Insurance plays a vital role in financial protection by safeguarding individuals and families from unexpected events such as medical emergencies, accidents, disability, or the loss of an earning member. Life,..

Corporate leaders often focus their attention on revenue growth, innovation, and operational efficiency, but one of the most underestimated pillars of sustainable success is insurance. Far from being a mere..

Launching a startup means navigating uncertainty, tight budgets, and constant pressure to grow. Amid the hustle of product development, hiring, and fundraising, insurance is often overlooked—until it's too late.Risk Is..

The unified architecture of modern underwriting platforms transforms isolated data into actionable business insights. Insurance organizations who implement insurance underwriting software gain the capability to deliver personalized services that align..

Car insurance is more than just a legal requirement—it is a critical tool for protecting yourself, your vehicle, and the passengers who travel with you. Among the wide range of..

Buying car insurance is an essential

part of responsible vehicle ownership. In India, the car insurance market has

grown rapidly, offering multiple options for comprehensive and third-party

coverage. However, choosing..

Star Health Insurance refers to health insurance plans offered by Star Health and Allied Insurance Company, one of India’s leading standalone health insurance providers. Established in 2006, the company focuses..

Maruti Suzuki is one of the most

trusted car brands in India. From small hatchbacks to family cars and compact

SUVs, Maruti Suzuki vehicles are known for their mileage, easy..

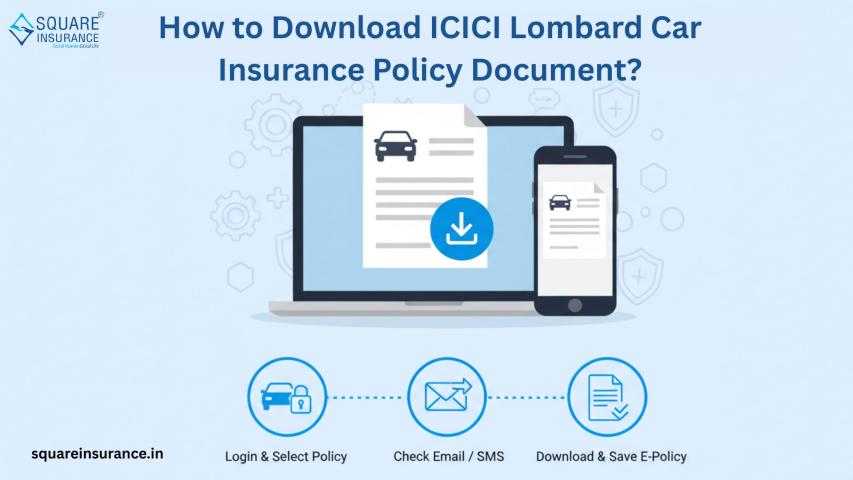

With the rapid shift toward digital

insurance services in India, accessing your car insurance policy online has

become simple and convenient. Whether you need a soft copy for traffic

verification,..

Car insurance is an essential part

of owning a vehicle in India. It provides financial protection against

accidents, theft, natural disasters, and third-party liabilities. Once you

purchase a policy, the..

The unified architecture of modern underwriting platforms transforms isolated data into actionable business insights. Insurance organizations who implement insurance underwriting software gain the capability to deliver personalized services that align..

Extended application processing times create friction for customers and brokers. Manual underwriting workflows often require days or weeks to complete standard applications. Lengthy processing times impact customer satisfaction and create..

Insurance underwriting continues evolving toward human-AI collaboration models. Companies adopting this approach will deliver faster service while maintaining decision accuracy and customer personalization. Underwriters can focus on complex risk evaluation..

The complexity of integrating analytics platforms with existing systems, training staff on new workflows, and ensuring compliance with regulatory requirements presents significant challenges. That’s why partnering with InsurTech service providers..

Blockchain scalability refers to the ability of a blockchain network to handle increasing numbers of transactions efficiently, without compromising speed, security, or decentralization. As blockchain adoption grows, many networks face..

Enterprise cloud solutions have transformed from a luxury to a necessity in the modern business landscape. Organizations that once relied on traditional IT infrastructure are now embracing cloud platforms to..

Launching a new website should be exciting. You've invested time, money, and countless hours perfecting your design, content, and user experience. But here's the harsh reality: 67% of new websites..

If you are a startup eyeing the blockchain space, there is one thing you should know upfront: Layer 1 alone won’t cut it anymore. Whether you’re building a DeFi app,..