Algorithmic trading has evolved rapidly over the past decade, and the rise of cryptocurrencies has accelerated this transformation even further. Unlike traditional financial markets, crypto markets operate continuously, experience extreme volatility, and generate massive volumes of real-time data. In this environment, manual trading is no longer sufficient. Crypto trading bot development has emerged as a powerful force, reshaping how modern algorithmic trading systems are designed, deployed, and optimized.

The Shift From Traditional Algorithms to Crypto Automation

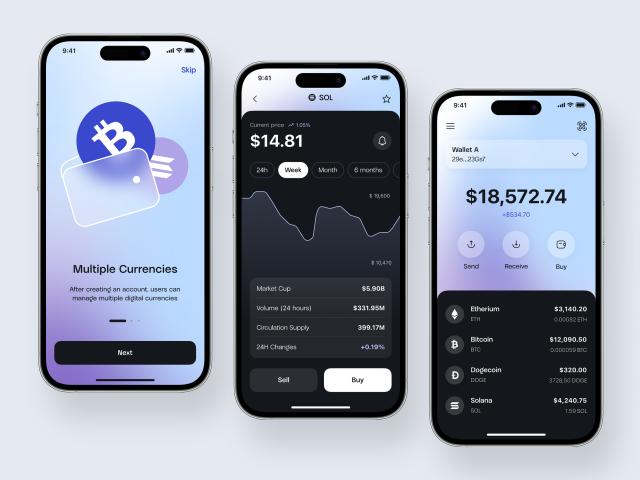

Traditional algorithmic trading was primarily limited to institutional players with access to sophisticated infrastructure and market data. Crypto trading bot development has democratized algorithmic trading by enabling startups, professional traders, and businesses to automate strategies across global markets. These bots execute predefined rules or adaptive algorithms with speed and consistency that manual traders cannot match.

Crypto markets also differ structurally from traditional exchanges. The absence of centralized trading hours and the presence of multiple exchanges with fragmented liquidity demand, continuous monitoring, and execution. Crypto trading bots address these challenges by operating 24/7 and reacting instantly to market conditions.

Advanced Strategy Implementation Through Automation

One of the most significant ways in which crypto trading bot development is transforming algorithmic trading is through advanced strategy execution. Bots can implement complex strategies such as arbitrage, market making, trend following, and mean reversion with precision. They continuously analyze price movements, order book depth, and volume patterns to identify opportunities in real time.

Custom bots allow traders to design proprietary strategies that are difficult to replicate. Unlike traditional algorithms that often rely on static rules, modern crypto trading bots can dynamically adjust parameters based on volatility, liquidity, and market sentiment. This adaptability plays a crucial role in sustaining performance over time.

Speed, Latency, and Real-Time Execution

Execution speed is a defining factor in modern algorithmic trading, and crypto trading bot development places strong emphasis on low-latency performance. Bots process real-time market data using WebSocket connections and execute trades within milliseconds. Faster execution reduces slippage, improves price accuracy, and increases profitability, particularly for high-frequency and arbitrage strategies.

Optimized infrastructure, efficient APIs, and proximity to exchange servers further enhance execution speed. These technical improvements give algorithmic traders a competitive edge in fast-moving crypto markets where timing is critical.

Data Driven Decision Making and AI Integration

Crypto trading bots generate and analyze vast amounts of data, enabling more informed decision-making. Historical price data, live market feeds, and performance metrics are continuously processed to refine strategies. Many modern bots incorporate machine learning and AI models to identify patterns, predict trends, and optimize entry and exit points.

AI-driven crypto trading bot development allows algorithms to learn from past trades and adapt to changing market conditions. This shift from static rule-based systems to data-driven intelligence is redefining the future of algorithmic trading.

Risk Management and Capital Protection

Effective risk management is a cornerstone of sustainable algorithmic trading. Crypto trading bots enforce discipline by executing predefined risk controls such as stop losses, position sizing rules, drawdown limits, and exposure caps. These mechanisms protect capital during periods of high volatility and emotional market behavior.

Automated risk management ensures consistency and eliminates human error, which is especially important in crypto markets where prices can change dramatically within seconds.

Scalability and Multi-Exchange Trading

Crypto trading bot development enables seamless scalability across multiple exchanges, assets, and strategies. Bots can monitor price discrepancies between exchanges, manage diversified portfolios, and execute trades simultaneously across markets. This level of scalability was previously accessible only to large institutions.

For businesses and fintech startups, trading bots also open opportunities for monetization through white-label solutions, subscription models, and algorithmic trading platforms.

The Future of Algorithmic Trading in Crypto

As blockchain technology, AI, and infrastructure continue to evolve, crypto trading bot development will play an increasingly central role in algorithmic trading. Greater automation, smarter algorithms, and improved execution capabilities will further narrow the gap between institutional and retail trading.

In conclusion, crypto trading bot development services are not just enhancing algorithmic trading but fundamentally transforming it. By combining speed, data-driven intelligence, advanced risk management, and scalability, trading bots are redefining how modern traders operate in the global crypto ecosystem.