Carbon Fibre Price Index Analysis – Europe Q4 2025 Overview

Carbon Fibre Prices in Germany:

In Q4 2025, carbon fibre prices in Germany stood at USD 33.8/kg, supported by steady usage in automotive and industrial applications. The Carbon Fibre Price Index remained stable as supply matched regular demand. Looking ahead, the Carbon Fibre Price Forecast indicates limited volatility, with prices expected to stay firm due to consistent consumption and Germany’s continued focus on lightweight material adoption.

Carbon Fibre Prices in United Kingdom:

The United Kingdom recorded carbon fibre prices of USD 34.9/kg in Q4 2025, reflecting stable buying activity across aerospace and performance manufacturing segments. The Carbon Fibre Price Index showed balanced movement, supported by controlled supply conditions. As per the Carbon Fibre Price Forecast, prices are likely to remain steady in the near term, driven by ongoing demand for high-strength, lightweight materials.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/carbon-fibre-pricing-report/requestsample

Note: This analysis can be adjusted to align with the customer's individual preferences.

Carbon Fibre Price Index Analysis – APAC Q4 2025 Overview

Carbon Fibre Prices in Thailand:

In Thailand, carbon fibre prices reached USD 31.1/kg during Q4 2025, remaining comparatively lower due to cost-efficient processing and steady regional demand. The Carbon Fibre Price Index reflected stable conditions with minimal fluctuations. According to the Carbon Fibre Price Forecast, pricing is expected to remain consistent, supported by growing use in industrial components and gradual expansion of advanced material applications.

Carbon Fibre Prices in South Korea:

South Korea reported carbon fibre prices at USD 37.7/kg in Q4 2025, among the highest globally, reflecting strong demand from electronics, automotive, and advanced manufacturing sectors. The Carbon Fibre Price Index stayed elevated due to high-grade material usage. Based on the Carbon Fibre Price Forecast, prices are expected to remain firm as innovation-driven consumption continues.

Regional Analysis: The price analysis can be extended to provide detailed carbon fiber price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Carbon Fibre Price Index Analysis – South America Q4 2025 Overview

Carbon Fibre Prices in Argentina:

Argentina saw carbon fibre prices at USD 28.5/kg in Q4 2025, supported by steady industrial usage and improving supply availability. The Carbon Fibre Price Index showed stable movement, with limited price pressure during the quarter. As per the Carbon Fibre Price Forecast, prices are expected to stay largely stable, driven by consistent demand and gradual adoption across manufacturing applications.

Regional Analysis: The price analysis can be expanded to include detailed carbon fiber price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Carbon Fibre Price Trend, Index, History & Forecast - Latest Prices Updates

In Q4 2025 and early 2026, carbon fibre prices faced downward pressure from capacity growth: USA around 23 USD/kg, Germany around 33.8 to 34.9 USD/kg, Thailand around 31.1 USD/kg, South Korea around 37.7 USD/kg, India 50K grade around 14.1 USD/kg. North America softened with selective stability, while Asia saw 2-4% quarterly declines amid oversupply.

Influencing Factors:

- Downstream Demand: Aerospace, automotive EVs, wind energy, and emerging hydrogen storage sustained key consumption.

- Production Constraints: Global capacity expansions and raw material costs pressured pricing.

- Supply Dynamics: China production ramps and Asian self-sufficiency increased availability.

- Logistics Challenges: Freight normalization eased earlier premiums.

- Application Growth: Urban air mobility and lightweight composites provided counter-support.

- Energy Costs: Crude oil fluctuations influenced manufacturing expenses.

Recent Changes:

- Germany peaked at 34.5 USD/kg in Q1 2025 before Q4 stabilization around 33.8 USD/kg on wind energy demand.

- Thailand reached 31.1 USD/kg December 2025 with automotive component growth.

- South Korea firmed to 37.7 USD/kg on electronics and advanced materials procurement.

- India 50K grade declined 4% to 14.1 USD/kg September 2025 from low liquidity.

- USA held around 23 USD/kg amid balanced aerospace and industrial orders.

Historical Context:

Q3 2025 Asia saw significant declines from competition despite volume gains; Q1 2025 featured crude-driven rises before Q2 normalization. Full year 2025 pressured by capacity growth after 2024 mixed dynamics; contrasted 2023 lows from weak manufacturing and 2022 stability.

Forecast:

Prices anticipate medium-term improvement post-early 2026 dips, driven by EV, aerospace, and renewable applications at 7.76% to 9.3% CAGR through 2032-2034. Capacity utilization and emerging uses like hydrogen storage support recovery, though short-term oversupply lingers.

Summary — Key Points

- The Carbon Fibre Price Index in Q4 2025 highlights clear regional differences driven by production efficiency, energy costs, and technology standards.

- Carbon Fibre Price levels remain higher in South Korea and the United Kingdom due to advanced processing and quality-focused output.

- Thailand and Argentina continue to record comparatively lower prices, supported by cost-efficient manufacturing and moderate local demand.

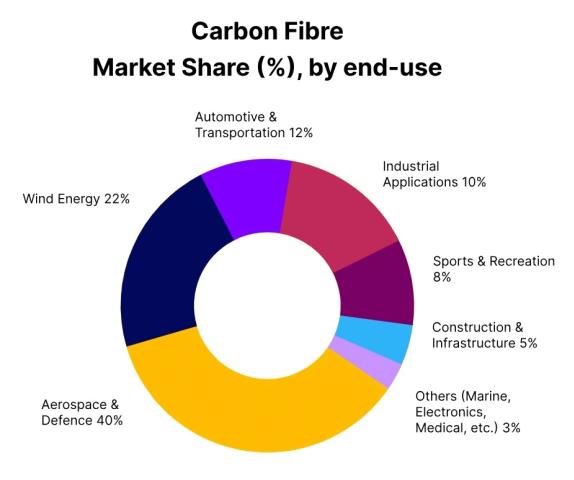

- Global consumption is led by aerospace, automotive lightweighting, wind energy, construction, and advanced industrial applications.

- Tracking the Carbon Fibre Price Index supports informed sourcing decisions, cost planning, and long-term procurement strategies.

FAQs on Carbon Fibre Price Trend, Index, and Forecast

What factors are influencing the Carbon Fibre Price Index in 2025?

The Carbon Fibre Price Index in 2025 is influenced by raw material availability, energy costs, and production complexity. Demand from aerospace, automotive, wind energy, and industrial manufacturing also plays a key role. Regional differences in technology adoption and manufacturing scale further shape price trends across both developed and emerging economies.

How does the Carbon Fibre Price differ across Europe, Asia, and Latin America?

The Carbon Fibre Price varies by region due to differences in production capacity, labor costs, and end-use demand. Europe and South Korea generally record higher prices because of advanced processing standards, while countries like Thailand and Argentina maintain more competitive pricing supported by cost-efficient manufacturing and localized consumption patterns.

Why is monitoring the Carbon Fibre Price Index important for manufacturers and buyers?

Monitoring the Carbon Fibre Price Index enables manufacturers and procurement teams to manage cost volatility, plan long-term contracts, and improve sourcing decisions. It provides clarity on regional price movements and helps businesses align purchasing strategies with future Carbon Fibre Price trends, reducing financial uncertainty.

Which industries are driving global demand for carbon fibre in 2025?

Global demand for carbon fibre in 2025 is primarily driven by aerospace, automotive lightweighting, wind energy, construction, and sporting goods. Growth in electric vehicles and renewable energy infrastructure continues to support higher consumption, directly impacting the Carbon Fibre Price Index and long-term pricing outlook.

Where can businesses find reliable Carbon Fibre Price data and future forecasts?

Businesses can access reliable Carbon Fibre Price data, regional comparisons, and future outlooks through specialized pricing intelligence reports. These resources offer insights into the Carbon Fibre Price Index, supply conditions, and demand patterns, helping companies strengthen procurement planning and improve cost control strategies.

How IMARC Pricing Database Can Help

The latest IMARC Group study, Carbon Fibre Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Carbon Fibre price trend, offering key insights into global Carbon Fibre market dynamics. This report includes comprehensive price charts that trace historical data and highlight major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Carbon Fibre demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302