With the rapid shift toward digital

insurance services in India, accessing your car insurance policy online has

become simple and convenient. Whether you need a soft copy for traffic

verification,..

Car insurance is an essential part

of owning a vehicle in India. It provides financial protection against

accidents, theft, natural disasters, and third-party liabilities. Once you

purchase a policy, the..

AI is rapidly redefining policy management software by introducing intelligent automation, advanced data analytics, and real-time decision support across the policy lifecycle. This article examines how AI-driven capabilities help insurers..

Legacy insurance operations relied heavily on manual processes for policy administration, claims processing, and customer service. These manual workflows created bottlenecks that slowed service delivery and increased operational costs. GenAI-powered..

Buying a car insurance policy online is convenient, fast, and often more affordable. However, convenience should not replace careful evaluation. Many buyers focus only on the premium amount and miss..

Car insurance is an important

document that every vehicle owner must keep safe. If you have purchased a

policy from Go Digit, you may need your policy copy for many..

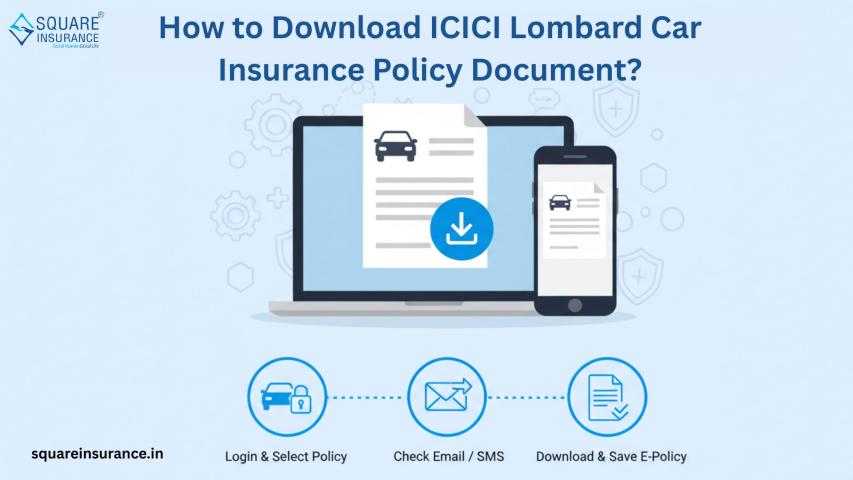

In today’s digital era, managing insurance policies has become simpler than ever. Gone are the days of maintaining bulky paper files. With ICICI Lombard, you can now download your ICICI..

Do you think modernizing insurance operations requires massive system overhauls? Cloud-based policy administration systems prove otherwise. These platforms modernize core insurance processes without disrupting existing workflows. Cloud technology reshapes how..

Bike insurance is not just a legal requirement in India—it’s a crucial financial shield that protects you from unexpected expenses due to accidents, theft, or third-party liabilities. With the growing..

An insurance policy is a legal agreement between an individual and an insurance company that provides financial protection against specific risks. In return for regular premium payments, the insurer agrees..

Legacy insurance operations relied heavily on manual processes for policy administration, claims processing, and customer service. These manual workflows created bottlenecks that slowed service delivery and increased operational costs. GenAI-powered..

Do you think modernizing insurance operations requires massive system overhauls? Cloud-based policy administration systems prove otherwise. These platforms modernize core insurance processes without disrupting existing workflows. Cloud technology reshapes how..

Document automation represents a significant opportunity for insurance companies seeking operational efficiency and competitive advantage. Manual document management continues to hinder insurance operations through bottlenecks, errors, and compliance risks. Insurance..

In modern enterprise networks, maintaining secure and efficient access control is a top priority. Cisco Identity Services Engine (ISE) plays a pivotal role in providing centralized identity management, network access..

AI-powered proposal generators are essential for insurance companies seeking competitive advantage in modern markets. By integrating this tool in a policy administration system, insurers can address critical operational challenges while..

The compliance automation capabilities in policy administration software eliminates the operational risks that plague insurance businesses using manual processes. Manual compliance management exposes insurance companies to human error, fragmented data..

Stay ahead of evolving regulatory requirements with flexible and robust insurance policy administration software. By automating compliance checks, insurers can minimize human errors and ensure timely adherence to changing laws..

Modernization is an effective strategy to improve the agility and sustainability of legacy insurance policy management solutions. With the support of skilled insurance technical experts, businesses can modernize their insurance..