The rising popularity of the cryptocurrency market has created a huge demand for secure, scalable, and compliant trading platforms. From startups to financial institutions, a majority of firms are looking at the development of a cryptocurrency exchange as an opportunity. Developing a successful cryptocurrency exchange is a difficult process that comes along with a number of challenges. Knowledge about these challenges and the way they can be overcome plays an important role in achieving success.

1. Security Threats and Asset Protection

The Challenge:

Crypto exchanges are increasingly targeted by cyberattacks due to the large value of cryptocurrencies they handle. The major risks to such exchanges include hacking of wallets, phishing scams, DDoS attacks, internal threats, and vulnerabilities to smart contracts. A single mistake can cause huge losses.

How to Overcome It:

Security should be integral to all stages of development. These include the establishment of a multi-layered security infrastructure, separation of cold and hot wallets, multi-signature verification, encryption of sensitive information, and performing security audits.

2. Regulatory Compliance and Legal Uncertainty

The Challenge:

Regulations regarding the usage of cryptocurrencies differ from country to country and from time to time. Exchanges have to be compliant with KYC, AML, data protection laws, and regional finance laws.

How to Overcome It:

A compliance-oriented approach to development is the key. The inclusion of automated KYC/AML solutions, a transparent reporting mechanism, and familiarity with local laws can assist exchanges in being operational in a legitimate manner. Support from lawyers and a region-specific compliance structure can also mitigate regional risks to a great extent.

3. Scalability and Performance Issues

The Challenge:

The cryptocurrency exchanges also face scalability issues with high volumes of trades being executed, along with traffic bursts during times when the market is volatile. If scalability fails, the result could be system crashes and unhappy consumers.

How to Overcome It:

Developing a scalable architecture with microservices, Cloud infrastructure, and load balancing enables efficient performance at any level of trading volume. Optimization of the matching engine, database performance, and handling of API calls represents a prerequisite to enable stress-free trading.

4. Liquidity Management

The Challenge:

Liquidity is an important consideration for any cryptocurrency exchange. When liquidity is not sufficient, slippage, trading experience, and trust among users are affected, which is especially important while starting a new service.

How to Overcome It:

Exchanges can enhance the liquidity level of their system by integrating liquidity providers, market makers, and external trade APIs. There should be partnerships with other exchanges with low transaction fees and reward systems to attract more traders to the platform.

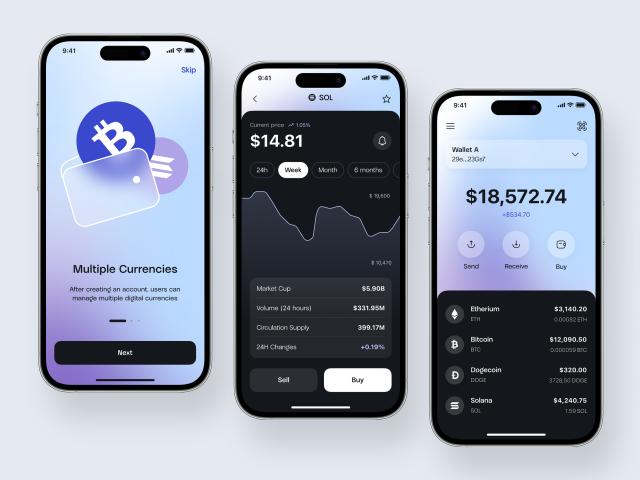

5. User Experience and Interface Complexity

The Challenge:

Crypto exchanges may find it challenging to implement sophisticated trading options along with a simplistic experience. This is because a hard-to-use interface can cause new users to lose interest in an exchange.

How to Overcome It:

It is important to invest in user-friendly UI/UX design. Better navigation, easy onboarding, responsive dashboards, and personalized trading interfaces are very important for user interaction. The provision of basic trading and advanced trading features helps the exchanges to serve beginners as well as experts.

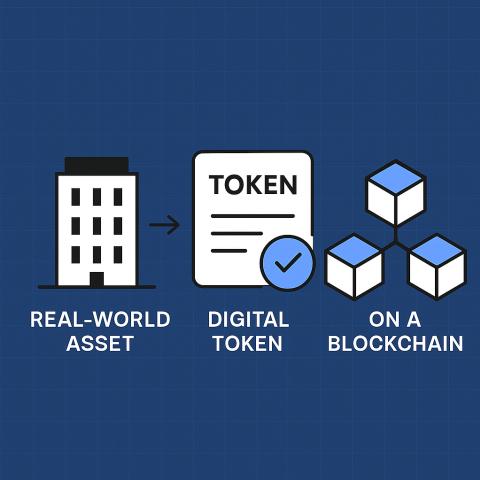

6. Integration with Payment Systems

The Challenge:

Handling fiat-to-crypto and crypto-to-fiat payments requires smooth interfacing with payment processors and banks. Failure to pay, delay in payments, and regulatory problems can affect trust.

How to Overcome It:

Integration with trusted payment facilitators and the use of various payment methods can limit dependence on a single payment channel. This can be achieved through secure API integration, monitoring, and ensuring compliance.

7. Ongoing Maintenance and Platform Upgrades

The Challenge:

The creation of an exchange alone will not suffice. Things will have to keep moving with updates and improvements. Markets change rapidly, and the exchange needs to compete.

How to Overcome It:

By embracing agile development methodology, updates and upgrades can be done at a faster pace. System audits, feedback from users, and regular upgrades to infrastructure ensure a safe, optimized, and market-demand-driven platform.

Conclusion

Developing a cryptocurrency exchange can boast great potential; it is equally overwhelming, considering the security risks, regulatory challenges, scalability demands, and user expectations associated with the process. However, if supported by the right technology stack, compliance strategy, and development expertise, the challenges shall be overcome easily.

Businesses that invest in secure architecture, scalable systems, and user-centric design are better positioned to launch successful and sustainable exchanges. Partnering with an experienced cryptocurrency exchange development company like Softean can help organizations navigate these challenges and accelerate their journey from concept to a fully operational trading platform.