Introduction

With digital adoption accelerating

across India, buying car insurance online has become the most convenient option

for vehicle owners. What once required multiple visits, paperwork, and lengthy

discussions can now be completed within minutes. However, convenience alone

should not drive the decision. Safety, accuracy, and proper coverage are

equally important when purchasing car insurance online.

This guide explains how to buy car insurance online safely and

quickly, especially for car owners who want clarity, transparency, and

long-term protection rather than rushed decisions.

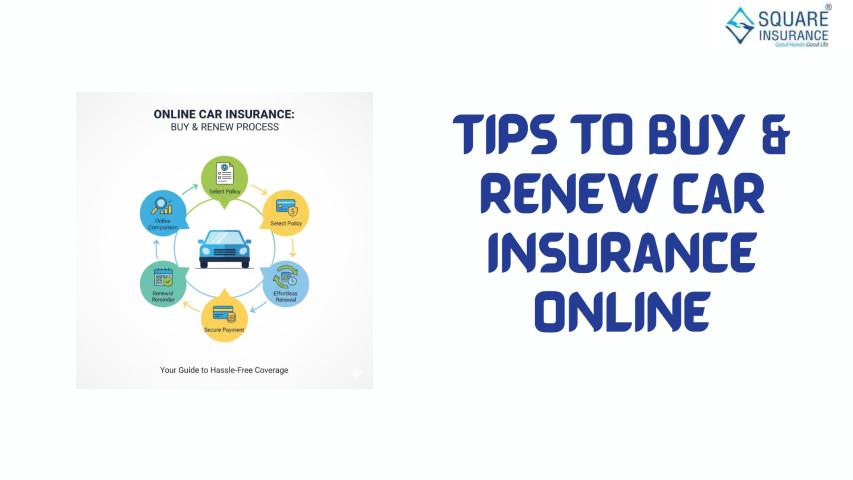

Why

Buying Car Insurance Online Is Gaining Popularity

The shift toward online insurance is

driven by greater awareness and the need for efficiency. Online platforms allow

buyers to:

- Compare policies without pressure

- Understand pricing clearly

- Avoid hidden charges

- Receive instant policy documents

More importantly, online buying

gives control back to the customer, allowing informed decisions instead of

agent-driven purchases.

Step

1: Understand Your Legal and Financial Responsibility

Before buying car insurance online,

it is essential to understand that:

- Third-party insurance is mandatory in India

- Comprehensive insurance is optional but highly

recommended

While third-party insurance fulfils

legal compliance, it does not protect your own car. Buying insurance online

gives you the flexibility to choose protection that goes beyond legal

requirements.

Step

2: Identify the Right Policy Type for Your Car

Choosing the correct policy type

ensures both safety and speed in the buying process.

Third-Party

Car Insurance

This covers liabilities toward

others but offers no financial protection for your own vehicle.

Comprehensive

Car Insurance

This includes third-party cover

along with protection against:

- Accidents

- Theft

- Fire

- Natural calamities

- Man-made damages

For most car owners, comprehensive

insurance is the

Step

3: Keep Vehicle Information Ready

One of the simplest ways to buy car

insurance online quickly is preparation. Keep the following details handy:

- Registration number

- Make and model

- Fuel type

- Year of manufacture

- Previous insurance status

Accurate details prevent errors and

ensure correct premium calculation.

Step

4: Compare Policies Based on Coverage, Not Discounts

Online insurance buying often

highlights discounts, but safety comes from coverage quality. While comparing

policies, check:

- What damages are covered

- What situations are excluded

- Whether consumables and accessories are included

- Claim-related conditions

A well-covered policy reduces

disputes and claim rejections later.

Step

5: Choose a Realistic Insured Declared Value (IDV)

IDV represents the maximum claim

amount in case of total loss or theft. Online platforms allow you to adjust

IDV, but this should be done carefully:

- Lower IDV reduces premium but weakens protection

- Higher IDV increases cost without real benefit

Select an IDV close to your car’s

current market value for balanced coverage.

Step

6: Add Only Relevant Add-On Covers

Add-ons improve protection but

should be chosen wisely to maintain affordability and speed. Useful add-ons

include:

- Zero depreciation cover for new or expensive cars

- Engine protection for waterlogged areas

- Roadside assistance for long-distance drivers

Avoid unnecessary add-ons that

complicate the policy and inflate premiums.

Step

7: Read Policy Terms Before Payment

Safety while buying car insurance

online depends on awareness. Always read:

- Exclusions related to driver behaviour

- Conditions affecting claim approval

- Deductible clauses

This step may take a few extra

minutes but saves time and stress during claims.

Step

8: Use Secure Payment Methods

To buy car insurance online safely:

- Use a private, secure internet connection

- Avoid clicking on unverified promotional links

- Save payment receipts and confirmation

A secure payment ensures data

protection and transaction safety.

Step

9: Verify Policy Details Immediately

Once the policy is issued:

- Download the policy document

- Verify vehicle and owner details

- Confirm coverage period and add-ons

Immediate verification helps correct

errors without delays.

Common

Mistakes That Slow Down Online Buying

Avoid these mistakes to ensure a

smooth experience:

- Waiting until policy expiry

- Selecting coverage in haste

- Ignoring exclusions

- Filing unnecessary claims that impact NCB

Awareness leads to faster decisions

and better outcomes.

How

Online Buying Helps During Renewals

Online platforms make renewal faster

by:

- Auto-fetching previous policy details

- Retaining No Claim Bonus

- Allowing coverage adjustments

Timely online renewal ensures

uninterrupted protection and premium savings.

Conclusion

Buying car insurance online is not

just about speed—it is about making the right choice without compromising

safety. By understanding policy types, selecting appropriate coverage, choosing

the right IDV, and reviewing policy terms carefully, car owners can secure

reliable protection in minutes.

Platforms like Square Insurance

simplify this journey by offering transparent comparisons, clear explanations,

and guidance that helps buyers choose the right policy with confidence. When

you buy car insurance online thoughtfully, you gain financial security, peace

of mind, and long-term value.

Frequently

Asked Questions

1.

Is buying car insurance online reliable?

Yes, buying car insurance online is

reliable when you review policy terms and verify details carefully.

2.

How fast can I buy car insurance online?

If details are ready, the process

can be completed within a few minutes.

3.

Can I customize my policy online?

Yes, add-ons and coverage options

can be selected as per your needs.

4.

What happens if I enter incorrect details?

Incorrect details may affect claim

settlement, so verification after purchase is essential.

5.

Is online renewal faster than offline?

Yes, online renewal is quicker and

avoids paperwork and inspections in most cases.

6.

Should I buy insurance online for an old car?

Yes, online platforms offer suitable

coverage options even for older vehicles