Buying car insurance online has

become the preferred choice for many vehicle owners due to convenience,

transparency, and easy comparison. Instead of relying on intermediaries or

paperwork-heavy processes, digital platforms allow you to evaluate policies, customize

coverage, and complete the purchase in minutes.

This step-by-step guide explains how

to buy car insurance online with clarity, helping you choose the right

coverage, avoid common mistakes, and secure long-term financial protection.

Step

1: Understand the Importance of Car Insurance

Car insurance is designed to protect

you financially against unexpected events such as accidents, theft, natural

disasters, or third-party liabilities. In most regions, at least basic coverage

is legally required, but adequate insurance goes beyond compliance—it

safeguards your savings and provides peace of mind.

Before purchasing online, it’s

essential to understand that the right policy balances affordability with

meaningful coverage.

Step

2: Know the Types of Car Insurance Available

Understanding the types of car

insurance helps you select a policy aligned with your needs.

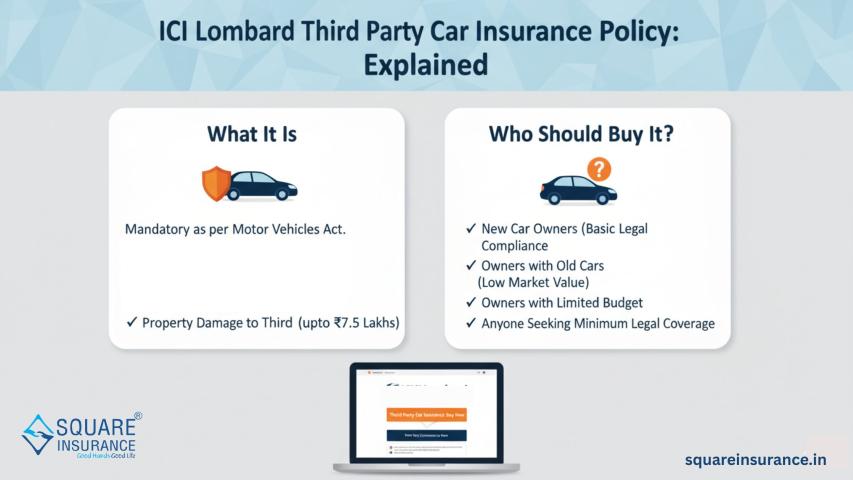

Common

Car Insurance Options

- Third-Party Liability Insurance: Covers damages or injuries caused to another person or

their property. It does not cover your own vehicle.

- Comprehensive Car Insurance: Offers wider protection by covering third-party

liabilities as well as damage to your own car due to accidents, theft,

fire, or natural calamities.

- Own Damage Cover:

Covers damages to your car but excludes third-party liabilities.

For most car owners, comprehensive

insurance offers balanced and reliable protection.

Step

3: Evaluate Your Coverage Requirements

Every driver’s insurance needs are

different. Before buying a policy online, consider:

- The age and value of your car

- How often and where you drive

- Road and traffic conditions in your area

- Your past claim history

A clear understanding of your usage

helps prevent over-insurance or insufficient coverage.

Step

4: Compare Car Insurance Policies Online

One of the biggest advantages of

online insurance platforms is easy comparison. While comparing policies, don’t

focus only on the premium.

Key

Factors to Compare

- Coverage benefits

- Policy exclusions

- Deductibles

- Claim settlement process

- Customer service accessibility

A slightly higher premium may

provide significantly better coverage and fewer claim-related issues.

Step

5: Select Add-Ons That Add Real Value

Add-ons enhance your policy by

covering specific risks not included in standard plans.

Popular

Car Insurance Add-Ons

- Zero Depreciation Cover

- Engine Protection Cover

- Roadside Assistance

- Return to Invoice Cover

Choose add-ons based on your driving

conditions and vehicle usage rather than opting for every available option.

Step

6: Review Policy Terms and Exclusions Carefully

Policy wording is often overlooked,

but it plays a crucial role during claims. Before purchasing online, review:

- Situations where claims may be rejected

- Claim reporting timelines

- Conditions related to driver eligibility

Clear understanding of exclusions

prevents confusion during emergencies.

Step

7: Enter Accurate Information

While buying car insurance online,

ensure all details entered are correct, including:

- Vehicle registration number

- Manufacturing year

- Fuel type

- Previous claim history

Incorrect information may lead to

claim rejection or policy cancellation.

Step

8: Complete the Online Payment Securely

Most insurers and insurance

platforms provide secure digital payment options. After payment, ensure you

receive:

- Policy confirmation

- Policy document (digital copy)

- Customer support details

Store the policy document safely for

future reference.

Step

9: Understand the Claims Process

Knowing how to file a claim before

you need it is essential. Check:

- Whether cashless garages are available

- Steps to notify the insurer

- Required documentation

A simple and transparent claims

process adds real value to your insurance policy.

Step

10: Review and Renew Your Policy on Time

Car insurance should be reviewed

annually to ensure it still meets your needs. Timely renewal helps maintain

continuous coverage and retain benefits such as no-claim bonuses.

Conclusion

Buying car insurance online offers

convenience and control, but making the right choice requires informed

decision-making. By understanding coverage options, comparing policies

carefully, and selecting add-ons wisely, you can secure reliable protection

without unnecessary costs.

Square Insurance helps simplify this process by offering clear comparisons,

transparent policy details, and a user-friendly experience that supports

confident insurance decisions.

Frequently

Asked Questions

1. Is it better to buy car insurance

online or offline?

Buying car insurance online allows easier comparison, faster policy issuance,

and better transparency compared to offline methods.

2. Can I switch my insurer when

buying car insurance online?

Yes, you can switch insurers online during renewal while retaining benefits

like the no-claim bonus.

3. How long does it take to buy car

insurance online?

The process typically takes only a few minutes once you have your vehicle

details ready.

4. Are online car insurance policies

legally valid?

Yes, online-issued car insurance policies are legally valid and recognized by

authorities.

5. What happens if I make a mistake

while entering details online?

Minor errors can usually be corrected by contacting customer support, but major

inaccuracies may affect claim eligibility.