The crypto is humming like a virtual gold rush, and you are piling your winnings on a Bitcoin trade or DeFi harvest. However, the shadow of the taxman is always..

Tax deductions are an important tool for businesses in the United States, helping to lower taxable income and reduce overall tax liabilities. For startups, understanding which expenses are deductible can..

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers,..

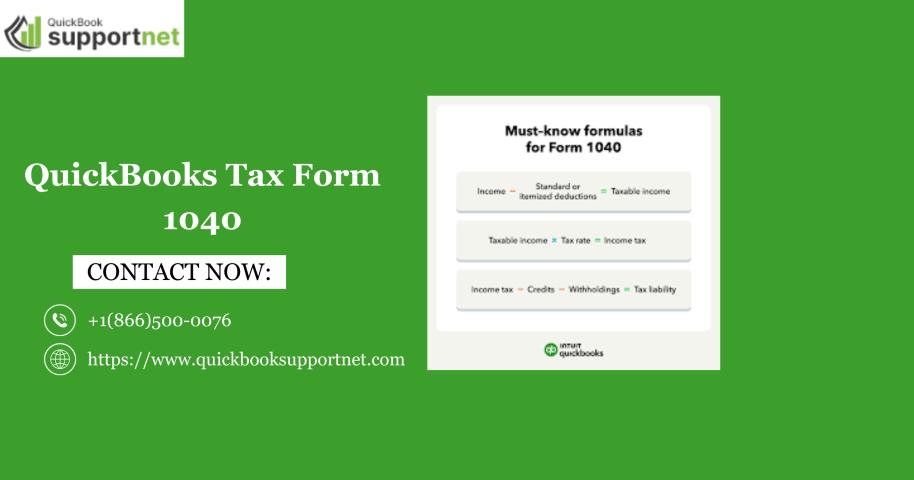

Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and..

Ever wondered how your accountant manages your tax so efficiently?

This Tax Agent Portal Guide breaks down how the portal works and why it helps accountants lodge accurately and on..

Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation..

In today’s fast-growing business environment, every entrepreneur needs a trusted partner who can simplify legal compliance, financial planning, and day-to-day accounting activities. BCPL Gujarat (Bizsmart Consultancy) stands out as a..

Shopify Tax Compliance for U.S. Sellers: Understanding Economic Nexus & Filing ObligationsSelling on Shopify is a great opportunity, but U.S. sellers often find that handling taxes is more complicated than..

The Goods and Services Tax (GST) is one of the most important reforms in India’s taxation system. It replaced a mix of state and central taxes with a single unified..

Ednet Consultants are trusted study abroad consultants in Delhi, offering expert guidance, top university admissions, visa support, and personalized counseling to help students achieve global education goals.Website: https://www.ednetconsultants.com/study-abroad/Address: 2nd Floor,..

BIS certification is now mandatory for hundreds of products in India, from electronics and appliances to cables, valves and industrial equipment. For many manufacturers and importers, understanding standards, coordinating lab..

When you are in your home country, you can study well as you have your loved ones to support you in your daily routine. But as an international student, you..

Planning to Study in Ireland? IVY Overseas is best Study in Ireland consultants in Hyderabad and Andhra Pradesh and one of the best study in ireland consultants, Ireland is Renowned..

Studying abroad is a dream for many students—but it often comes with doubts, myths, and misinformation that hold them back. Whether it’s about cost, eligibility, or safety, these concerns can..

IVY OversBest Study in USA Consultants in Hyderabadeas is the best study abroad consultants in Hyderabad, IVY Overseas mission is to help the student community with the right advice to..

Planning to Study in Ireland? IVY Overseastudy abroad consultants for irelands is best Study in Ireland consultants in Hyderabad and Andhra Pradesh and one of the best study in ireland..

IVY Overseas is a best Study in GeBest consultancy in hyderabad for study in germanyrmany consultants in Hyderabad and Andhra Pradesh, helping students achieve their dream of studying in Germany...

Studying abroad is one of the most life-changing decisions a student can make — but it’s also completely normal to feel hesitant or unsure. Between the fear of moving to..