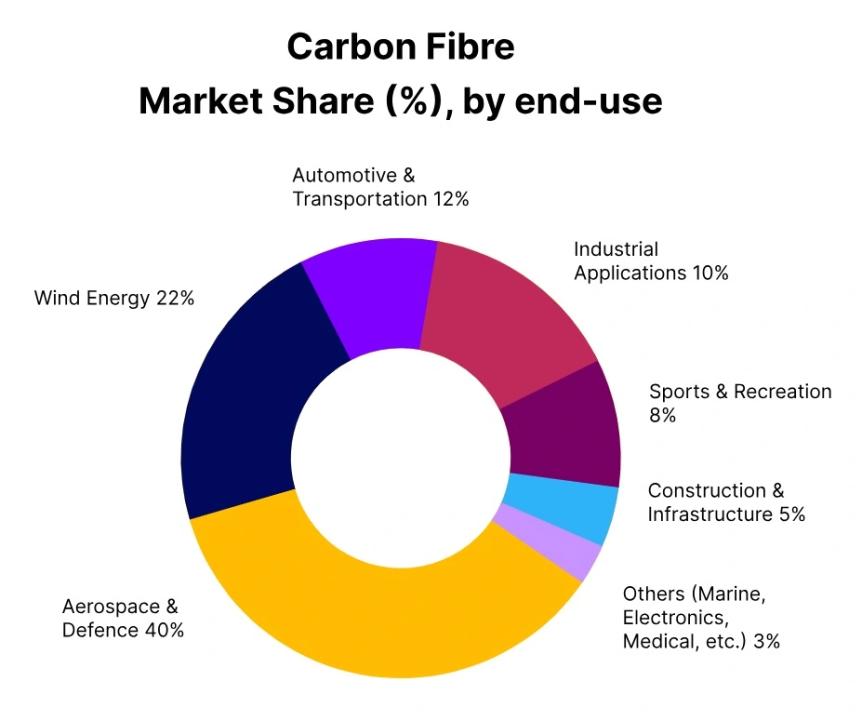

Carbon fibre has become an essential material in many modern industries. It is known for being strong, lightweight, and durable, which makes it useful in sectors such as automotive, wind energy, aerospace, industrial equipment, and advanced composites. Because carbon fibre is often used in long-term projects and high-value products, changes in its price tend to reflect deeper shifts in demand, production planning, and industrial confidence. During the third quarter of 2025, the Carbon Fibre Price Trend showed a phase of moderate correction and consolidation across many regions rather than sharp movements.

In Q3 2025, the global market for industrial-grade, standard modulus carbon fibre continuous tow experienced a generally balanced environment. Prices softened slightly in some countries due to weaker demand, while a few regions showed mild improvement supported by emerging applications. Overall, the market moved cautiously, with buyers and suppliers focusing more on inventory control, stable supply chains, and measured purchasing decisions.

Global Overview: A Market in Consolidation Mode

Across the global market, the Carbon Fibre Price Trend in Q3 2025 reflected a period of consolidation. Instead of strong growth or steep declines, prices adjusted gradually. This was mainly because demand from key sectors such as wind energy, automotive manufacturing, and industrial composites slowed in certain regions. At the same time, supply remained stable, as producers continued operating at planned capacity levels without major disruptions.

Buyers in many countries adopted a cautious approach. Rather than placing large long-term orders, they focused on short-term needs and careful inventory management. Raw material and energy costs remained mostly stable, which helped prevent sudden price swings. As a result, the market entered a phase where availability was adequate, competition increased, and pricing power shifted slightly toward buyers.

Please Submit Your Query For Carbon Fibre Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Mexico: Softer Demand Brings Price Pressure

In Mexico, the Carbon Fibre Price Trend during Q3 2025 moved downward. Prices for industrial-grade standard modulus continuous tow declined by around 2.4% compared to the previous quarter, averaging close to USD 14,635 per metric ton. This price softening was mainly driven by reduced activity in wind-energy projects and industrial composite manufacturing.

Demand from these sectors slowed as project timelines stretched and new investments were delayed. Buyers also became more cautious, choosing to restock slowly instead of committing to large volumes. On the supply side, production remained steady, supported by existing capacity and gradual expansions, which kept material availability comfortable.

In September 2025, prices dropped further by around 4%. International competition added more pressure, as buyers explored alternative sourcing options. Even though production costs remained stable, sellers had limited room to push prices higher. Overall, Mexico’s market reflected a waiting phase, with expectations tied closely to a recovery in renewable energy and industrial demand.

Turkey: Gradual Decline Linked to Industrial Use

Turkey also experienced a softening Carbon Fibre Price Trend in Q3 2025. Prices for imported continuous tow declined by around 2% on a quarter-on-quarter basis. Demand from automotive and industrial manufacturing sectors weakened slightly, as production schedules slowed and cost control became a priority.

By September 2025, prices had declined by about 4%, easing procurement costs for buyers. Despite the lower prices, supply remained sufficient, and no shortages were reported. Import volumes adjusted downward in line with actual consumption rather than speculative buying.

Manufacturers and processors in Turkey focused on managing inventories carefully, ensuring that stock levels matched current demand. This measured approach helped avoid oversupply while keeping the market stable. Overall, Turkey’s market showed a controlled correction rather than a sharp downturn.

India: Muted Demand and Liquidity Constraints

In India, the Carbon Fibre Price Trend during Q3 2025 remained under pressure. Prices for industrial-grade continuous tow declined by around 2% over the quarter. Domestic demand stayed muted, particularly in automotive components and wind turbine blade manufacturing, where project execution slowed.

Liquidity management also played a role. Many downstream users operated cautiously, limiting purchases to essential volumes. By September 2025, prices for the popular 50K grade dropped by approximately 4%, settling in the range of USD 14,100 to 14,200 per metric ton.

Despite the price decline, supply chain conditions remained stable. Imports continued smoothly, and no major disruptions were reported. Manufacturers focused on adjusting costs and keeping inventories lean. India’s market during the quarter reflected caution rather than weakness, with expectations of gradual improvement once demand recovers.

South Korea: Support from Advanced Applications

South Korea stood out as one of the more positive markets in Q3 2025. The Carbon Fibre Price Trend for 12K grade material improved by around 4% quarter-on-quarter, reaching approximately USD 20,620 per metric ton. This increase was supported by rising demand from advanced applications such as hydrogen fuel tanks, electric vehicle lightweighting, and wind-energy components.

These sectors provided stability after a softer first half of the year. However, the market was not without short-term fluctuations. In September 2025, prices slipped by around 2% compared to August, reflecting cautious monthly procurement and inventory adjustments.

Even with competitive pressure from lower-cost suppliers, steady demand from aerospace and industrial uses helped maintain overall balance. South Korea’s market showed signs of gradual normalization rather than strong growth.

Malaysia: Stable Growth with Temporary Adjustments

Malaysia’s imported carbon fibre market showed a generally upward Carbon Fibre Price Trend in Q3 2025. Prices for 12K grade material increased by around 4% quarter-on-quarter, reaching roughly USD 20,760 per metric ton. Demand from industrial composites, pressure vessels, and automotive components remained firm throughout the quarter.

This steady demand supported improved pricing and stronger import activity. Buyers showed confidence in near-term consumption, especially in industrial applications. However, September 2025 brought a slight correction, with prices declining by around 2% as buyers adjusted inventories and slowed monthly purchasing.

Despite this short-term dip, the overall market remained stable. Malaysia’s experience highlighted how consistent downstream demand can support prices even during broader global consolidation.

Overall Market Sentiment and Near-Term Outlook

Looking back at Q3 2025, the global Carbon Fibre market was characterized by balance rather than extremes. The Carbon Fibre Price Trend reflected moderate corrections in regions facing weaker demand and mild improvements where advanced applications provided support. Stable supply chains, steady production, and disciplined buying behavior helped prevent volatility.

In the near term, prices are expected to remain relatively steady. Much will depend on the pace of recovery in wind energy projects, automotive production, and emerging technologies such as hydrogen storage. Buyers are likely to continue focusing on efficiency and cost control, while suppliers aim to maintain stable operations.

In simple terms, Q3 2025 was a period of adjustment for the carbon fibre market. Prices moved carefully, supply stayed reliable, and the industry prepared for the next phase of demand growth rather than reacting to sudden changes.

Please Submit Your Query For Carbon Fibre Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

LinkedIn: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/