As we move toward 2026, two parts of life are getting more demanding at the same time: managing your money and taking care of your health.

Loans are bigger, interest rates can change fast, and medical costs keep rising. At the same time, we’re sitting more, sleeping less, and trying to squeeze in fitness wherever we can.

The people who are coping best aren’t necessarily earning the most or spending hours in the gym. They’re the ones using simple digital tools to get clear numbers before making decisions—on both their finances and their bodies.

Why Your Monthly Payments Need More Than Guesswork

Too many people still sign a loan agreement based on one thing: the size of the monthly EMI they think they can handle.

What they don’t see clearly is:

- How much of each payment is interest versus principal

- How long it will actually take to become debt‑free

- How much total interest they’ll pay over the full term

- What happens if interest rates change or they prepay early

Whether it’s a home loan, car loan, education loan, or personal loan, guessing here can cost you years of extra payments and thousands in interest.

A clear, accurate projection of your repayment schedule is not a luxury anymore—it’s basic financial self‑defense.

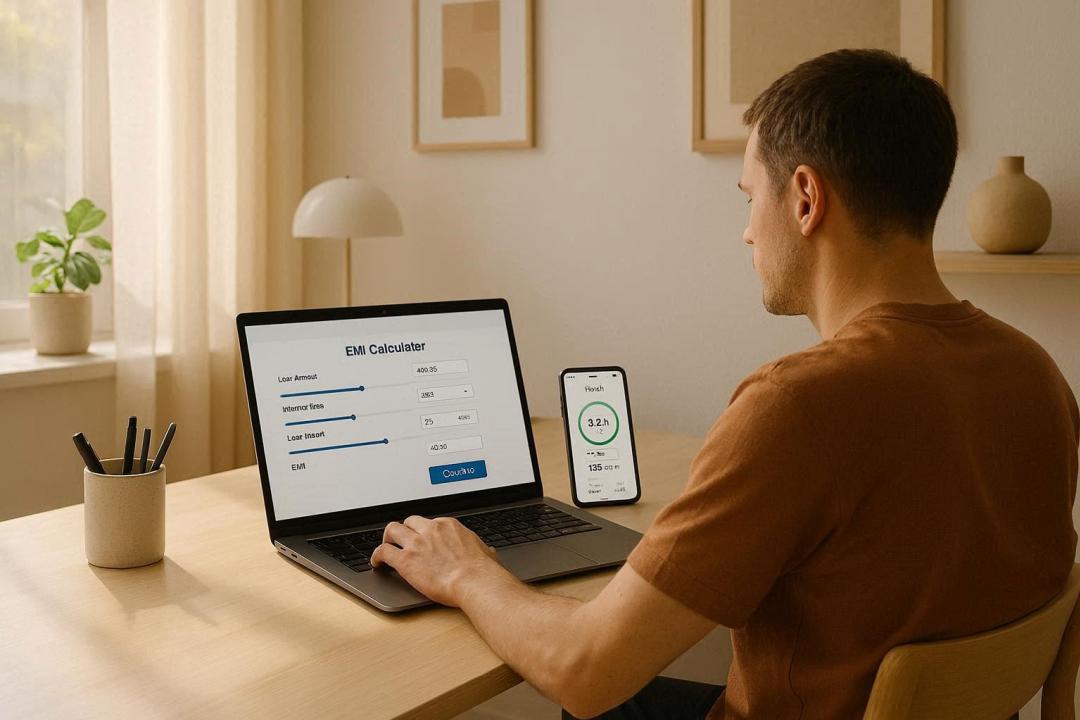

How an Online EMI Tool Changes the Conversation

Instead of relying on a bank executive’s quick explanation, you can open a loan EMI calculator online and see the math for yourself in seconds.

With a good EMI tool, you can:

- Adjust loan amount, interest rate, and tenure to see how your monthly installment changes

- View an amortization schedule that breaks down every month’s interest and principal

- Compare short‑term, high‑EMI plans with long‑term, lower‑EMI options

- Check how prepayments or part‑payments might reduce your interest and tenure

This turns a vague question like “Can I afford this?” into something much sharper:

- “If I choose a 15‑year term instead of 20 years, I’ll save this much interest.”

- “If rates rise by 1%, my monthly cash flow will be affected by exactly this amount.”

- “If I prepay once a year, I could clear this loan three or four years earlier.”

When you can see these scenarios laid out clearly, you’re less likely to overborrow and far more likely to pick a loan structure that fits your real life, not just your dreams.

Financial Wellness Is Part of Your Health

Money stress is one of the biggest drivers of anxiety, burnout, and even physical illness.

Think about the last time you worried about a loan payment or credit card bill. Chances are you:

- Slept badly

- Ate poorly or skipped meals

- Struggled to focus at work

- Put off exercise or self‑care

Planning your EMIs smartly isn’t just about saving interest. It’s about building a financial routine that lets you breathe—so you have the mental space to care about the rest of your life, including your body.

That’s where health tracking comes in. Once you’ve brought some structure to your loans, it makes sense to bring the same level of clarity to your physical well‑being.

Tracking Your Body as Carefully as Your Budget

Most of us can quote our salary or monthly EMI from memory. But ask for basic health numbers—like weight, height, or risk range—and the answers are often rough guesses.

An online body mass index calculator gives you a fast snapshot of where your weight stands relative to your height. It categorizes you as underweight, normal, overweight, or obese based on widely used medical guidelines.

Used well, BMI is not about chasing a “perfect” number. It’s about:

- Spotting potential risk early (especially for life>

- Tracking changes over time as you adjust diet and activity

- Starting a better conversation with your doctor or coach

- Setting realistic goals instead of following extreme trends

Just like EMI plans, BMI is not the full picture—but it’s a powerful starting point.

Two Calculators, One Life: Practical Ways to Use Both

When you put financial and health tools side by side, patterns start to appear.

1. Planning a Big Loan? Plan Your Life>

If you’re about to take on a major EMI—for a home, car, or higher education:

- Use the EMI tool to find a payment amount that leaves room for healthy food, insurance, and basic fitness costs (like a gym membership or sports activity).

- Check your BMI and ask: “If I’m going to be paying this loan for 10–20 years, what kind of body and energy level do I want during that time?”

A massive loan that leaves no space for well‑being is a hidden cost you’ll feel every day.

2. Adjusting Your Budget? Protect Your Health Line Items.

If your EMI is high and you’re tightening expenses, it’s tempting to cut health spending first. Instead:

- Use the EMI calculator to see if a slightly longer tenure or occasional prepayment could give you some monthly breathing room.

- Use BMI and other health markers (waist size, blood tests, fitness levels) to decide what not to cut—like basic nutrition, movement, and preventive care.

The goal is balance, not perfection.

3. Setting Goals for 2026 and Beyond

As you look ahead:

- Set financial milestones (e.g., “Reduce my total interest by X% with prepayments”).

- Set health milestones (e.g., “Move from one BMI category to a better one in a sustainable way”).

By checking both regularly—once a month or once a quarter—you build a habit of living deliberately instead of drifting.

Simple Rules for Using Online Calculators Wisely

To get the most from these tools without becoming obsessed:

- Be honest with numbers. Enter real loan amounts, realistic interest rates, accurate height and weight.

- Update periodically, not daily. Check EMI scenarios when loans or income change; track BMI and weight every few weeks rather than every morning.

- Use them for planning, not punishment. If a result worries you, treat it as a signal to act, not a reason to panic.

- Talk to experts. Use what you learn as a starting point for conversations with financial planners and healthcare professionals.

The calculators are there to give you clarity. What you do with that clarity is what truly shapes your life.

The 2026 Mindset: Quiet, Data-Backed Confidence

By 2026, more of our decisions will be supported by data—whether through apps, wearables, or web tools. But the most powerful shifts often come from the simplest habits:

- Running the numbers before signing a loan

- Checking your basic health stats before problems appear

- Reviewing both money and body metrics a few times a year

You don’t need to be a financial analyst or a fitness influencer to live well. You just need to stop guessing and start looking at clear, understandable numbers—then make small, steady improvements from there.