Car insurance is an essential part of owning a vehicle in India. It provides financial protection against accidents, theft, natural disasters, and third-party liabilities. Once you purchase a policy, the next important step is to have your ICICI Lombard Car Insurance Policy Document safely stored. This document is proof of your insurance and contains important information about coverage, terms, and conditions.

In this blog, we will explain in

simple language how to download your

ICICI Lombard Car Insurance Policy Document, why it is important, and

tips to manage it effectively.

What Is an ICICI Lombard

Car Insurance Policy Document?

The ICICI Lombard Car Insurance Policy Document is an official

certificate issued by the insurer that confirms your vehicle is insured. It

contains essential details such as:

- Policy number

- Vehicle details (make, model, registration number)

- Insured Declared Value (IDV)

- Coverage type (comprehensive or own damage)

- Policy tenure and expiry date

- Terms, conditions, and exclusions

- Add-on covers (if any)

- Contact details of the insurer

This document acts as legal proof

while driving and is required during claim settlement, police verification in

case of accidents, and renewing your insurance.

Why Is It Important to

Download Your ICICI Lombard Car Insurance Policy Document?

Downloading and keeping a digital

copy of your ICICI Lombard Car

Insurance Policy Document has many benefits:

1. Legal Proof

It serves as proof of insurance when

driving, during inspections, or in case of accidents.

2. Easy Access

You can access your policy anytime

for claims, renewals, or adding coverage.

3. Secure Backup

Having a digital copy ensures you do

not lose your insurance document in case of misplacement of the physical copy.

4. Hassle-Free Claims

Most claims require you to provide

policy details. A downloaded copy allows you to submit information quickly and

avoid delays.

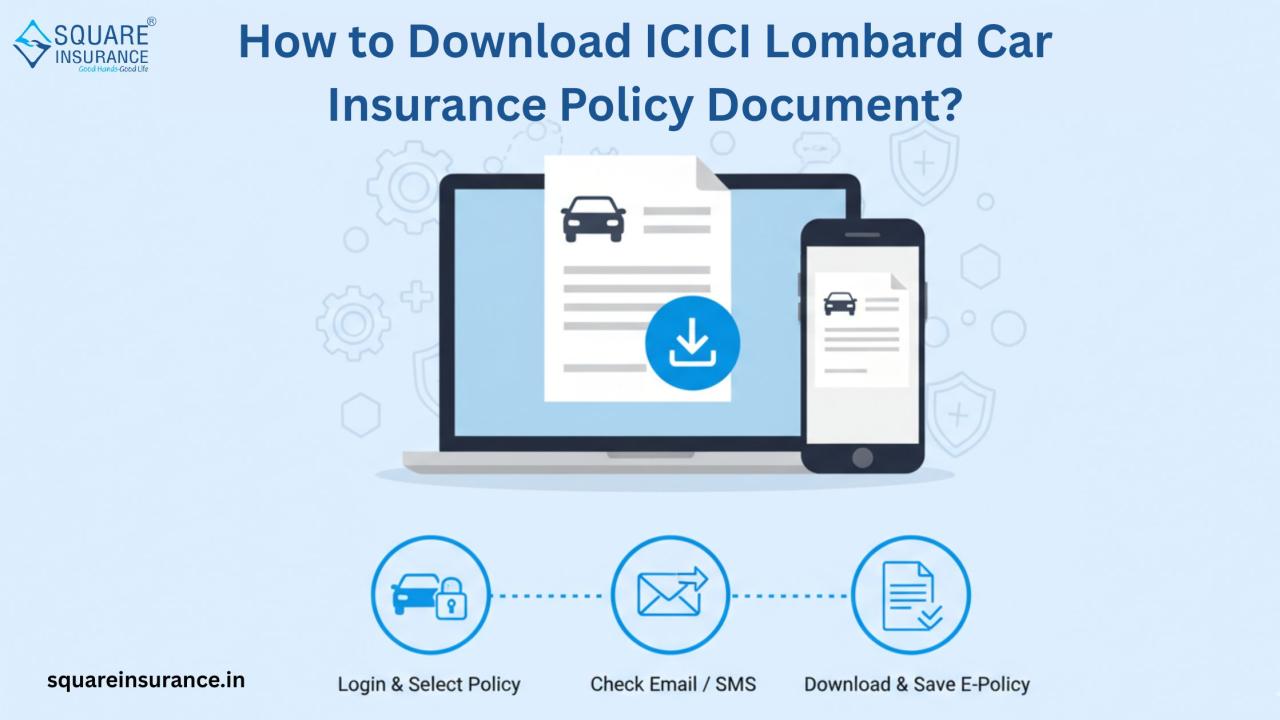

Methods to Download ICICI

Lombard Car Insurance Policy Document

ICICI Lombard provides multiple ways

to download your Car Insurance Policy

Document, making it easy for policyholders to access their insurance

digitally.

1. Download via ICICI

Lombard Website

Step 1: Visit the official ICICI Lombard website.

Step 2: Navigate to the ‘Car Insurance’ section and select ‘Policy

Document Download’.

Step 3: Enter your policy number or vehicle registration number

along with your registered mobile number or email.

Step 4: Verify your details using the OTP sent to your registered

mobile number.

Step 5: Once verified, your ICICI

Lombard Car Insurance Policy Document will be displayed. You can

download it in PDF format and save it on your device.

2. Download via ICICI

Lombard Mobile App

ICICI Lombard also provides a mobile

app for policyholders to manage their insurance easily.

Step 1: Download the ICICI Lombard mobile app from Google Play

Store or Apple App Store.

Step 2: Log in using your registered mobile number or policy

details.

Step 3: Go to the ‘My Policies’ section.

Step 4: Select your car insurance policy and click on ‘Download

Policy Document’.

Step 5: Save the PDF copy on your phone for easy access anytime.

3. Download via Email

When you purchase or renew your

ICICI Lombard car insurance policy, the company sends the policy document via email to your

registered email ID.

- Check your inbox for an email from ICICI Lombard with

the subject line “Policy Document”.

- Download the PDF attachment and save it securely.

- Keep a backup in cloud storage or an external drive for

safety.

4. Contact Customer Care

If you face any difficulty

downloading your ICICI Lombard Car

Insurance Policy Document online, you can contact ICICI Lombard customer

care.

- Provide your policy number and registered details.

- The support team will email or guide you to download the

document online.

What to Check in Your

Policy Document

After downloading the ICICI Lombard Car Insurance Policy Document,

it is important to verify the details:

- Policy Number

– Ensure it matches your records.

- Vehicle Details

– Check the make, model, registration number, and year.

- IDV – Ensure

the Insured Declared Value is correct.

- Coverage Type

– Verify whether it is comprehensive or own damage.

- Policy Period

– Check the start and expiry date.

- Add-Ons

– Confirm any additional covers you opted for.

- Exclusions and Terms

– Read the terms to avoid surprises during a claim.

Benefits of Downloading

Policy Document Online

- Immediate Access

– No need to wait for postal delivery.

- Eco-Friendly

– Reduces paper usage and helps the environment.

- Secure Storage

– Digital copies are easy to back up.

- Ease of Sharing

– Share via email for claims or verification.

- Convenience During Emergencies – Quickly access your policy when needed.

Tips to Manage Your ICICI

Lombard Car Insurance Policy Document

- Always keep a digital

copy saved on your phone, computer, or cloud storage.

- Keep a hard

copy in your car for emergencies.

- Regularly check the expiry date and plan for renewal.

- Update your contact details with ICICI Lombard to

receive policy emails.

- In case of changes to the vehicle, request an updated

policy document immediately.

Frequently Asked Questions

(FAQs)

Q1.

Can I download my policy document anytime?

Yes,

the ICICI Lombard Car Insurance Policy Document can be downloaded anytime

through the website or mobile app.

Q2.

Is the digital copy valid for legal and claim purposes?

Yes,

the PDF version of your policy document is legally valid and accepted during

claims, police verification, and renewals.

Q3.

What if I lose my physical copy?

You

can always download a new copy online or contact customer care for assistance.

Q4.

Can I get help from squareinsurance for policy download?

Yes,

if you purchased your policy through squareinsurance, their team can

guide you to download your ICICI Lombard Car Insurance Policy Document and

ensure you have all the correct details.

Q5.

Can I download a renewed policy document?

Yes,

after renewal, ICICI Lombard sends the updated policy document to your

registered email, and you can also download it from the website or app.

Conclusion

Downloading and storing your ICICI Lombard Car Insurance Policy Document

is an essential step to ensure continuous protection for your car. With digital

copies, you can access your policy anytime, make claims quickly, and avoid

unnecessary delays. Whether through the website, mobile app, or email, ICICI Lombard

makes it simple and convenient for policyholders.

Always verify your policy details,

keep a backup, and update contact information to avoid any issues. A

well-managed policy document ensures peace of mind and smooth claim settlement.

Note

At squareinsurance, we make car

insurance easy and convenient. We guide our customers on downloading and

managing their ICICI Lombard Car

Insurance Policy Document, ensuring all details are accurate and

accessible.

For added convenience, you can also

download our mobile application “Square

Insurance POS – Apps on Google Play” to manage your insurance policies,

access documents, and stay updated anytime, anywhere.