In today’s digital era, buying car

insurance online has become fast, convenient, and cost-effective. Among the top

insurers in India, ICICI

lombard online car insurance stands

out for its seamless online process, instant policy issuance, and attractive

discounts. If you’re planning to secure your car with a reliable insurer, ICICI

Lombard online car insurance is a smart choice.

As an insurance content expert with

over 15 years of experience and 10,000+ blogs written in this domain, I’ll

share in-depth insights to help you understand ICICI Lombard’s online car insurance—from features and benefits to discounts and claims—following EEAT principles

for trust and authority.

Why Choose ICICI Lombard

Online Car Insurance?

Buying car insurance online from

ICICI Lombard offers multiple advantages:

- Instant policy issuance—no waiting period

- Paperless process—100% digital documentation

- Transparent pricing—no hidden charges

- Secure online payments

- Customizable coverage

- 24x7 customer support

- Access to exclusive online

discounts

Their advanced digital platform

ensures a smooth and user-friendly experience, even for first-time buyers.

Types of ICICI Lombard Car Insurance Plans

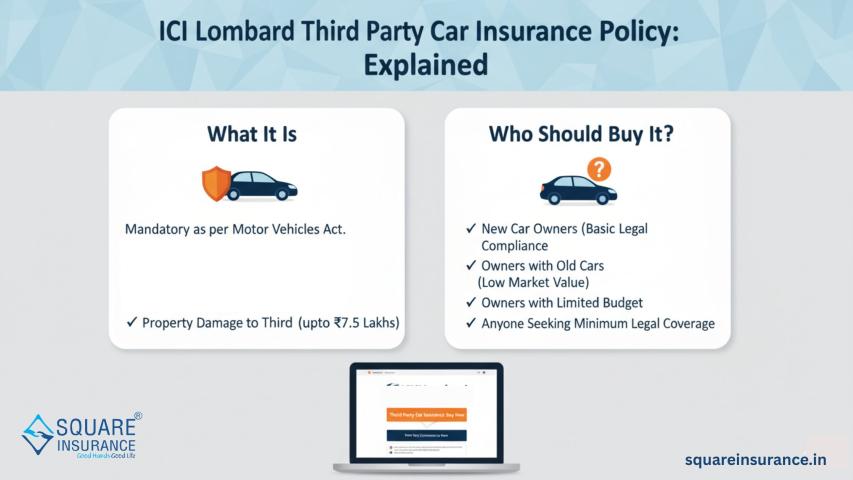

1. Third-Party Car

Insurance

This policy is mandatory as per

Indian motor laws. It covers:

- Injury or death of a third person

- Damage to third-party property

- Legal liabilities arising from accidents

However, it does not cover your own vehicle damage.

2. Comprehensive Car

Insurance

This is the most popular and

recommended plan. It includes:

- Third-party liability cover

- Own damage cover

- Theft protection

- Fire and explosion

- Natural disasters (flood, earthquake, cyclone)

- Man-made disasters (riot, vandalism)

- Personal accident cover

3. Standalone Own Damage

Policy

If you already have third-party

insurance, you can buy this plan to protect your car against:

- Accidental damage

- Theft

- Fire

- Natural calamities

Coverage Offered by ICICI

Lombard

What’s Covered?

- Accidental damages

- Theft or burglary

- Fire, explosion, self-ignition

- Flood, storm, earthquake

- Riot, strike, vandalism

- Personal accident cover (owner-driver)

- Legal liabilities to third parties

What’s Not Covered?

- Normal wear and tear

- Mechanical or electrical breakdown

- Driving under alcohol/drug influence

- Invalid driving license

- Consequential losses

- Usage beyond geographical limits

Add-On Covers for Enhanced

Protection

You can enhance your policy with

these valuable add-ons:

- Zero Depreciation Cover – Full claim amount without depreciation

- Engine Protect Cover—Covers engine damage due to water ingression

- Roadside Assistance

– 24x7 towing and emergency help

- Return to Invoice Cover—Get full invoice value in case of total loss

- Consumables Cover

– Covers engine oil, nuts & bolts

- No Claim Bonus Protection – Protects your NCB

ICICI Lombard Online

Discounts

When you buy ICICI Lombard car

insurance online, you can enjoy:

- Online purchase discounts

- No Claim Bonus (up to 50%)

- Long-term policy discounts

- Voluntary deductible

discounts

- Anti-theft device discount

Pro

Tip:

Maintaining a claim-free record and

renewing on time can help you save thousands on your premium.

How is the ICICI Lombard

Premium Calculated?

Your premium depends on:

- Vehicle age

- Car’s IDV (market value)

- Fuel type

- City of registration

- Claim history

- Add-ons selected

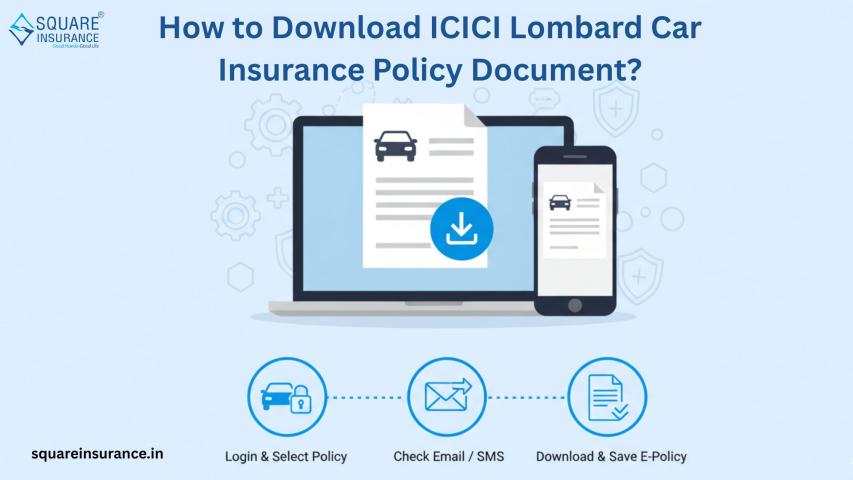

How to Buy ICICI Lombard

Car Insurance Online?

Follow these simple steps:

- Visit official website or trusted aggregator

- Enter car registration number

- Select policy type

- Customize coverage & add-ons

- Compare premium

- Make online payment

- Get policy instantly on email

ICICI Lombard Claim Process

(Online)

Step-by-Step Claim

Procedure

- Inform ICICI Lombard immediately

- Register claim online/app

- Provide accident details

- Surveyor inspection

- Repair at network garage

- Claim settlement

Required Documents

- RC copy

- Driver's license

- Policy copy

- FIR (if required)

- Repair bills

Cashless vs Reimbursement

Claims

Cashless Claim

- The insurer pays garage directly

- No upfront payment

- Only at network garages

- Faster processing

Reimbursement Claim

- You pay repair bills first

- The insurer reimburses later

- Any garage allowed

- Slightly more documentation

Benefits of ICICI Lombard

Online Car Insurance

- 8,800+ cashless garages across India

- Fast claim settlement

- High customer satisfaction

- Strong financial backing

- Advanced mobile app

- Easy renewals

Why Is ICICI Lombard a

Trusted Insurer?

- Over 20 years in insurance

- Backed by ICICI Bank

- 3+ crore customers

- High claim settlement ratio

- Transparent policy wording

Frequently Asked Questions

(FAQs)

Q.1.

Is ICICI Lombard online car insurance safe?

Yes, it offers secure transactions,

fast claims, and reliable support.

Q.2.

Can I buy an ICICI Lombard policy through Square Insurance?

Yes, you can easily compare and

purchase ICICI Lombard car insurance through squareinsurance, ensuring expert

guidance and competitive pricing.

Q.3.

Does ICICI Lombard provide zero depreciation cover?

Yes,

it is available as an add-on.

Q.4.

How long does claim settlement take?

Usually within 3–5 working days

after document verification.

Q.5.

Can I transfer my No Claim Bonus?

Yes, NCB is transferable when

switching insurers.

Expert Opinion (EEAT

Perspective)

Having worked closely with multiple

insurers over the past 15 years, I’ve seen ICICI Lombard consistently deliver

quick claim resolutions and strong customer service. Their digital ecosystem

and transparent processes make them a reliable choice for modern car owners.

Conclusion

ICICI Lombard online car insurance

offers the perfect balance of:

- Easy online purchase

- Instant policy issuance

- Attractive discounts

- Strong claim support

Whether you’re buying a new policy

or renewing an existing one, ICICI Lombard provides flexibility, reliability,

and peace of mind.

Note:

Download our app "Square

Insurance POS – Apps on Google Play" to compare policies, track

renewals, manage clients, and grow your insurance business digitally.