Car insurance is not just a safety measure; it is also a legal requirement in India. Every car owner must have at least a third-party insurance policy to drive legally on public roads. One such option is the ICICI Lombard Third Party Car Insurance Policy, which offers basic coverage at an affordable cost.

In this blog, we will explain what

the ICICI Lombard Third Party Car Insurance Policy is, what it covers, what it

does not cover, and who should consider buying it. The information is written

in simple and easy language so that everyone can understand it clearly.

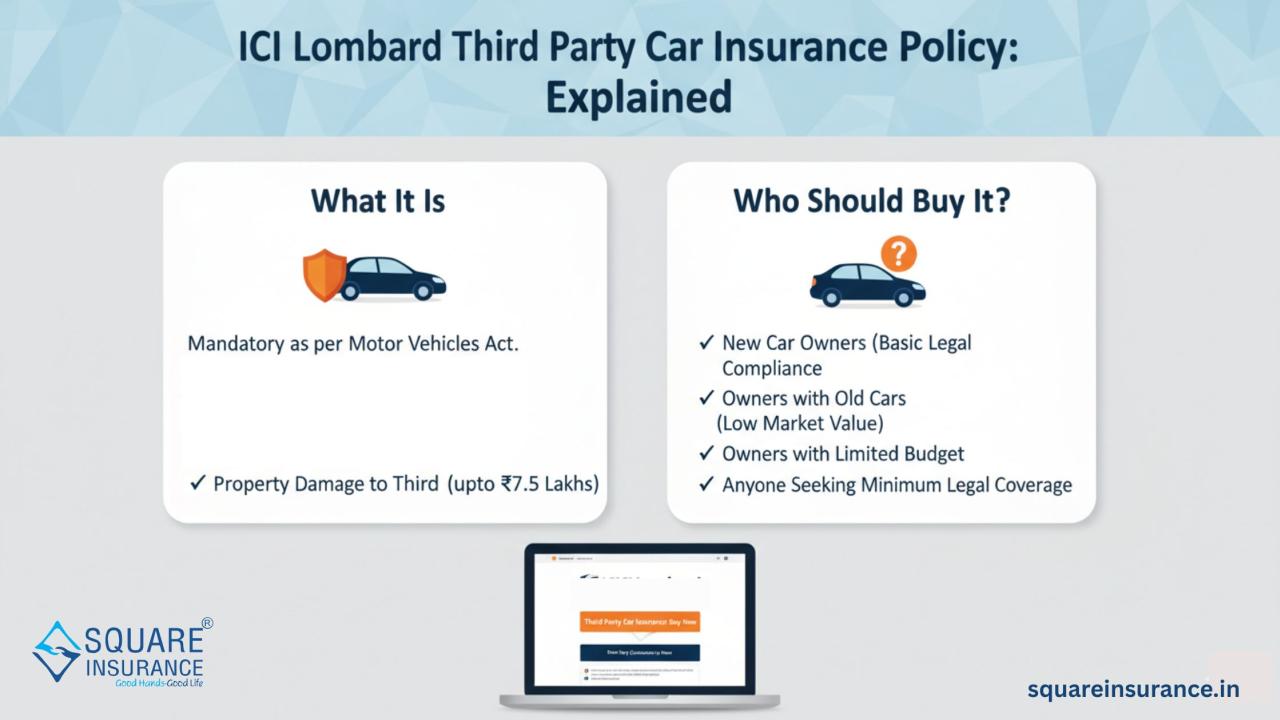

What Is the ICICI Lombard Third-Party Car Insurance Policy?

The ICICI Lombard Third Party Car Insurance Policy is a basic car

insurance plan that covers damages or losses caused to a third party due to

your car. A third party can be another person, another vehicle, or property.

This policy does not cover damage to

your own car. It only provides protection against legal and financial

liabilities arising from injury, death, or property damage caused to others.

As per Indian motor laws,

third-party car insurance is mandatory for all vehicle owners.

Why Is Third-Party Car

Insurance Mandatory?

The government has made third-party

car insurance compulsory to protect victims of road accidents. If your car

causes injury or damage to someone else, the third-party insurance ensures that

the affected person receives financial compensation.

Without valid third-party insurance,

you may face:

- Traffic fines

- Legal penalties

- Driving restrictions

Having an ICICI Lombard Third Party

Car Insurance Policy helps you meet legal requirements and avoid these issues.

What Does the ICICI Lombard

Third-Party Car Insurance Policy Cover?

Understanding coverage is important

before buying any insurance policy.

Third-Party Injury or Death

If your car causes injury or death

to another person, the policy covers the legal liability and compensation.

Third-Party Property Damage

If your car damages someone else’s

property, such as another vehicle or roadside structure, the policy covers the

repair or replacement cost up to the specified limit.

Legal Expenses

The policy also covers legal

expenses if a third party files a case against you due to an accident.

What Is Not Covered Under

This Policy?

The ICICI Lombard Third Party Car

Insurance Policy has certain exclusions.

- Damage to your own car

- Theft of your car

- Natural disasters like floods or earthquakes

- Fire damage to your own vehicle

- Personal accident coverage for the owner-driver

- Mechanical or electrical breakdown

If you want coverage for your own

car, you need to choose a comprehensive car insurance policy.

Key Features of ICICI

Lombard Third-Party Car Insurance Policy

Here are some important features of

this policy:

Affordable Premium

Third-party insurance is cheaper

than comprehensive insurance because it offers limited coverage.

Legal Compliance

The policy meets the legal

requirements set by the Motor Vehicles Act.

Simple Policy Structure

The policy is easy to understand

with fixed coverage and standard terms.

Reliable Insurance Provider

ICICI Lombard is a well-known

insurer with an established claim handling system.

How Is the Premium Decided?

The premium for the ICICI Lombard Third Party Car Insurance

Policy is fixed by the Insurance Regulatory and Development Authority of

India (IRDAI). It depends on:

- Engine capacity of the car

- Type of vehicle

Because the premium is regulated, it

remains the same across insurers for the same vehicle category.

Who Should Buy an ICICI Lombard Third-Party Car Insurance Policy?

This policy is suitable for certain

types of car owners.

Owners of Old Cars

If your car is old and has a low

market value, third-party insurance can be a cost-effective choice.

Low-Usage Car Owners

If you rarely use your car, basic

insurance may be enough.

Budget-Conscious Buyers

If you want the cheapest legal

insurance option, this policy fits well.

Legal Compliance Only

If your main goal is to meet legal

requirements, third-party insurance is sufficient.

Who Should Not Rely Only on

Third-Party Insurance?

Third-party insurance may not be

suitable for everyone.

- Owners of new or expensive cars

- People driving frequently or in high-traffic areas

- Those who want protection for their own vehicle

In such cases, comprehensive

insurance offers better protection.

How to Buy an ICICI Lombard

Third-Party Car Insurance Policy?

Buying this policy is simple and can

be done online.

- Visit the official website

- Enter car and registration details

- Select third-party insurance

- Check premium amount

- Make online payment

- Receive policy document by email

The process takes only a few

minutes.

Claim Process for Third-Party Insurance

The claim process for third-party

insurance is different from own damage claims.

Step 1: Inform the Insurer

Notify ICICI Lombard about the

accident immediately.

Step 2: File FIR

In case of injury or death, an FIR

must be filed.

Step 3: Legal Process

Claims are handled through the Motor

Accident Claims Tribunal.

Step 4: Claim Settlement

The insurer settles the claim as per

legal judgment.

Third-party claims usually take more

time due to legal involvement.

Advantages of ICICI Lombard

Third-Party Car Insurance Policy

- Low premium cost

- Meets legal requirements

- Simple coverage structure

- Suitable for basic protection

Things to Keep in Mind

Before Buying

- It does not cover your own car damage

- Claims may take longer

- No add-on options are available

- Limited financial protection

Understanding these points helps you

make the right decision.

Conclusion

The ICICI Lombard Third Party Car Insurance Policy is a basic and

affordable insurance option for car owners who want to meet legal requirements

without spending much. It is suitable for old cars, low usage vehicles, and

budget-focused buyers.

However, it does not protect your

own car. If you want complete peace of mind and financial safety, you should

consider upgrading to a comprehensive car insurance policy.

Before buying, always assess your

car’s value, usage, and budget. Choosing the right insurance policy helps you

stay legally safe and financially protected on the road.

Frequently Asked Questions

(FAQs)

Q.1.

What is the ICICI Lombard Third Party Car Insurance Policy?

The

ICICI

Lombard Third Party Car Insurance Policy is a basic motor

insurance plan that covers legal and financial liabilities arising from injury,

death, or property damage caused to a third party by your car.

Q.2. Is third-party car

insurance mandatory in India?

Yes,

third-party car insurance is mandatory under the Motor Vehicles Act. Driving

without it can lead to fines and legal penalties.

Q.3. Does the ICICI Lombard

Third Party Car Insurance Policy cover damage to my own car?

No,

this policy does not cover damage to your own car. It only covers third-party

liabilities. For own car damage, you need a comprehensive policy.

Q.4. How is the premium for

third-party car insurance decided?

The

premium is fixed by the Insurance Regulatory and Development Authority of India

(IRDAI) and depends on the engine capacity of the car.

Q.5. Who should buy an ICICI Lombard Third Party Car Insurance Policy?

This

policy is suitable for owners of old cars, people who use their car less often,

and those who want a low-cost insurance option to meet legal requirements.

Q.6. Can I buy an ICICI Lombard Third Party Car Insurance Policy online?

Yes,

you can buy the policy online by entering your car details, checking the

premium, and making an online payment. The policy document is issued digitally.

Q.7. Can Square Insurance help me understand third party car insurance?

Yes,

squareinsurance

helps customers understand ICICI Lombard Third Party Car Insurance Policy, its

coverage, limitations, and who should buy it, making insurance decisions

easier.

Note:

For

easy insurance guidance, policy comparison, and support, you can also use our

mobile application:

Square Insurance POS – Apps on Google

The

app is designed to make insurance simple, clear, and easy to manage.