In today’s fast-paced digital world, buying car insurance has become easier than ever. No more paperwork, long queues, or agent visits. With ICICI Lombard Online Car Insurance, you can get instant quotes, compare plans, and receive your policy within minutes. This digital shift not only saves time but also ensures transparency and better pricing.

As a professional insurance content writer with over 15 years of experience and 10,000+ published blogs, I have seen how online insurance platforms have transformed the customer experience. ICICI Lombard stands out for its user-friendly process, quick claim settlement, and wide coverage options.

Let’s explore everything you need to know about ICICI Lombard online car insurance.

What is ICICI Lombard Online Car Insurance?

- ICICI Lombard online car insurance allows you to:

- Get instant premium quotes

- Compare plans

- Choose add-ons

- Buy or renew policy digitally

- Download policy instantly

All this can be done from your mobile or laptop without visiting any branch.

Types of ICICI Lombard Car Insurance Plans

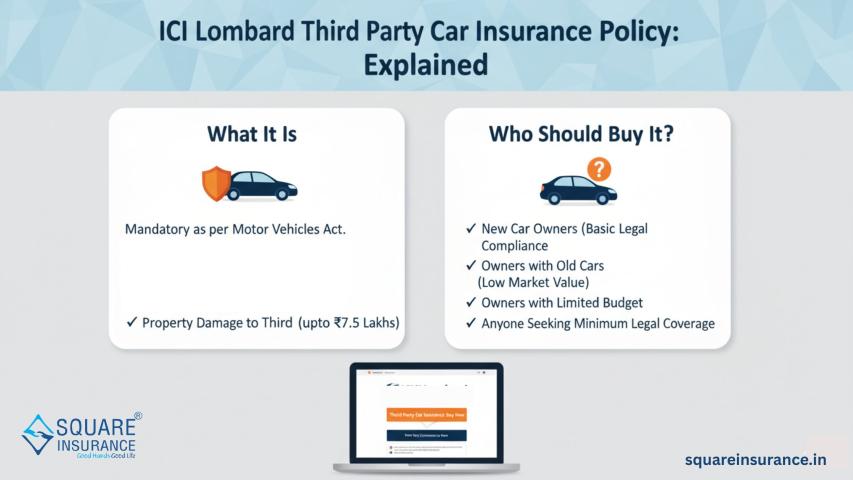

1. Third-Party Insurance

This is mandatory by law and covers:

- Injury or death of a third party

- Damage to third-party property

It does NOT cover damage to your own car.

2. Comprehensive Insurance

- Offers complete protection, including:

- Third-party liabilities

- Own car damage

- Theft

- Fire

- Flood, earthquake

- Riots and vandalism

This is the most recommended plan.

3. Standalone Own-Damage Policy

If you already have third-party insurance, you can buy this to protect your car.

Coverage Provided

A comprehensive ICICI Lombard policy covers:

- Road accidents

- Theft or burglary

- Fire and explosion

- Natural disasters

- Man-made disasters

- Third-party legal liabilities

Add-On Covers for Extra Protection

Enhance your policy with add-ons:

- Zero Depreciation Cover – Full claim without depreciation

- Engine Protection – Covers hydrostatic lock

- Roadside Assistance—24x7 help

- Return to Invoice – Full invoice value

- NCB Protection – Saves No Claim Bonus

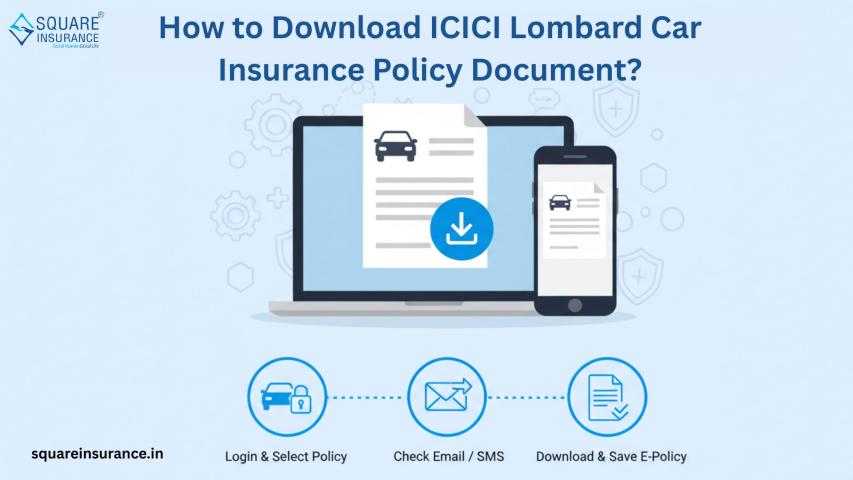

How to Get Instant Quotes Online?

Follow these steps:

- Enter your car number

- Select policy type

- Choose add-ons

- View instant premium quotes

- Compare plans

- Proceed to payment

You’ll receive your policy instantly on email.

Benefits of Buying ICICI Lombard Car Insurance Online

- Instant policy issuance

- Paperless process

- Transparent pricing

- Better discounts

- Easy comparison

- Secure payment

- 24x7 access

How Is Premium Calculated?

Your premium depends on:

- Car make & model

- City of registration

- Vehicle age

- IDV (Insured Declared Value)

- Add-ons selected

- Claim history

Tips to Reduce Premium

- Maintain a claim-free record

- Use NCB discount

- Install anti-theft device

- Avoid unnecessary add-ons

- Compare plans online

Claim Process

- Inform ICICI Lombard immediately

- Submit documents

- Vehicle inspection

- Cashless repair or reimbursement

- Claim settlement

Why Choose ICICI Lombard?

- Large network of cashless garages

- Quick claim processing

- 24x7 customer support

- Strong digital platform

- High customer satisfaction

Expert Opinion (EEAT Approach)

With 15+ years of industry experience, I strongly recommend online car insurance for every vehicle owner. It not only saves time but also gives you complete control over your coverage. ICICI Lombard’s online platform is one of the most reliable in the industry, offering instant quotes and seamless renewals.

Always opt for comprehensive coverage and add relevant add-ons like zero depreciation and engine protection, especially if you drive frequently or live in flood-prone areas.

Frequently Asked Questions

Q1. Is online car insurance safe?

Yes, ICICI Lombard uses secure payment gateways and encrypted data.

Q2. Can I renew my policy online?

Yes, renewal takes just a few minutes.

Q3. Can I switch insurers online?

Yes, you can easily port your policy.

Q4. How does Square Insurance help?

squareinsurance helps users compare ICICI Lombard online car insurance plans, get instant quotes, choose the best coverage, and complete purchase or renewal digitally with expert assistance.

Q5. Can I add covers online?

Yes, you can customize your policy anytime.

Conclusion

ICICI Lombard Online Car Insurance – Instant Policy & Quotes is the smartest way to protect your vehicle. With digital convenience, fast processing, and competitive pricing, ICICI Lombard makes car insurance simple and stress-free. Always compare plans and renew on time to enjoy continuous protection.

Important Note

You can buy, renew, and manage your car insurance easily through our mobile application:

Square Insurance POS – Apps on Google Play

Download now and enjoy seamless insurance services with expert support anytime, anywhere!