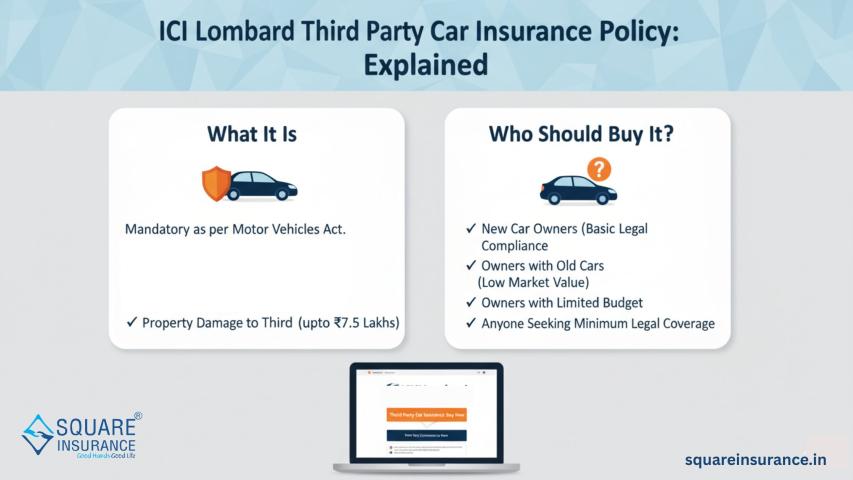

Insurance plays a vital role in financial protection by safeguarding individuals and families from unexpected events such as medical emergencies, accidents, disability, or the loss of an earning member. Life, health, motor, and general insurance policies are designed to offer financial support and peace of mind during difficult times. People rely on insurance not to generate profit, but to secure their current life>

How Mutual Funds Help in Wealth Creation

Mutual funds are one of the most popular investment options for individuals seeking long-term financial growth. They allow people to invest in various sectors such as equity, debt, and hybrid categories depending on risk tolerance and financial goals. Instead of picking individual stocks, investors benefit from professionally managed funds that diversify risk and maximize potential returns. Mutual funds support disciplined financial planning through systematic investments, offer liquidity, transparency, and performance tracking tools. Investors who want simplified portfolio management often rely on platforms like HDFC Mutual Fund Distributor Login to access investments securely and monitor growth digitally through a single portal.

Why Insurance and Mutual Funds Work Best Together

Insurance and mutual funds complement each other because one protects wealth and the other grows it. Insurance ensures that a family remains financially stable in emergencies, whereas mutual funds help achieve future goals such as children’s education, retirement planning, home buying, and wealth building. Without insurance, individuals remain vulnerable to financial risks, and without investment, savings lose value due to inflation. Building a balanced financial plan involves securing life and health coverage while consistently investing for long-term growth. People who combine both strategies create stronger financial resilience and long-term prosperity.

The Role of Digital Growth in Financial Planning

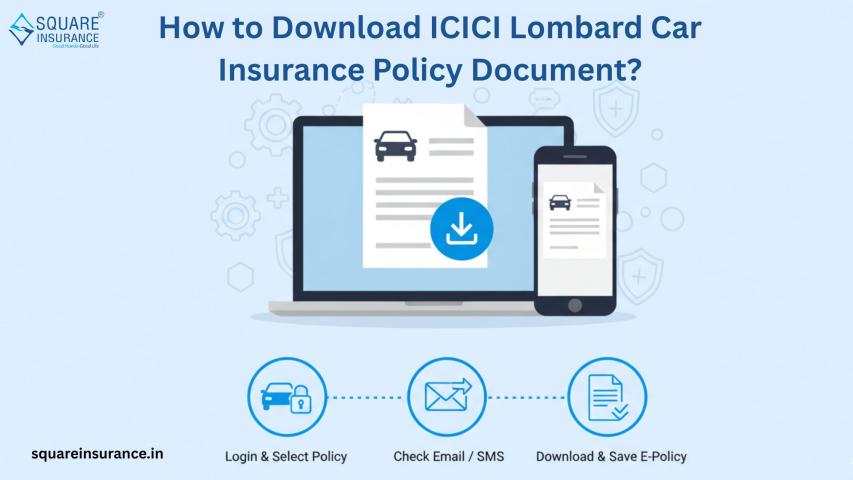

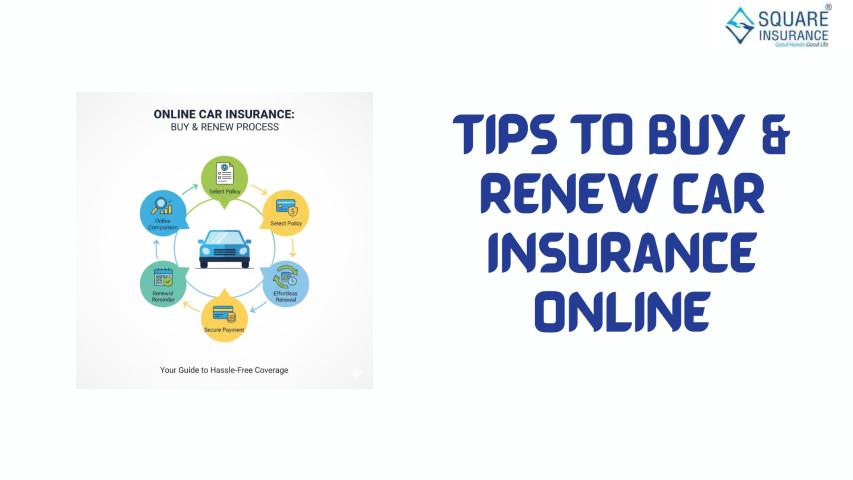

The financial ecosystem in India is evolving rapidly through technology-led solutions. Insurance companies are improving claim support, online documentation, automated policy servicing, and customer experience through self-service platforms. Similarly, mutual fund companies now offer paperless onboarding, real-time NAV updates, portfolio insights, and instant transactions through web and mobile platforms. Digital accessibility is helping investors and policyholders manage wealth smartly, stay informed, and make better decisions with minimal complexity.

Conclusion

Insurance protects your future, while mutual funds shape it. Both are essential pillars of healthy financial planning and should be incorporated into every individual’s financial strategy. A smart approach includes understanding risk, planning for emergencies, and investing consistently for growth. Modern solutions such as mPRO Axis Max Life Insurance offer powerful coverage benefits for long-term financial security, helping families stay protected while pursuing wealth creation goals. When used together, insurance and mutual funds enable stability, growth, and confidence in building a secure financial journey.