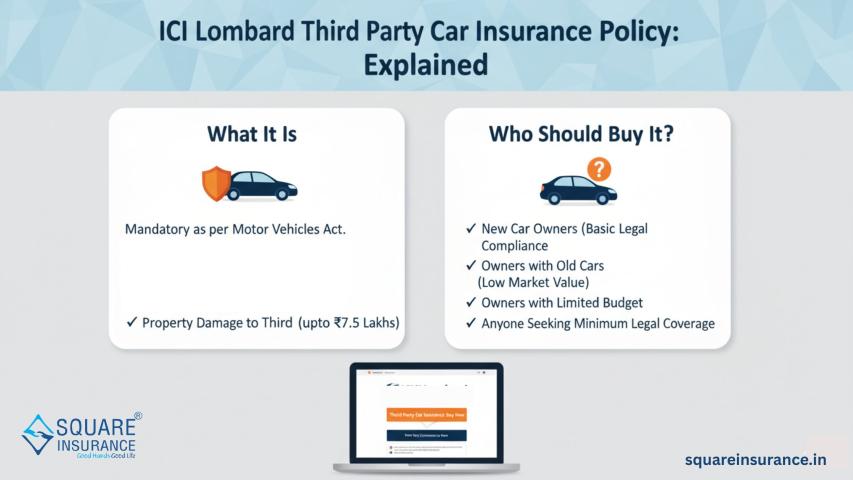

In India, car insurance is not just a financial safeguard—it’s a legal requirement. According to the Motor Vehicles Act, every vehicle owner must have at least a third-party car insurance policy. If you’re looking for reliable protection and legal compliance, ICICI Lombard Third Party Car Insurance Policy is one of the most trusted options in the market, offering hassle-free coverage and strong claim support.

With over 15 years of experience in the insurance content domain and having written 10,000+ industry-focused blogs, I can confidently say that ICICI Lombard stands out for its transparent policies, strong claim support, and customer-centric approach. This article explains everything you need to know about ICICI Lombard third-party car insurance.

What is ICICI Lombard Third Party Car Insurance?

ICICI Lombard third-party car insurance is a mandatory policy that protects you against:

- Injury or death of a third person

- Damage to third-party property

- Legal liabilities arising from accidents

It does not cover damage to your own car. However, it ensures you remain legally compliant and financially protected in case of a third-party claim.

Why is Third-Party Insurance Mandatory?

The Government of India has made third-party insurance compulsory to:

- Protect accident victims

- Ensure compensation for third-party damages

- Reduce legal complications

- Promote responsible driving

Driving without valid insurance can result in heavy fines, penalties, or even imprisonment.

Key Coverage Details

ICICI Lombard third-party policy covers:

- Bodily injury or death of a third party

- Property damage up to ₹7.5 lakh

- Legal expenses

- Court case liabilities

What is Not Covered?

This policy does NOT cover:

- Damage to your own car

- Theft of your vehicle

- Natural disasters

- Fire or vandalism

- Personal accident (unless added separately)

Benefits of ICICI Lombard Third Party Insurance

- Legal compliance

- Affordable premiums

- Quick policy issuance

- Trusted insurer

- 24x7 customer support

- Easy online renewal

Premium Rates (IRDAI Approved)

Premiums are fixed by IRDAI based on engine capacity:

1. Cars up to 1000cc

If your car’s engine capacity is up to 1000cc, the annual third-party insurance premium is ₹2,094. This category mainly includes small hatchbacks and entry-level cars, making it the most affordable segment.

2. Cars between 1000cc – 1500cc

For vehicles with an engine capacity between 1000cc and 1500cc, the annual premium is ₹3,416. This segment covers popular sedans and compact SUVs.

3. Cars above 1500cc

Cars with an engine capacity above 1500cc attract a higher premium of ₹7,897 per year. This includes premium sedans, SUVs, and high-performance vehicles.

Important Note:

These premium rates are subject to change as per IRDAI guidelines. Always check the latest pricing before purchasing or renewing your policy.

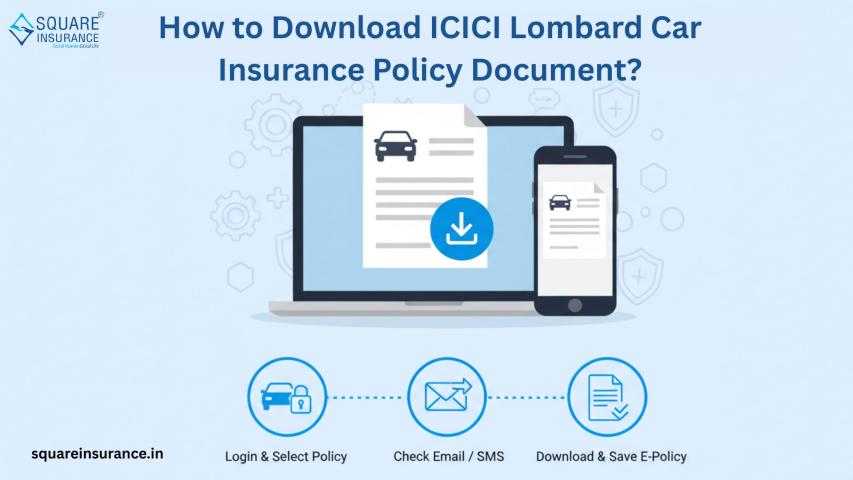

How to Buy ICICI Lombard Third Party Car Insurance Online?

- Visit the official website or trusted insurance platform

- Enter car details

- Select third-party policy

- View premium

- Make payment

- Download policy instantly

No paperwork required!

Renewal Process

Renewing is simple:

- Enter policy number

- Check expiry date

- Pay premium online

- Receive renewed policy instantly

Always renew before expiry to avoid penalties and inspection.

Claim Process

- Inform ICICI Lombard immediately

- File FIR (if required)

- Submit claim documents

- Court proceedings (if applicable)

- Settlement to third party

Who Should Buy Third-Party Insurance?

- Owners of old vehicles

- Budget-conscious drivers

- Occasional car users

- People looking for legal compliance only

Expert Insight (EEAT Approach)

From my professional experience in the insurance sector, third-party insurance is ideal for those who drive less or own older vehicles. However, if you use your car daily, a comprehensive policy is strongly recommended for full protection.

ICICI Lombard has maintained a strong reputation due to its ethical practices, claim transparency, and regulatory compliance.

ICICI Lombard vs Comprehensive Insurance

1. Legal Compliance

Both Third Party and Comprehensive insurance policies fulfill the legal requirement mandated by the Motor Vehicles Act. You can legally drive your car on Indian roads with either policy.

2. Own Damage Coverage

Third-party insurance does not cover damage to your own car. In contrast, a comprehensive policy protects your vehicle against accidents, collisions, and self-damage, offering complete financial security.

3. Theft Protection

If your car is stolen, third-party insurance provides no compensation. However, comprehensive insurance covers vehicle theft and compensates you based on the Insured Declared Value (IDV).

4. Add-on Benefits

Third-party insurance does not allow add-ons. Comprehensive insurance offers multiple add-ons such as zero depreciation, engine protection, roadside assistance, and more for enhanced coverage.

5. Premium Cost

Third-party insurance comes with a lower premium as it provides limited coverage. Comprehensive insurance has a higher premium but offers extensive protection, making it more valuable in the long run.

Frequently Asked Questions

Q1. Is third-party insurance enough?

It meets legal requirements but doesn’t protect your car.

Q2. Can I upgrade later?

Yes, you can switch to comprehensive anytime.

Q3. Is inspection required?

Only if your policy has expired.

Q4. How does squareinsurance help?

squareinsurance helps customers compare ICICI Lombard third-party policies, check premiums, renew instantly, and get expert guidance for claim assistance.

Q5. Is online renewal safe?

Yes, 100% secure with encrypted payment gateways.

Conclusion

ICICI Lombard Third Party Car Insurance – Policy Details highlight how this policy is the most economical way to stay legally protected on Indian roads. While it doesn’t cover your own car, it ensures peace of mind by handling third-party liabilities efficiently.

For complete protection, consider upgrading to comprehensive insurance.

Important Note

Manage, renew, and compare insurance policies easily using our mobile application:

Square Insurance POS – Apps on Google Play

Download now and experience fast, secure, and expert-driven insurance services anytime, anywhere!