This article provides a comprehensive overview of Section 16(4) of the GST Act, highlighting key input tax credit (ITC) court judgments related to it. Section 16(4) offers a significant benefit by allowing taxpayers to avoid the cascading effect prevalent in the previous VAT regime. However, this provision comes with specific conditions that must be met, transforming the previously vested nature of ITC into a conditional right. Understanding these elements is crucial for businesses looking to navigate the complexities of GST and optimise their tax credits.

Section 16(4) of the GST Act Explained with Key ITC Court Judgments

Written by

saginfotech

233 days ago

Related articles:

Understanding the Importance of HTML Head Tags for SEO

When creating a website, there’s a lot of focus on the visible parts of a page—content, images, layout. However, what’s often overlooked is what happens behind the scenes in the..

Section 8 Company Registration in India: A Complete Guide

In many organizations work toward social welfare, charity,

education, healthcare, environment, and other public causes. For such

not-for-profit entities, the Section 8 Company structure offers legal

recognition with credibility and..

Essential Business and Compliance Registrations

Starting a business in India is an exciting

journey, but it requires more than just a brilliant idea and determination. To

build a legally compliant, trusted, and scalable enterprise, choosing..

The Geometry of Strength – Joint Detailing in Steel Hollow Sections

Steel hollow sections are used in many buildings. You see them in bridges, stadiums, and warehouses. These sections look clean and modern. They are also strong and reliable. But strength..

How to Apply for FCRA Registration Online: A Complete Guide

Foreign donations play a crucial role in funding non-profit organizations (NGOs), trusts, societies, and Section 8 companies working for social welfare. However, to legally receive foreign contributions in India, organizations..

A Section 8 Company: A Nonprofit Organization in India

A Section 8 Company is a nonprofit organization established under Section 8 of the Companies Act, 2013, in India. The primary objective of such a company is to promote charitable..

Section 8 Company Registration Process: A Complete Guide

A

Section 8 Company is one of the most structured and credible forms of nonprofit

organization in India. Governed by the Companies Act, 2013, this type of

company is designed..

A Complete Guide to Company Registration: Steps & Benefits

IntroductionStarting a business is an exciting venture, but it often comes with the complex task of company registration. Whether you’re launching a small startup or a large corporation, the registration..

The Importance of Regular Hot Section Inspections: Keeping Your PT6A Engine Running Strong

Periodic checks are necessary for the PT6A engine in your aircraft to guarantee optimal performance and longevity, much like you would take your automobile in for routine maintenance. The Hot..

Simplify GST Registration with a VPOB: A Smart Choice for Businesses

It sounds fun to expand your business to new states in India, but it can be challenging to follow the rules. Giving a local address is one of the trickiest..

GST Payment and Registration in India: Complete Guide

The Goods and Services Tax (GST) is one of the most important reforms in India’s taxation system. It replaced a mix of state and central taxes with a single unified..

GST Return Filing in India: A Complete Guide

Goods and Services Tax (GST),

implemented on July 1, 2017, has revolutionized the Indian indirect tax system

by replacing multiple taxes with one unified tax. One of the cornerstones of..

GST Return Filing for Beginners – Complete Online Filing Guide

Introduction to GST Return FilingGoods and Services Tax (GST) changed the way India does business. It's a unified indirect tax system, and if you're a registered business, filing your GST..

GST Registration Online Process – Step-by-Step Guide

Thinking about starting a business or already have one? Then you've probably heard of GST registration. If the thought of dealing with taxes makes you want to run the other..

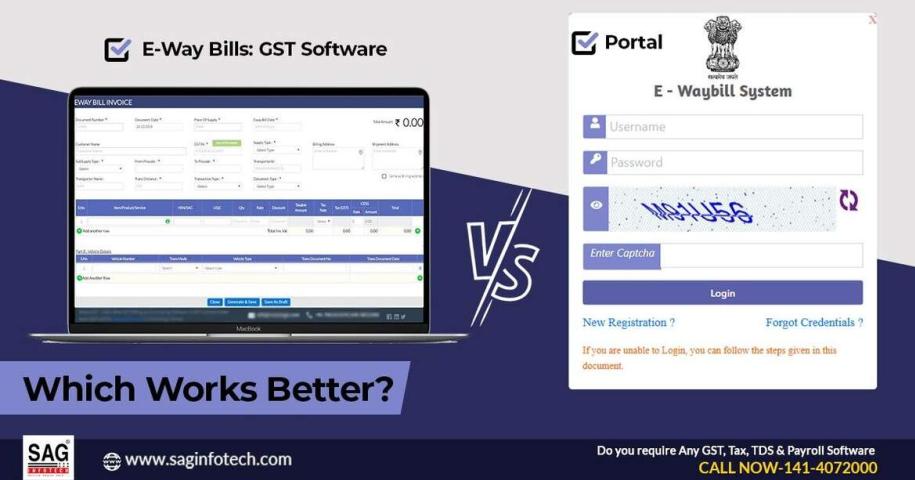

How to Choose the Best Method to Generate E-Way Bills: GST Software vs. Portal

For businessmen with goods valued at over Rs 50,000, it is crucial to utilise the GST E-way bill system to effectively track the transportation of these goods. When considering the..

GST Return Filing: Complete Guide for Beginners

IntroductionWhat is GST?GST (Goods and Services Tax) is a unified, multi-stage, destination-based tax levied on every value addition in India. It replaced many indirect taxes and brought uniformity across the..

GST Return Filing Made Easy: Step-by-Step Guide for Businesses in India

What is GST Return Filing?GST Return Filing is the process of submitting details of sales, purchases, and tax payments to the Government of India under the Goods and Services Tax..

Everything You Need to Know About GST Registration in India

If you are launching or operating a business in India, then you must have heard of GST, which stands for Goods and Services Tax. It is one of the most..