Some people shy away from

buying car insurance online. There might be numerous reasons for opting the

traditional method for getting a car insured. One might have placed their

trust in a traditional insurer that offers offline policies. Another reason

could be that a person is not comfortable with the idea of buying a product

online.

Making a purchase online

has become very simple and buy car insurance online is no more a big deal.

Take a look at the following advantages if you are skeptical about buying your

car insurance policy online.

Benefits

of buying car insurance online:

1. Multiple policies can

be compared:

Traditionally

buying car insurance required a lot of effort for the potential policyholder.

Getting in touch with the insurance company or an insurance agent via calls or

personal visits is the first step. Next, one has to either buy the policy on

offer or repeat step one with another insurance company or agent. In this

situation, comparing various policies for their features, car insurance quotes,

and services provided by the insurer becomes a tedious process. However, buying

car insurance online eliminates manual comparison. Simply visit any insurance

aggregator’s website and use the free comparison tool to get the best car

insurance policy. Remember that comparison is the key to find the most suitable

policy available in the market.

2. You get

the best deal:

In today’s competitive market, various car insurance policies with similar features and

services are available for different car insurance quotes. When you compare car

insurance online, you can compare the cost of each insurance policy and then

decide which one you wish to buy. The only thing to note here is that one

should consciously compare similar types of policies.

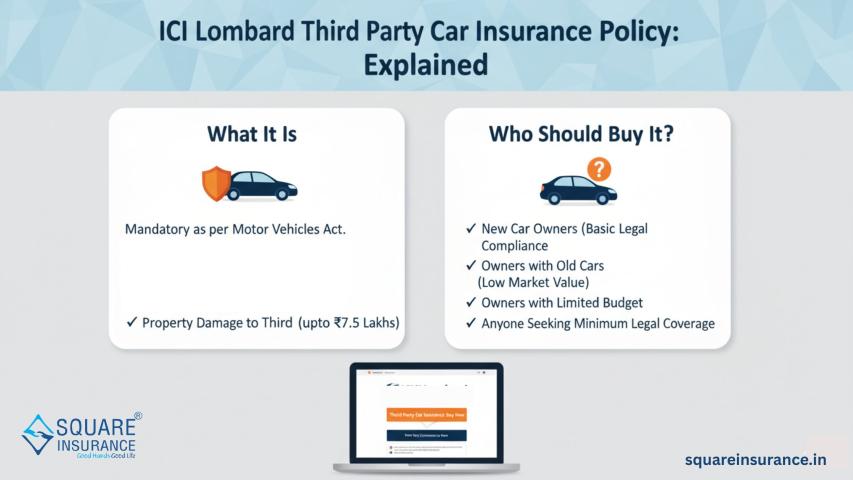

For

example, comparing a Third-party liability policy with a Comprehensive policy

will not be fruitful. One should compare the same type of policies offered by

different companies to find the one with a lower quote.

3. Minimum to nil

paperwork required:

When

you set out to buy a car insurance policy online, you are asked basic questions

about you and your car. Based on these questions, you can select the coverage

you wish to buy for your car. If you have been renewing your policy in time or

if you are about to buy a new policy, you can get your car insurance without

any paperwork. That is you will require zero paperwork to buy a car insurance

policy.

In

some cases like when there is a break in policy or case of a claim, you may be

asked to get an inspection done. This might require you to submit documents

like personal identification, previous car insurance policy, etc. The paperwork

you submit will be less as compared to buying a car insurance policy offline.

4. Instant policies:

Buying

car insurance via the traditional method requires time. You have to start

looking for an ideal policy much in advance say a couple of months before the

actual expiry date. This is because you first need to look for a suitable car

insurance plan, compare it manually to other plans available in the market,

complete the required documentation like your ID proofs, car insurance application,

etc. After your application is accepted a policy will be generated and a hard

copy will be sent to you via post.

On

the other hand, buying a policy online will give access to instant policies. As

mentioned earlier, you just have to answer some simple questions and if things

are in place you will receive your car insurance policy instantly.

5. Checking the credibility of the insurer is easy:

Social

media has its set of pros and cons. One of the benefits is that people can

leave genuine reviews on the services they avail. When buying car insurance,

you must buy your policy from a credible insurance company. This will ensure a

smooth process at the time of claims. If you accidentally choose an insurer

that has high turnaround time or does not offer seamless services, you will end

up dissatisfied in spite of making proper payments for getting your car

insured.

Make

it a point to go through various social media handles of your preferred car

insurance policy before making a payment. You can decide if you wish to buy the

policy or not based on the reviews and user testimonials.

7. Genuine policies:

Contrary

to popular belief, buying car insurance online provides completely genuine

policies, provided you buy them from credible insurance companies. These

policies are fully legal and are accepted by any authorized person. Insurers need

to get their products approved before selling them to potential

policyholders. The process of getting these products/policies approved

from the Insurance Regulatory and Development Authority of India (IRDAI) is

similar for both types of policies – online and offline.

8. Does not require expertise of an agent:

The

need of buying car insurance from an agent arises when you have no knowledge

about the plans, the jargons used and what is the best match for your needs.

However, while buying a policy online you have the whole web of information to

your disposal. You can simply use any search engine to understand the meaning

of any phrase mentioned on the insurer’s website all by yourself. Thus

eliminating the need for an agent.

Nowadays,

insurance companies also take efforts to explain the meaning of jargon they

use. You will most likely not require any special knowledge while buying car

insurance online. If you still need clarification, you can always get in touch

with your insurer get your queries solved.

Always

make it a point to buy your policy at least one week before the expiry date of

the previous policy. Read the terms and conditions before buying your car

insurance policy.

Conclusion

When you make an informed

choice and compare options effectively, you enhance your protection and reduce

the risk of unpleasant surprises during a claim. Square Insurance offers tools

and insights that help you compare, evaluate, and select the right car

insurance policy online with clarity and confidence — making the transition

from a traditional purchase method to a digital one both practical and

rewarding.

Frequently

Asked Questions

1. Is it safe to buy car insurance

online?

Yes. Buying car insurance online is safe as long as you purchase directly from

a credible insurer’s website or a recognised platform. Online policies are

legally valid and regulated by authorities. Online transactions use secure

payment gateways and data encryption, ensuring personal and financial

information is protected.

2. What are the main advantages of

buying car insurance online compared to offline?

Buying car insurance online offers several advantages: you can compare multiple

policies easily, often get better pricing due to no middleman, experience

minimal paperwork, receive instant policy documents, and access digital tools

that make comparison and purchase faster and more transparent.

3. Do I need an insurance agent to

buy a car insurance policy online?

No. When buying car insurance online, you don’t need an agent’s assistance. The

online process is designed for self‑service—policy details, premium quotes, and

coverage options are presented clearly so you can make an informed decision on

your own.

4. Can I compare different car insurance

policies online before buying?

Yes. One of the biggest benefits of purchasing car insurance online is the

ability to compare different policies side by side using online tools and

aggregators. This helps you evaluate features, coverage, and premiums quickly

to find a suitable policy.

5. Are online car insurance policies

legal and accepted by authorities?

Absolutely. Car insurance plans bought online are legally valid and accepted

for all official purposes, including renewal and regulatory checks, provided

they are purchased from authorised insurers. The same approval and regulatory

standards apply to online and offline policies.