Buying a car is a big investment, and protecting it properly is very important. While a standard car insurance policy provides basic protection, it may not always cover the full repair cost after an accident. This is where a zero depreciation add-on becomes useful. In this blog, we will explain ICICI Lombard Zero Depreciation Add-On Cover in simple and easy language so you can understand how it works and why it is important.

Understanding Depreciation

in Car Insurance

Before understanding zero

depreciation cover, it is important to know what depreciation means in car

insurance.

Depreciation refers to the reduction

in the value of car parts over time due to regular use. When you make a claim

under a normal car insurance policy, the insurer deducts depreciation on parts

such as plastic, rubber, metal, and fibre. Because of this deduction, you may

have to pay a large amount from your own pocket during repairs.

This is where ICICI Lombard Zero Depreciation Add-On Cover

helps.

What Is ICICI Lombard Zero

Depreciation Add-On Cover?

ICICI Lombard Zero Depreciation

Add-On Cover is an additional cover that you can add to your comprehensive or

standalone own damage car insurance policy. It ensures that depreciation is not

deducted from the claim amount for covered parts.

This means you receive a higher

claim payout, and your out-of-pocket expenses during car repairs are reduced.

How ICICI Lombard Zero

Depreciation Add-On Cover Works

When you make a claim with a

standard car insurance policy, depreciation is applied as follows:

- Plastic and rubber parts: up to 50%

- Fibre parts: depreciation applies

- Metal parts: partial depreciation

With the ICICI Lombard Zero Depreciation Add-On Cover, these depreciation

deductions are not applied. The insurer pays the full cost of covered parts, as

per policy terms, except for consumables and deductibles.

What Does the ICICI Lombard

Zero Depreciation Add-On Cover?

This add-on offers strong protection

during claims. Below are the key inclusions.

1. No Depreciation on

Replaced Parts

The add-on removes depreciation on

parts replaced during repair after an accident.

2. Higher Claim Amount

Since depreciation is not deducted,

the claim amount is higher compared to a standard policy.

3. Suitable for New and

Expensive Cars

This add-on is especially useful for

new cars and cars with expensive parts.

What Is Not Covered Under

This Add-On?

Even with zero depreciation cover,

some items are not covered.

- Consumables such as engine oil, grease, nuts, and bolts

- Mechanical or electrical breakdown

- Damage caused due to driving under the influence of

alcohol or drugs

- Damage caused due to illegal driving or without a valid

driving license

- Claims beyond the number allowed in the policy year

Knowing these exclusions helps avoid

confusion at the time of claim.

Benefits of ICICI Lombard

Zero Depreciation Add-On Cover

There are many reasons why car

owners choose this add-on.

1. Lower Repair Costs

The biggest benefit is reduced

repair expenses during claims.

2. Peace of Mind

You do not have to worry about high

depreciation deductions after an accident.

3. Ideal for New Car Owners

New cars have higher depreciation

value. This add-on helps protect your investment.

4. Better Value for Money

Even though the premium is slightly

higher, the savings during claims make it worthwhile.

Who Should Buy the ICICI Lombard Zero Depreciation Add-On Cover?

This add-on is suitable for:

- Owners of new cars

- People driving in traffic-heavy areas

- Owners of luxury or high-value cars

- Drivers who want maximum claim benefit

If you want better protection and

fewer expenses during repairs, the ICICI Lombard Zero Depreciation Add-On Cover is a smart choice.

How Many Claims Are Allowed

Under This Add-On?

ICICI Lombard allows a limited

number of zero depreciation claims in a policy year. The exact number depends

on policy terms. Once the limit is reached, depreciation may apply to further

claims.

It is always recommended to check

the policy wording for clarity.

Difference Between Standard

Policy and Zero Depreciation Add-On

|

Feature |

Standard

Policy |

Zero

Depreciation Add-On |

|

Depreciation Deduction |

Yes |

No |

|

Claim Amount |

Lower |

Higher |

|

Out-of-Pocket Expense |

High |

Low |

|

Ideal For |

Old cars |

New and expensive cars |

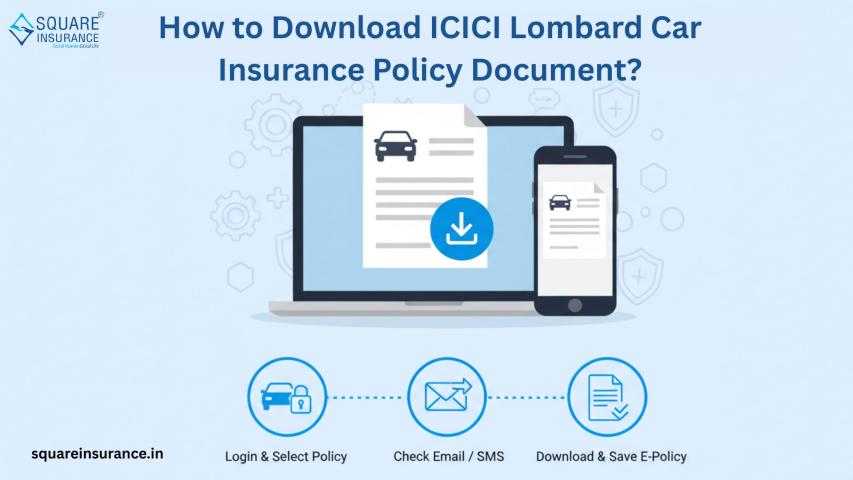

How to Buy ICICI Lombard

Zero Depreciation Add-On Cover?

You can purchase this add-on at the

time of buying or renewing your car insurance policy. The process is simple:

- Select comprehensive or standalone own damage policy

- Choose ICICI Lombard Zero Depreciation Add-On Cover

- Pay the additional premium

- Receive updated policy documents

Points to Keep in Mind

Before Buying

- The add-on is usually available for cars up to a

certain age

- Premium increases slightly with this cover

- Claim limits apply per policy year

- Always read policy terms carefully

Conclusion

ICICI

Lombard Zero Depreciation Add-On Cover

is an excellent option for car owners who want maximum protection and minimal

expenses during insurance claims. It helps reduce depreciation deductions and

ensures higher claim payouts.

While it increases the premium

slightly, the benefits during claims often outweigh the extra cost. If you

value peace of mind and want to protect your car without worrying about high

repair bills, this add-on is worth considering.

Before making a decision, review the

policy details and choose the add-ons that match your driving needs. With the

right coverage, you can drive confidently knowing your car is well protected.

Frequently Asked Questions

(FAQs)

Q1.

What is the ICICI Lombard Zero Depreciation Add-On Cover?

ICICI Lombard Zero

Depreciation Add-On Cover is an optional add-on that can be added to a

comprehensive or standalone own damage car insurance policy. It removes

depreciation on replaced parts during a claim, helping you get a higher claim

amount.

Q2.

Is the ICICI Lombard Zero Depreciation Add-On Cover mandatory?

No, this add-on is not

mandatory. It is optional but highly recommended for car owners who want to

reduce repair costs during insurance claims.

Q3.

With which policies can I buy the ICICI Lombard Zero Depreciation Add-On Cover?

You can buy this add-on

with ICICI Lombard Comprehensive Car Insurance or ICICI Lombard Standalone Own

Damage Car Insurance.

Q4.

How many claims are allowed under this add-on?

The number of zero

depreciation claims allowed in a policy year is limited and depends on the

policy terms and conditions. After the limit is reached, depreciation may

apply.

Q5.

Does zero depreciation cover consumable items?

No, consumables such as

engine oil, grease, coolant, nuts, and bolts are not covered under ICICI

Lombard Zero Depreciation Add-On Cover.

Q6.

Can I buy ICICI Lombard Zero Depreciation Add-On Cover through squareinsurance?

Yes, you can buy ICICI

Lombard Zero Depreciation Add-On Cover through squareinsurance, where you can compare policy options,

understand coverage details, and select the right add-ons for your car

insurance.

Note

At Square Insurance, we aim to simplify car insurance decisions by helping customers understand

coverage and choose the right add-ons for their needs. Whether you are buying a

new policy or renewing an existing one, we help you make informed choices.

For

easy access to insurance products and policy management, you can also download

our mobile application “Square Insurance POS – Apps on Google Play,” and stay connected

anytime, anywhere.