Preparing W-2 forms is one of the most important year-end payroll responsibilities for employers. Accurate W-2 reporting ensures employees receive correct wage and tax information and helps businesses remain compliant with IRS and Social Security Administration requirements. However, many employers face challenges when working with W 2 forms in QuickBooks, especially when using the desktop version.

Discover how to resolve common W-2 form issues in QuickBooks Desktop and ensure accurate year-end payroll reporting. Call +1-866-500-0076 for expert assistance.

Understanding W-2 Forms in QuickBooks

W-2 forms summarize an employee’s annual wages, taxes withheld, and other payroll-related details. QuickBooks automates much of this process, but errors can still occur due to incorrect payroll setup, outdated tax tables, or data entry issues.

Whether you are managing w-2 forms for QuickBooks Desktop or w-2 forms for QuickBooks Online, understanding how payroll data flows into W-2 forms is the first step toward resolving issues. If problems persist, QuickBooks payroll specialists can be reached at +1-866-500-0076 for expert assistance.

Issue 1: Incorrect Employee Information

One of the most common problems with W 2 forms in QuickBooks is incorrect employee details, such as names, Social Security numbers, or addresses. Even small discrepancies can cause filing rejections.

How to fix it:

Review employee profiles before generating W-2s

Correct errors directly in employee records

Recreate W-2 forms after updates

Ensuring accurate employee data early prevents delays later in the filing process.

Issue 2: Payroll Tax Setup Errors

Improper payroll tax configuration can lead to incorrect wage or tax amounts on W-2 forms. This issue affects both w-2 forms for QuickBooks Desktop and w-2 forms for QuickBooks Online.

How to fix it:

Verify payroll tax settings

Update tax tables before generating forms

Review payroll liability reports

If payroll tax discrepancies are difficult to resolve, contacting support at +1-866-500-0076 can save time and reduce compliance risks.

Issue 3: Problems with W-2 Forms in QuickBooks Login

Some users encounter access issues during w 2 forms in quickbooks login, especially during peak tax season. Login errors or permission restrictions can delay form preparation.

How to fix it:

Confirm user permissions for payroll access

Ensure QuickBooks is updated to the latest version

Verify company file integrity

Having proper access ensures smooth navigation through W-2 preparation workflows.

Issue 4: Difficulty Downloading W-2 Forms

Another common concern is w 2 forms in quickbooks download issues. This may occur due to incomplete payroll setup or outdated software versions.

How to fix it:

Run payroll verification checks

Install the latest QuickBooks updates

Confirm payroll subscription status

Once resolved, downloading W-2 forms becomes a straightforward process.

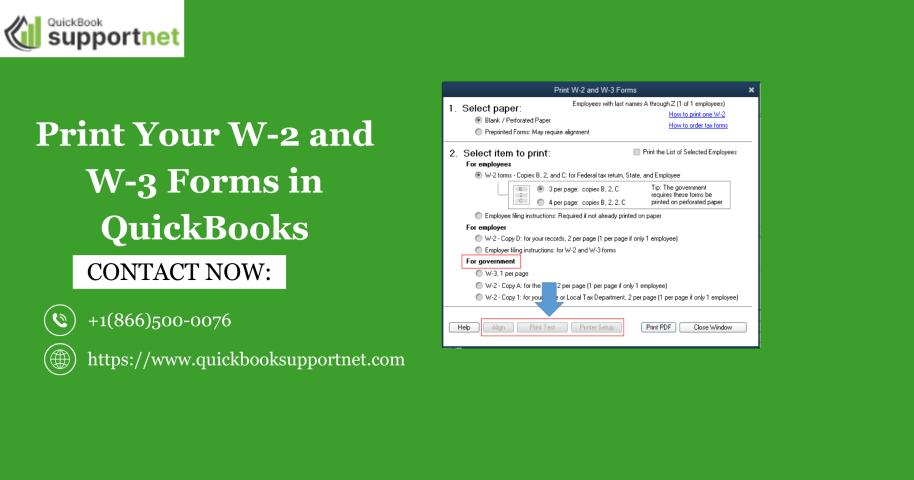

Issue 5: Errors When Printing W-2 and W-3 Forms

Many employers struggle when they attempt to print W 2 and W 3 forms in QuickBooks. Formatting problems, alignment issues, or missing data are common.

How to fix it:

Use approved W-2 and W-3 forms

Adjust printer alignment settings

Preview forms before printing

For complex printing issues, QuickBooks professionals at +1-866-500-0076 can provide step-by-step guidance.

Issue 6: Mismatch Between Payroll Reports and W-2 Forms

Discrepancies between payroll reports and W 2 forms in QuickBooks can cause confusion and compliance concerns.

How to fix it:

Reconcile payroll summary reports with W-2 totals

Check for manual journal entries affecting payroll accounts

Review year-end adjustment entries

Consistency between reports ensures accurate filings and fewer IRS notices.

Read Also: QuickBooks Requires That You Reboot Loop

Desktop vs. Online W-2 Form Considerations

While this article focuses on desktop users, it is important to understand differences between w-2 forms for QuickBooks Desktop and w-2 forms for QuickBooks Online. Desktop users must manually update software and tax tables, while online users benefit from automatic updates.

Regardless of the platform, reviewing payroll data regularly reduces year-end stress and errors.

Best Practices to Avoid W-2 Issues

To minimize problems with W 2 forms in QuickBooks, follow these best practices:

Update QuickBooks and payroll tax tables regularly

Review employee and payroll data quarterly

Verify reports before generating W-2s

Back up company files before year-end processing

If uncertainty arises at any stage, QuickBooks payroll support at +1-866-500-0076 can help ensure compliance.

Final Thoughts

Handling W-2 forms does not have to be overwhelming. By understanding common issues and knowing how to fix them, businesses can manage W 2 forms in QuickBooks with confidence. With accurate payroll setup, regular reviews, and expert assistance when needed at +1-866-500-0076, businesses can ensure smooth year-end reporting and maintain full payroll compliance.

Read More: How to Create and Manage a Journal Entry in QuickBooks Online