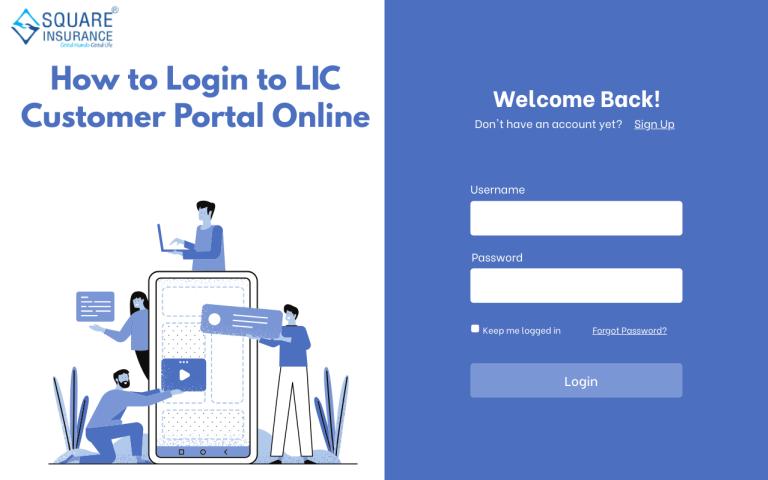

Managing insurance policies can feel complicated when information is scattered across documents, receipts, and reminders. As daily life becomes busier, people look for easier ways to stay informed and organized. The LIC Customer Portal is designed to meet this need by offering policyholders a single digital space to manage their insurance details. Through the LIC Customer Portal Login, users can securely access their policy information and use several helpful features that make policy management simpler, clearer, and more efficient.

This article explains the key benefits of using the LIC Customer Portal after login and how it supports policyholders in managing their insurance with confidence and ease.

What Is the LIC Customer Portal?

The LIC Customer Portal is a secure online platform created for policyholders to access and manage their insurance policies digitally. Once logged in, users can view policy-related information, track premium status, and stay updated without depending on physical documents or repeated visits to branches.

The portal is particularly helpful for long-term policy management, where clarity and regular monitoring are important.

Key Benefits of Using LIC Customer Portal After Login

1. Centralized Access to All Policy Information

One of the strongest advantages of using the customer portal is centralized information access. After login, policyholders can view details of all linked policies in one place. This eliminates the need to search through files, emails, or receipts for basic policy data.

Having everything in a single dashboard helps users stay organized and informed at all times.

2. Easy Monitoring of Premium Due Dates

Missing a premium due date can lead to policy lapse or additional stress. The customer portal allows users to clearly see premium due dates and payment schedules after login. This visibility helps policyholders plan their payments better and avoid last-minute issues.

For long-term policies, this feature alone adds significant value.

3. Transparent View of Payment History

After logging in, policyholders can review past premium payments and transaction records. This transparency ensures that users always have a clear understanding of their payment history.

It also becomes easier to verify payments, resolve doubts, or keep records for future reference.

4. Time-Saving and Convenient Experience

The traditional process of visiting offices or contacting support for basic information can be time-consuming. The LIC Customer Portal reduces this effort by offering instant access to key details.

Policyholders can check information at their convenience, saving time and energy while maintaining better control over their insurance matters.

5. Secure and Controlled Access

Security is a critical concern in insurance-related services. The portal’s login system ensures that personal and policy data is accessible only to authorized users. This controlled access protects sensitive information and maintains confidentiality.

Policyholders can confidently use the portal knowing their data is safeguarded.

6. Better Understanding of Policy Status

Understanding the current status of a policy is essential for long-term financial planning. After login, users can view whether their policy is active, paid up, or nearing a due date.

This clarity helps policyholders make timely decisions and prevents confusion that often arises from outdated or incomplete information.

7. Reduced Dependence on Physical Documents

Insurance policies often involve long-term paperwork that can be misplaced or damaged over time. The customer portal minimizes dependence on physical records by storing information digitally.

This digital approach supports better organization and reduces the risk of losing important documents.

8. Helpful for Long-Term Financial Planning

Insurance is a long-term commitment, and the customer portal supports this by providing a complete overview of policy details over time. Users can track progress, review premium patterns, and stay aligned with their financial goals.

This long-term visibility makes insurance planning more structured and reliable.

9. Encourages Proactive Policy Management

When information is easily accessible, policyholders are more likely to stay engaged with their policies. Regular login and review encourage timely actions, such as monitoring due dates and reviewing policy details.

This proactive involvement reduces the chances of unexpected issues later.

10. Accessible Across Locations and Devices

The customer portal can be accessed from different locations, allowing policyholders to manage their insurance without location-based limitations. Whether at home or while traveling, users can log in and access their policy information as needed.

This flexibility aligns well with modern digital life>

11. Simplifies Insurance Awareness

Many policyholders lose track of policy details over time. The portal helps maintain awareness by presenting clear and updated information in a user-friendly format.

This improved awareness leads to better understanding and more confident decision-making.

12. Suitable for Different Age Groups

The customer portal is designed with simplicity in mind, making it usable for people across age groups. Clear menus and structured information make navigation easier, even for those who are not highly tech-savvy.

This inclusiveness ensures that more policyholders can benefit from digital services.

Frequently Asked Questions (FAQs)

Q1. Why should I use the LIC Customer Portal after login?

Using the portal allows you to access policy details, premium information, and payment history in one secure place, making insurance management easier and more organized.

Q2. Is the LIC Customer Portal safe to use?

Yes, the portal uses secure login credentials to protect personal and policy-related information, ensuring controlled access.

Q3. Can I view multiple policies under one login?

If multiple policies are linked, they can be viewed together after login, providing a consolidated overview.

Q4. How does the portal help avoid missed premium payments?

The portal displays premium due dates clearly, helping policyholders plan payments on time and avoid lapses.

Q5. Is the customer portal useful for long-term policyholders?

Yes, it is especially beneficial for long-term policyholders as it maintains historical records and supports better long-term planning.

Conclusion

The LIC Customer Portal after login is more than just a digital convenience—it is a practical tool that empowers policyholders with information, transparency, and control. By offering centralized access, secure data handling, and real-time policy insights, the portal simplifies insurance management and supports long-term financial discipline.

In the broader picture, tools like the customer portal align well with the concept of square insurance, where all aspects of policy management are brought together in a balanced, transparent, and accessible manner. When policyholders have clarity on all sides—payments, status, and records—they are better equipped to manage their insurance confidently and responsibly.