Introduction

Imagine buying fractional shares of Apple, Tesla, or Amazon instantly—without the usual middlemen, paperwork, or trading hours. Welcome to the future of investing: stock tokenization.

Through asset tokenization, traditional securities like stocks can now be converted into digital tokens on blockchain networks. And thanks to secure frameworks like Hyperledger Fabric, these transactions are faster, cheaper, and more transparent.

👉 Did you know? According to a 2023 report by BCG, asset tokenization could unlock up to $68 trillion in illiquid assets by 2030. The tokenized stock market alone could grow to over $5 trillion within the next five years as institutional adoption increases.

In this guide, we’ll explore how stock tokenization works, what role Hyperledger Fabric plays, and why this innovation is a game changer for global markets.

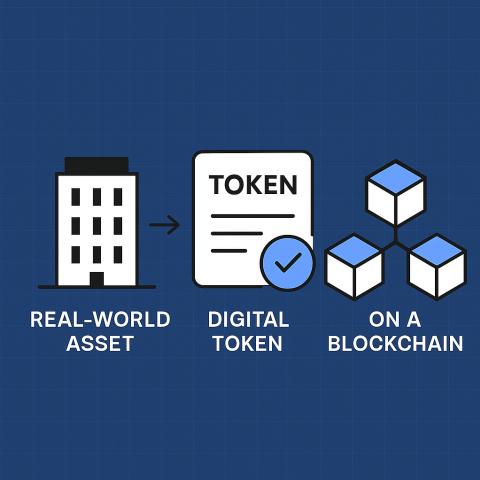

What is asset tokenization?

At its core, asset tokenization is the process of converting ownership rights of a real-world asset — such as stocks, bonds, real estate, or art — into a digital token on a blockchain. These tokens represent fractions of the asset and can be bought, sold, or traded easily.

✅ Why it matters? Because asset tokenization reduces friction, lowers costs, and opens up new liquidity options for assets that were once difficult to trade.

👉 Key stats on asset tokenization:

-

Transaction costs could drop by up to 65% through tokenization compared to traditional clearing systems.

-

Deloitte predicts tokenized securities could generate $5 trillion in new trading volumes globally by 2030.

What is Stock Tokenization?

Stock tokenization is a subset of asset tokenization that focuses specifically on equities. Here’s how it works: traditional shares are mirrored as digital tokens on a blockchain. Each token represents a share (or a fraction of a share) of a company’s stock.

These tokens can be:

-

Traded 24/7 on digital asset exchanges

-

Fractionalized so investors can buy small pieces of high-value stocks

-

Settled instantly, avoiding delays tied to traditional clearinghouses

👉 In 2022, Binance and FTX began offering stock tokenization services, allowing investors to buy tokenized versions of Tesla, Apple, and other top stocks.

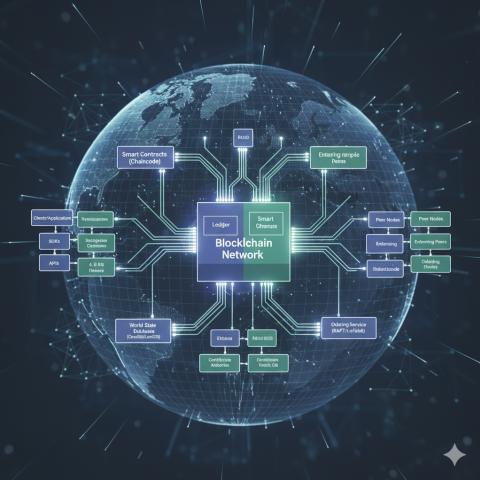

Why Hyperledger Fabric is Powering Stock Tokenization

You might be wondering: what technology is behind all this? This is where Hyperledger Fabric comes into play.

Hyperledger Fabric, developed by the Linux Foundation, is an open-source blockchain framework designed for enterprise use. It’s ideal for stock tokenization because:

-

It’s permissioned: Only authorized participants can join the network, making it compliant with regulatory frameworks.

-

It supports privacy: Fabric allows confidential transactions, so sensitive trading data stays secure.

-

It’s fast and scalable: Fabric can process thousands of transactions per second — critical for stock markets.

👉 Many leading financial institutions exploring stock tokenization, including Deutsche Börse and SGX, use Hyperledger Fabric for their pilots and live platforms.

How Stock Tokenization Works: A Quick Breakdown

Let’s walk through how stocks are tokenized:

1️⃣ Stock selection — A company or issuer chooses stocks to tokenize.

2️⃣ Legal structuring — Rights to these stocks are represented by tokens through a legal wrapper, ensuring they comply with securities laws.

3️⃣ Token issuance — Digital tokens are created on a blockchain like Hyperledger Fabric.

4️⃣ Distribution — Investors purchase tokens through a regulated platform.

5️⃣ Trading & settlement — Tokens can be traded on secondary markets, with instant or near-instant settlement.

The Big Benefits of Stock Tokenization

Here’s why investors and issuers alike are excited about stock tokenization:

✅ Fractional ownership: You can buy small fractions of expensive stocks, democratizing access to top equities.

✅ Around-the-clock trading: Blockchain platforms don’t sleep — tokens can be traded 24/7 globally.

✅ Faster settlements: No more waiting days for trades to clear — tokenized stock trades can settle within seconds.

✅ Cost reduction: No intermediaries mean lower trading and settlement fees.

The Risks You Should Know

Of course, tokenization isn’t risk-free. Be mindful of:

🚩 Regulatory uncertainty: Different countries are at different stages of regulating tokenized securities.

🚩 Platform risk: If a tokenization platform shuts down, you could have difficulty proving or transferring ownership.

🚩 Market volatility: Even tokenized stocks can experience wild price swings depending on demand.

The Market Potential: A Glimpse Into the Future

📊 Stats you can’t ignore:

-

A 2023 BCG report estimates that the tokenized securities market (including stock tokenization) could exceed $16 trillion by 2030.

-

Tokenized stock trading volume could reach $1 trillion annually by 2027 if adoption continues at its current pace.

Big names are getting involved too — JP Morgan, Goldman Sachs, and Nasdaq have all run pilots or launched platforms exploring stock tokenization.

How to Start Investing in Tokenized Stocks

Thinking about dipping your toes in? Here’s how to get started:

🔹 Choose a reputable platform: Look for regulated exchanges offering stock tokenization, such as tZERO, FTX (before its collapse, now successors), or smaller startups backed by institutions.

🔹 Do your homework: Check whether the tokens are backed 1:1 by actual shares, and that they comply with your local laws.

🔹 Diversify: Don’t concentrate your entire portfolio in tokenized stocks. Spread across asset types and markets.

🔹 Understand the tech: Learn the basics of blockchain and Hyperledger Fabric to better understand how your investments are managed.

Wrapping Up: Is Stock Tokenization the Future of Trading?

In short: Yes — but with caution.

Stock tokenization offers a fresh take on trading equities, combining the flexibility of digital assets with the stability of traditional securities. And thanks to powerful frameworks like Hyperledger Fabric, this transformation is happening in a secure, scalable way.

If you’re looking to invest in a more flexible, cost-efficient, and global stock market, tokenized stocks could be worth exploring. But as always, do your research and stay up-to-date with the latest regulatory developments.

FAQs

What’s the difference between stock tokenization and traditional stock trading?

Stock tokenization uses blockchain to represent shares digitally, offering faster settlement, fractional ownership, and 24/7 trading.

Is Hyperledger Fabric the only blockchain for stock tokenization?

No, but it’s a leading choice for institutional-grade platforms due to its permissioned and secure architecture.

Can tokenized stocks pay dividends?

Yes — dividends can be distributed directly to token holders based on the number of tokens they own.