The global Satellite-Based Augmentation Systems (SBAS) market is on a steady growth trajectory, fueled by rising airline traffic, stringent safety requirements, and heavy infrastructure investments across both developed and emerging economies. SBAS technology has become indispensable in industries where accurate navigation and positioning are critical, such as aviation, maritime, road and rail transportation, and land surveying.

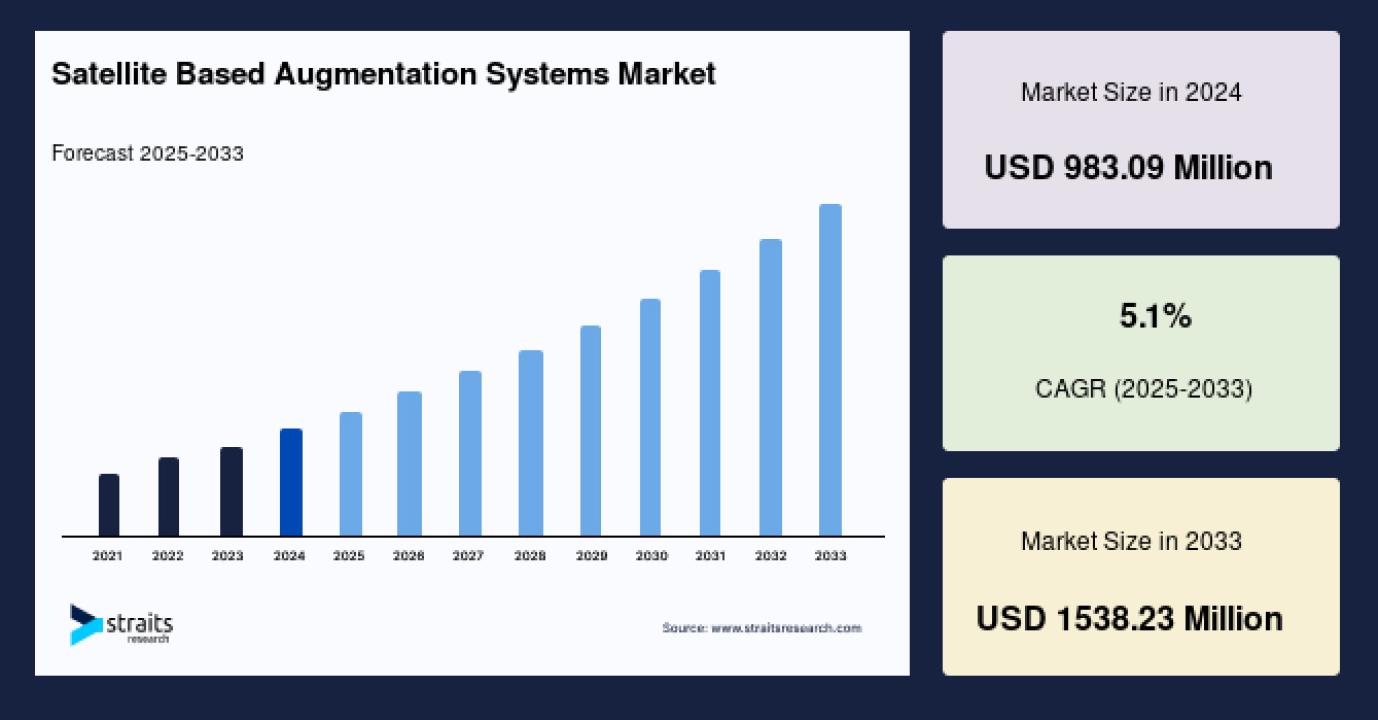

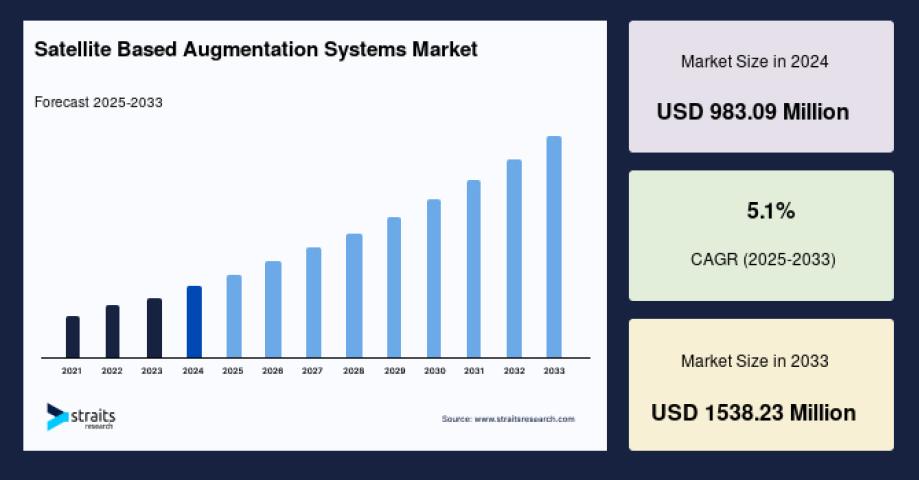

According to recent insights, the SBAS market is projected to grow from USD 983.09 million in 2024 to USD 1,538.23 million by 2033, reflecting a CAGR of 5.1% (2025–2033).

Market Overview

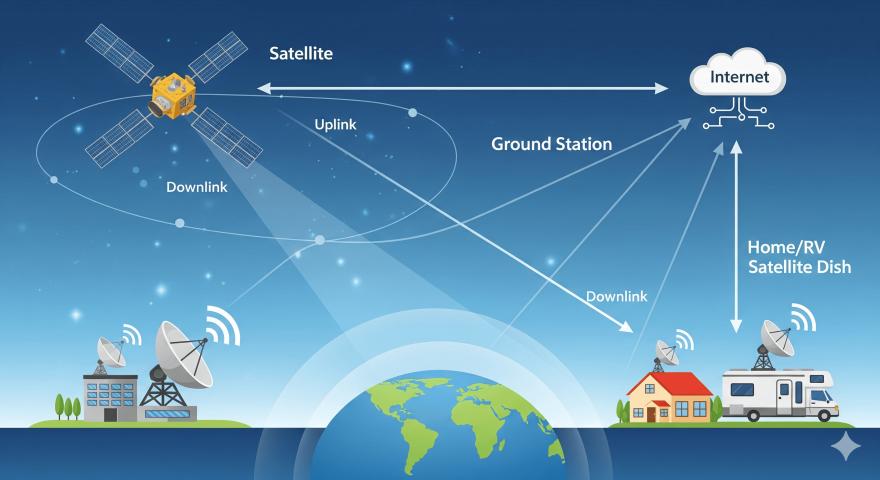

SBAS enhances the accuracy, reliability, and integrity of Global Navigation Satellite Systems (GNSS) such as GPS. Systems like WAAS (USA), EGNOS (Europe), and GAGAN (India) provide real-time corrections to satellite signals, ensuring precision during critical operations, including aircraft landings or vessel docking.

The technology is gaining significant adoption due to government regulations on aviation safety, modernization of navigation infrastructure, and its application across multiple transportation sectors.

Market Drivers

Aviation Demand: SBAS ensures safe and reliable navigation during all stages of flight, particularly in bad weather or congested airspace.

Maritime Growth: Accurate vessel positioning and collision avoidance are increasingly dependent on SBAS.

Road & Rail Expansion: Intelligent transportation systems and fleet management rely on SBAS for tracking and route optimization.

Technological Advances: Progress in satellite payloads, reference stations, and GNSS connectivity boosts system performance.

Emerging Market Investments: Infrastructure development in Asia-Pacific, Africa, and Latin America is accelerating adoption.

Market Challenges

Despite its potential, the SBAS market faces key obstacles:

High Infrastructure Costs: Deploying satellites, ground stations, and networks requires substantial investment.

Regulatory Barriers: Complex international standards can hinder interoperability.

Ongoing Maintenance Costs: Systems like WAAS and EGNOS demand continuous updates and operation.

Skill Gaps: Specialized training and personnel are required for deployment and monitoring.

👉 For detailed segmentation, trends, and competitive intelligence, Request Free Sample Report.

Market Segmentation

By Technology and Type

Geostationary SBAS: Largest segment, offering consistent coverage (e.g., WAAS, EGNOS, MSAS).

Non-Geostationary SBAS: Emerging, providing improved capabilities for complex environments.

BDSBAS (BeiDou SBAS): Strongly linked with Asia-Pacific growth.

By Component

SBAS Payloads: Dominant segment, delivering correction signals from satellites.

Reference Stations: Fastest-growing, processing GNSS error/correction data on the ground.

By Application

Aviation: Leading application due to regulatory mandates.

Maritime: Key for collision avoidance and port navigation.

Road & Rail: Rising use in public transport, logistics, and fleet safety systems.

By Region

North America: Largest market, backed by FAA’s WAAS system and strong infrastructure.

Asia-Pacific: Fastest-growing, led by China, India, and Australia with initiatives like GAGAN and BeiDou.

Europe: Strong presence with EGNOS integration.

Latin America, Middle East, and Africa: Emerging regions focused on new SBAS deployments.

Competitive Landscape

Key players driving the SBAS market include:

Raytheon Technologies (USA) – WAAS upgrades, FAA contracts.

Thales Group (France) – EGNOS and multi-sector SBAS solutions.

Airbus Defence and Space (France) – Advanced payload and navigation augmentation.

Northrop Grumman (USA) – SBAS system integration and secure navigation.

SES S.A. (Luxembourg) – Satellite payload investments.

Harris Corporation (USA) – Ground infrastructure development.

Inmarsat (UK) – Satellite communication for SBAS.

Rockwell Collins (USA) – Avionics for commercial and defense.

Honeywell International Inc. (USA) – Aviation and ground SBAS navigation equipment.

Kongsberg Gruppen (Norway) – Maritime SBAS-based navigation solutions.

Conclusion

The satellite-based augmentation systems market is poised for significant expansion, driven by regulatory mandates, rising aviation and maritime demands, and growing infrastructure investments in emerging economies. With continuous technological advancements and increasing reliance on precision navigation, SBAS is set to play a pivotal role in the modernization of global transportation systems through 2033.