Real estate has long been considered one of the most reliable asset classes, but it has traditionally been inaccessible to many investors due to high capital requirements, complex legal processes, and geographic limitations. Real estate tokenization, powered by blockchain technology, is changing this landscape by making property investment more inclusive, flexible, and global.

The following article will describe how, through Real Estate Tokenization, the entry barriers to investors will be lowered significantly.

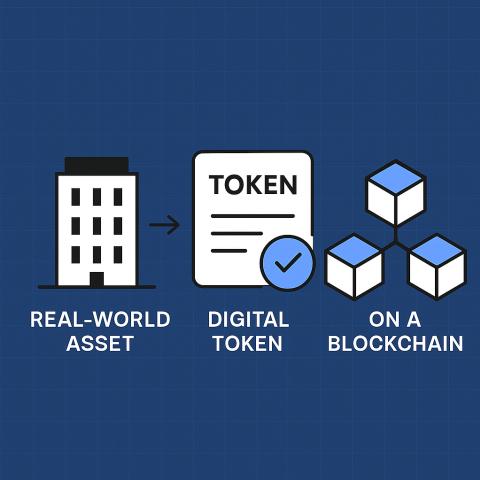

What is Real Estate Tokenization?

Real Estate Tokenization is the process by which ownership rights of a physical property are converted into digital tokens on a blockchain. Each token represents a fractional ownership interest in the property, which allows multiple investors to have partial ownership of a premium asset.

Real estate tokenization allows for easy and secure buying, selling, trading, etc., of real estate assets throughout the world via blockchain-based platforms, much like what is done with digital securities.

Lower Capital Requirements Through Fractional Ownership

The primary barrier to traditional real estate investing has always been the large amount of required upfront capital. Tokenization eliminates this obstacle by creating fractional ownership opportunities for investors.

Instead of having the means to purchase an entire property, an investor can now:

- Owns small fractionalized interests in a variety of real property assets.

- Invest significantly lower amounts of capital into a variety of real estate assets.

- Diversify their investment portfolios across multiple types of real estate assets.

This investment model provides retail investors access to the real estate investment market that previously had limited availability.

Global Access Without Geographic Restrictions

Real estate has traditionally required the investor to be physically present, use intermediaries in that specific geographical area, and comply with all local laws and regulations. With tokenized real estate, many of these challenges are no longer an issue.

When using blockchain technology:

- Investors can invest from anywhere in the world.

- Cross-border transactions are faster and easier.

- Transferring currencies internationally is simpler.

By having access to more potential investors around the world, the market for tokenized real estate will increase and have a larger number of participants.

Improved Liquidity Compared to Traditional Real Estate

Real estate is typically viewed as illiquid because it can take several months to complete a single transaction. However, through tokenized real estate, secondary markets offer increased liquidity, making it easier to trade tokens.

Some of the benefits of secondary markets:

- Faster access to funds.

- Less reliance on long-term investments.

- Greater flexibility for investors.

More liquid tokenized real estate reduces the risk associated with investing in traditional real estate and, therefore, increases the attractiveness of tokenized real estate to new investors.

Reduced Transaction Costs and Intermediaries

Investors traditionally incur many additional costs when buying and selling properties, including broker commissions, attorney fees, bank fees, escrow fees, etc. Using blockchain technology will eliminate or significantly reduce these costs.

Tokenized real estate:

- Automates the execution of smart contracts.

- Offers lower legal and administrative fees.

- Allows investors to settle transactions more quickly.

By reducing the costs of real estate investment, tokenization will open the door to smaller investors.

Transparent and Secure Ownership Records

Through Blockchain's ability to create an unchangeable and visible record of transactions and ownership,

The transparency,

- Create confidence in global investors,

- Decrease the number of disputes and fraud cases,

- Create easier auditing and compliance services for investors.

With safe ownership records, investors can have confidence when investing across borders.

Easier Portfolio Diversification

Tokenisation enables the investor to diversify their portfolio into,

- Different types of properties (residential, commercial, industrial, etc.),

- Different geographic regions,

- Different levels of risk,

Having smaller dollar amounts in the portfolio makes for less risk exposure and less overall risk on investment.

Automated Compliance and Investor Protection

Tokenization platforms of today use various compliance measures, such as:

- KYC and AML,

- Investor Eligibility Check,

- Jurisdictional Restrictions.

Automation helps create an easy onboarding process for global investors while ensuring compliance with regulations.

Faster Settlement and Ownership Transfer

Unlike conventional methods of purchasing real estate, blockchain technology enables quick settlement (title transfer) and property ownership.

Key benefits will include:

- Immediacy of ownership delivery (immediate transfer of title).

- Less documentation (fewer forms to fill out).

- Streamlining of processes to enhance company efficiency.

This speed makes real estate investing more dynamic and accessible.

Conclusion

Real estate tokenization services are transforming property investment by breaking down traditional barriers related to capital, geography, liquidity, and complexity. Through fractional ownership, global accessibility, reduced costs, and enhanced transparency, tokenization allows investors from around the world to participate in real estate markets that were once out of reach.

As blockchain adoption continues to grow, real estate tokenization is set to redefine global property investment, making it more inclusive, efficient, and investor-friendly