In today’s digital era, managing insurance policies has become simpler than ever. Gone are the days of maintaining bulky paper files. With ICICI Lombard, you can now download your ICICI Lombard Car Insurance Policy Document PDF online within minutes. This digital access ensures convenience, security, and instant availability whenever you need it.

As an insurance content writer with over 15 years of experience and more than 10,000 published blogs, I strongly recommend policyholders to always keep a soft copy of their ICICI Lombard Car Insurance Policy Document handy. Let’s understand why this document is crucial, how to download it, and what to do if you face any issues.

What Is an ICICI Lombard Car Insurance Policy Document?

The ICICI Lombard Car Insurance Policy Document is official proof of insurance issued by the insurer. It contains all vital information related to your policy, such as:

- Policy number

- Insured vehicle details

- Coverage type

- Policy validity period

- Insured Declared Value (IDV)

- Add-on covers

- Premium paid

- Terms & conditions

This document is legally recognized and must be carried (physically or digitally) while driving.

Why Is the Policy Document Important?

Here’s why you should always keep your policy document:

- Legal Requirement

Traffic police can ask for it anytime.

- Claim Processing

Required during claim filing.

- Proof of Coverage

Confirms your insured benefits.

- Policy Renewal

Helps during the renewal process.

- Loan & RC Transfer

Mandatory for ownership changes.

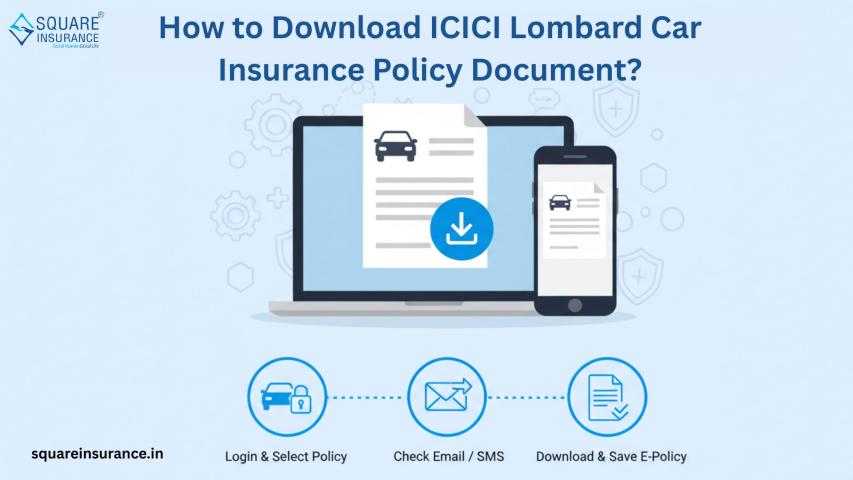

How to Download ICICI Lombard Policy Document PDF Online?

Downloading your policy document is simple:

Step-by-Step Process:

- Visit the ICICI Lombard official website

- Click on ‘Login’

- Enter registered mobile number/email

- Verify with OTP

- Go to My Policies

- Select your car policy

- Click Download PDF

Your policy document will be downloaded instantly.

Alternative Ways to Get Policy Copy

1. Email

You receive the PDF instantly after purchase.

2. Mobile App

Download from the ICICI Lombard mobile app.

3. Customer Care

Request a duplicate copy anytime.

4. Branch Visit

Get a physical copy from the nearby branch.

What If You Lose Your Policy Document?

No worries! You can easily:

- Re-download from the website

- Check the registered email inbox

- Request a duplicate copy

- Contact customer support

Digital copies are legally valid.

Details Mentioned in Policy Document

Your policy PDF includes:

- Policyholder name

- Vehicle registration number

- Engine & chassis number

- Coverage type

- Insured Declared Value (IDV)

- Add-ons opted

- Premium breakup

- Claim process

- Exclusions

Always cross-check details after downloading.

Benefits of Downloading Policy Online

- Instant access

- Paperless process

- Eco-friendly

- Easy storage

- Shareable

- Secure

Common Issues While Downloading & Solutions

- Wrong login details

Use registered number/email only - OTP not received

Check network & spam folder - Policy not visible

Contact customer support

Tips to Safely Store Policy Document

- Save in the cloud (Google Drive)

- Email to yourself

- Keep in the mobile gallery

- Print backup copy

ICICI Lombard – Trusted Insurer

ICICI Lombard is one of India’s leading general insurance providers offering:

- Quick digital services

- High claim settlement ratio

- Wide garage network

- 24/7 support

- User-friendly portal

Their online policy download feature reflects their tech-driven approach.

Frequently Asked Questions (FAQs)

Q1. Is the digital policy document valid?

Yes, it is legally accepted.

Q2. Can I download old policy documents?

Yes, from your login dashboard.

Q3. Is there any charge to download?

No, it’s completely free.

Q4. What if I changed my mobile number?

Contact customer support for an update.

Q5. How does Square Insurance help in policy management?

squareinsurance helps customers download ICICI Lombard policy documents, compare insurance plans, renew policies, and receive expert assistance for claims and coverage selection—all in one place.

Expert Opinion (EEAT Approach)

As a seasoned insurance professional, I always advise customers to download and verify their policy PDF immediately after purchase. This avoids errors, ensures coverage clarity, and speeds up claims. Digital documents are safer, easier to store, and instantly accessible—making them far superior to physical copies.

Conclusion

The ICICI Lombard Car Insurance Policy Document – Download PDF Online feature makes policy management effortless. Whether it’s verification, renewal, or claim filing, having your document digitally stored ensures you’re always prepared.

If you haven’t downloaded your policy yet, do it today and stay stress-free on the road.

Important Note

You can also manage your policies, track renewals, and compare insurers using our mobile application:

Square Insurance POS – Apps on Google Play

Download now and experience smart, simple, and secure insurance management at your fingertips!