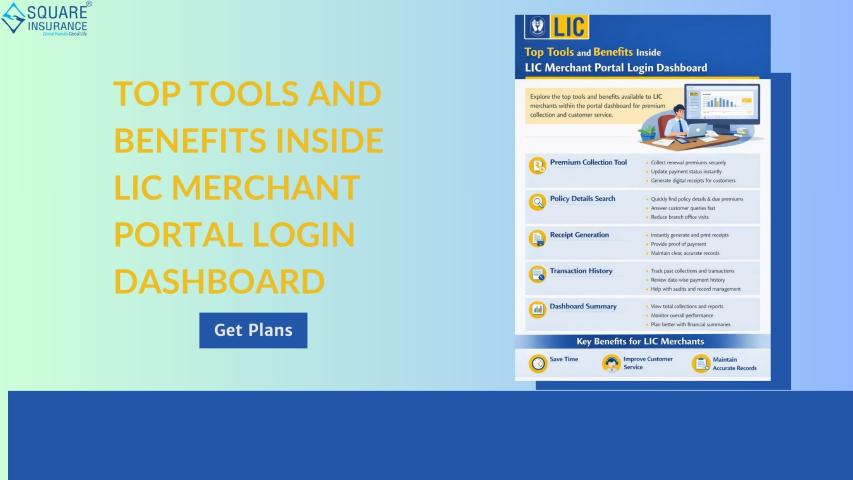

2. Faster Premium Collection Processing

Premium collection is one of the most

important responsibilities of insurance merchants. The online portal enables

faster premium transaction processing and confirmation.

Instead of maintaining cash registers or paper

receipts, merchants can record transactions directly into the system. This

improves financial transparency and reduces accounting confusion.

Digital premium tracking also helps merchants

reconcile payment records efficiently.

3. Secure Customer Data Protection

Data security is a major priority in financial

services. The merchant portal uses advanced authentication mechanisms to ensure

safe access.

Only authorized users can log in and manage

policy information. Customer financial data and personal details are protected

through secure data encryption methods.

This level of security helps build long-term

trust between agents, merchants, and policyholders.

4. Commission and Payment Tracking

Insurance business earnings are closely linked

to commission structures. The portal allows merchants to track their commission

status and payment history.

Agents can verify pending commission payments

and analyze business performance. This feature helps in financial planning and

improves transparency in earnings calculation.

5. Real-Time Policy Status Updates

The merchant portal provides real-time updates

regarding policy status. Agents can check whether a policy is active, pending,

or nearing renewal.

Real-time monitoring helps merchants inform

customers about upcoming premium deadlines, preventing policy lapses.

This feature enhances customer satisfaction

and service reliability.

6. Reduced Administrative Workload

Traditional insurance operations required

extensive paperwork and office visits. The online merchant system significantly

reduces administrative burden.

Agents can complete most business tasks

digitally, including record verification and transaction monitoring.

This allows merchants to focus more on

customer communication and business expansion rather than documentation work.

7. Improved Customer Relationship Management

Customer relationship management plays a vital

role in insurance success. The portal helps agents maintain organized customer

records.

Merchants can track policy history, premium

payment behavior, and renewal patterns. This information helps in providing

personalized service recommendations.

Better customer management ultimately improves

business retention rates.

8. Convenient Access Anytime and Anywhere

The portal is accessible through

internet-enabled devices, allowing merchants to manage business operations from

different locations.

Whether agents are working from office, home,

or field locations, they can log in and monitor policy information easily.

This flexibility is especially useful for

modern mobile business operations.

9. Accurate Business Reporting

Business performance analysis becomes easier

with digital reporting tools. The merchant portal provides transaction

summaries, collection reports, and policy activity data.

These reports help agents understand business

growth trends and identify improvement opportunities.

Regular performance monitoring supports

strategic business planning.

10. Faster Customer Service Delivery

Customers expect quick responses regarding

policy queries and payment confirmation. The merchant portal allows agents to

provide faster service by accessing updated policy information instantly.

Quick service improves customer satisfaction

and strengthens professional credibility.

Importance of Using Official Portal Access

Using the official merchant portal is

important for maintaining business authenticity and operational security.

Unauthorized platforms may expose users to data risks and financial fraud.

The digital infrastructure provided by the

insurance organization ensures reliable service performance and data

protection.

Agents and merchants are advised to use only

authorized login credentials to avoid security issues.

Future of Digital Insurance Management

The insurance industry is moving towards more

advanced digital solutions. Online platforms are expected to integrate

artificial intelligence, automated customer assistance, and predictive

analytics.

The merchant portal system represents a step

toward modernizing insurance business operations and improving service delivery

standards.

Conclusion

The LIC merchant portal is an essential

digital tool for insurance agents and merchants who want to manage policy

operations efficiently. The platform provided by the Life Insurance Corporation of India supports

secure transactions, faster policy management, and better customer service.

From premium collection tracking to commission

monitoring, the portal simplifies many business activities. It saves time,

improves data accuracy, and enhances professional productivity for insurance

partners.

For agents looking for additional insurance

business assistance and modern service solutions, platforms like Square Insurance can provide useful support

resources and digital insurance guidance.

Adopting digital merchant portal services is a

smart decision for insurance professionals who want to grow their business in

today’s competitive market.

Frequently Asked Questions

1. Who

can use the LIC Merchant Portal Login?

Only authorized insurance merchants, agents, and business partners with

official credentials can access the portal.

2. What

services are available in the merchant portal?

Users can manage policy records, track premium payments, check commission

details, and view business reports.

3. Is

the LIC merchant portal safe for financial operations?

Yes, the portal uses secure authentication and encrypted data protection

methods.

4. Can I

access the merchant portal using a mobile device?

Yes, the portal is compatible with internet-enabled smartphones, tablets, and

computers.

5. How do I recover my merchant portal password?

You can use the password recovery option available on the official login page

or contact authorized support channels.