Stock Tokenization vs Traditional Shares: A Complete Comparison

Capital markets are evolving—no doubt about it. While traditional shares have long been the backbone of equity investing, Stock Tokenization is challenging the status quo with blockchain-powered infrastructure.

For institutional investors and fintech leaders, this isn’t just a technical debate—it’s a strategic decision. Infrastructure choices today will shape liquidity models, operational efficiency, and competitive positioning tomorrow.

So, how exactly does Stock Tokenization stack up against traditional shares?

Let’s dig in.

Understanding the Basics

Before comparing, let’s quickly define both models.

What Are Traditional Shares?

Traditional shares represent ownership in a company, typically issued, traded, and settled through centralized exchanges. Transactions pass through multiple intermediaries, including:

Brokers

Clearinghouses

Custodians

Transfer agents

Settlement cycles traditionally operate on T+2 (now moving toward T+1 in some markets).

What Is Stock Tokenization?

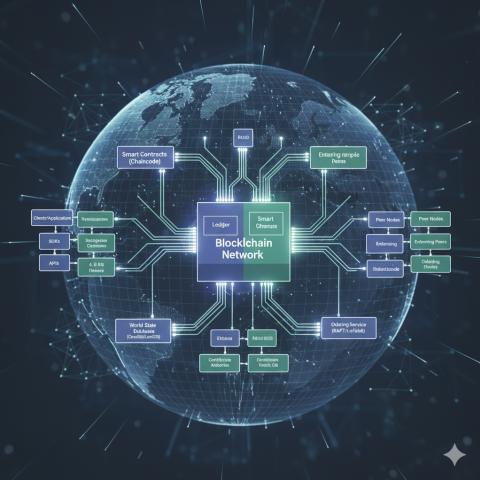

Stock Tokenization refers to representing equity ownership as digital tokens on a blockchain network. These tokens mirror real shares and can embed compliance rules, automation, and near-instant settlement capabilities.

Unlike traditional systems, blockchain records transactions on an immutable distributed ledger, reducing reliance on intermediaries.

Now that we’ve set the stage, let’s compare them head-to-head.

1. Settlement Speed

Traditional Shares

T+2 or T+1 settlement cycles

Delayed capital efficiency

Counterparty risk during clearing

Settlement delays require institutions to allocate capital buffers, increasing operational constraints.

Stock Tokenization

Potential for near-instant (T+0) settlement

Atomic settlement reduces counterparty exposure

Real-time ownership updates

For institutions managing high-volume trades, faster settlement translates directly into improved capital efficiency.

Winner? Tokenized equities clearly offer structural advantages here.

2. Liquidity and Market Access

Traditional Shares

Limited to exchange trading hours

Cross-border investing involves friction

Access barriers for smaller investors

Liquidity is often strong—but geographically restricted and time-bound.

Stock Tokenization

Potential 24/7 trading

Fractional ownership at scale

Borderless digital access

By lowering entry barriers, tokenized shares expand global participation. Liquidity becomes more dynamic and distributed rather than exchange-centric.

For fintech innovators, this opens new product design possibilities.

3. Cost Structure and Operational Efficiency

Traditional Shares

The ecosystem involves:

Brokerage fees

Clearing fees

Custody costs

Administrative overhead

Reconciliation processes are often manual and resource-intensive.

Stock Tokenization

Blockchain-based systems can:

Automate reconciliation

Reduce intermediary layers

Streamline back-office processes

Smart contracts automate dividends, voting rights, and compliance checks—cutting administrative expenses significantly.

Institutions aiming to reduce operational friction see clear efficiency gains.

4. Transparency and Auditability

Traditional Shares

Records are maintained by centralized entities. While regulated, transparency often requires reconciliation between multiple parties.

Stock Tokenization

Blockchain offers:

Immutable transaction records

Real-time audit trails

Enhanced reporting transparency

For institutional compliance teams, this level of visibility improves risk oversight and governance.

Transparency isn’t just a feature—it’s infrastructure.

5. Regulatory Framework

Here’s where nuance matters.

Traditional Shares

Mature regulatory environment

Well-defined compliance standards

Established legal protections

Investors feel secure because frameworks are tested and trusted.

Stock Tokenization

Emerging but evolving regulatory clarity

Embedded compliance via smart contracts

Jurisdiction-specific frameworks

While regulatory structures are still developing, many jurisdictions are actively supporting digital securities innovation.

The key isn’t regulation vs no regulation—it’s programmable compliance.

6. Custody and Asset Security

Traditional Shares

Held through custodians and brokerage accounts. Security is centralized but regulated.

Stock Tokenization

Digital custody requires:

Institutional-grade wallet solutions

Multi-signature security

Secure key management

As enterprise-grade custody solutions mature, tokenized securities are closing the trust gap.

Security remains paramount—but technology is rapidly catching up.

7. Corporate Actions and Governance

Traditional Shares

Corporate actions like dividends, splits, and voting require multiple administrative layers.

Stock Tokenization

Smart contracts enable:

Automated dividend distribution

Real-time voting mechanisms

Transparent governance processes

Automation reduces errors and accelerates execution.

For fintech platforms, this programmability becomes a strategic advantage.

8. Scalability and Innovation Potential

Traditional equity markets are stable—but relatively rigid.

Stock Tokenization, on the other hand, allows:

Hybrid financial products

Tokenized ETFs

Programmable equity structures

Integration with DeFi liquidity pools

This flexibility encourages experimentation and innovation within regulated boundaries.

As detailed in this exploration of the rise of tokenized stocks going on-chain, blockchain infrastructure is already reshaping how equities can be issued and traded in compliant frameworks.

Innovation isn’t theoretical—it’s happening now.

Risk Comparison

No comparison is complete without addressing risks.

Risks of Traditional Shares

Settlement delays

Operational inefficiencies

High intermediary dependence

Risks of Stock Tokenization

Regulatory uncertainty in some regions

Technology adoption barriers

Market fragmentation across blockchain ecosystems

Institutions must weigh maturity against innovation.

But here’s the reality: every transformative financial infrastructure—from electronic trading to algorithmic systems—faced skepticism before becoming standard.

Strategic Implications for Institutional Investors

Choosing between traditional shares and tokenized equities isn’t binary.

Most forward-thinking institutions are exploring hybrid models:

Maintaining traditional exchange exposure

Piloting tokenized securities initiatives

Partnering with blockchain infrastructure providers

The goal isn’t disruption for its own sake—it’s competitive positioning.

Institutions that adopt early gain:

Operational efficiencies

Product innovation capabilities

Access to emerging liquidity channels

Waiting too long may mean adapting to standards set by others.

Frequently Asked Questions

Are tokenized shares legally recognized?

Yes, in many jurisdictions, provided they comply with securities regulations. Legal recognition continues to expand globally.

Do tokenized shares replace traditional exchanges?

Not necessarily. Hybrid ecosystems are likely, where both models coexist and integrate.

Is Stock Tokenization secure?

When built on enterprise-grade blockchain infrastructure with proper custody solutions, security standards can meet institutional requirements.

Why should fintech professionals care?

Because tokenization enables entirely new financial products, client experiences, and operational efficiencies.

The Bigger Picture: Evolution, Not Elimination

Let’s be clear—traditional shares aren’t disappearing tomorrow.

But markets evolve. Paper certificates gave way to electronic records. Floor trading shifted to algorithmic systems. Now, blockchain is the next infrastructure upgrade.

Stock Tokenization represents an evolution in how equity ownership is structured, transferred, and governed.

For institutional investors, the decision isn’t about abandoning legacy systems. It’s about recognizing where capital markets are heading.

Key Takeaways

Here’s the complete comparison at a glance:

| Factor | Traditional Shares | Stock Tokenization |

|---|---|---|

| Settlement | T+2 / T+1 | Near-instant potential |

| Trading Hours | Limited | Potential 24/7 |

| Intermediaries | Multiple | Reduced layers |

| Transparency | Centralized records | Immutable ledger |

| Corporate Actions | Manual processes | Smart contract automation |

| Innovation | Moderate | High flexibility |

Final Perspective

Stock Tokenization vs traditional shares isn’t a battle—it’s a transition.

Traditional equity markets offer stability and regulatory maturity. Tokenized equities offer efficiency, programmability, and global accessibility.

For institutional investors and fintech professionals, the smartest strategy may not be choosing one over the other—but integrating both.

The capital markets of tomorrow will likely combine the trust of traditional systems with the efficiency of blockchain infrastructure.