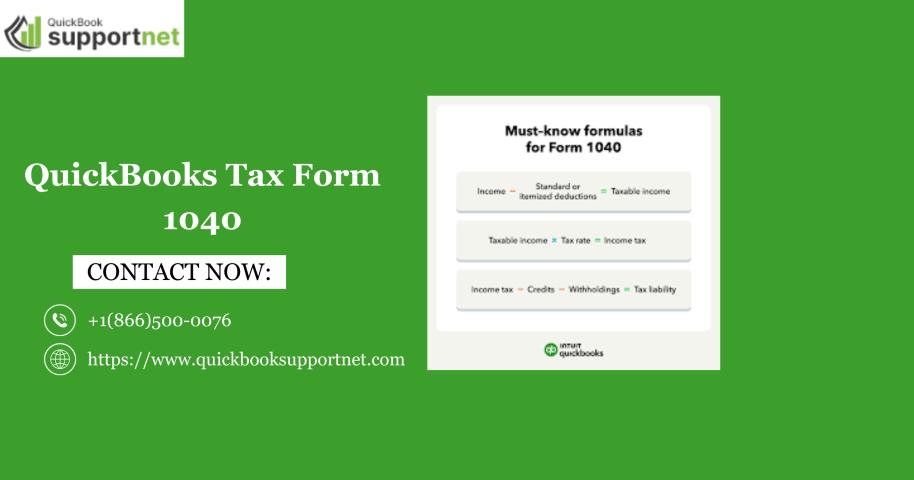

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers, and small business owners now rely on accounting software to simplify tax season. QuickBooks Tax Form 1040 is one such solution that helps users organize income, deductions, and tax details efficiently without unnecessary stress.

QuickBooks Tax Form 1040 tutorial for fast, accurate tax filing. Avoid errors, save time, and get expert help at +1-866-500-0076.

What Is Tax Form 1040?

Tax Form 1040 is the standard IRS form used by U.S. taxpayers to file their annual income tax returns. It reports:

Total income

Adjustments to income

Tax credits

Deductions

Taxes owed or refunds due

Almost every individual taxpayer is required to file some version of Form 1040. Accuracy is critical because even small mistakes can trigger delays, penalties, or IRS notices.

How QuickBooks Helps with Tax Form 1040 Filing

QuickBooks is widely known for bookkeeping, but it also plays a powerful role during tax season. By organizing financial data throughout the year, QuickBooks makes it easier to prepare information required for Form 1040.

Key benefits include:

Automatic income tracking

Categorized expenses

Year-end financial reports

Easy export of tax-ready data

When tax time arrives, all your financial details are already organized, reducing last-minute panic and guesswork.

Getting Started with QuickBooks for Form 1040

Before preparing your tax return, ensure your QuickBooks file is accurate and complete.

Step 1: Review Your Financial Data

Check that all income and expenses are properly categorized. Look for uncategorized transactions and assign them correctly.

Step 2: Reconcile Bank and Credit Card Accounts

Reconciliation ensures that your QuickBooks balances match your bank statements. This step is essential for accurate tax reporting.

Step 3: Verify Personal and Business Details

Confirm your name, address, Social Security Number, and filing status are correct. Any mismatch can cause IRS rejections.

If you encounter technical issues during setup or data review, QuickBooks experts are available at +1-866-500-0076 to help resolve them quickly.

Preparing Income for Tax Form 1040

QuickBooks automatically tracks income from various sources, including:

Self-employment income

Freelance projects

Side businesses

Interest and other earnings

Use reports such as Profit and Loss or Income Summary to verify totals. These figures feed directly into your Form 1040, ensuring accuracy.

Managing Deductions and Expenses

One of the biggest advantages of QuickBooks is expense tracking. Properly categorized expenses can significantly reduce your tax liability.

Common deductible categories include:

Office supplies

Home office expenses

Travel and meals

Utilities and internet

Professional services

Accurate expense tracking ensures you don’t miss deductions while staying compliant with IRS rules.

Exporting Data for Tax Filing

QuickBooks allows you to export financial reports that can be shared with your tax preparer or imported into tax filing software. This reduces manual data entry and minimizes errors.

If you experience file-related issues while exporting data, such as company file access errors, you may encounter problems like quickbooks error code 6000 77.

Addressing these errors early helps keep your tax filing on schedule.

For immediate assistance, QuickBooks professionals are reachable at +1-866-500-0076.

Common Mistakes to Avoid When Filing Form 1040

Even with QuickBooks, mistakes can happen if you’re not careful. Avoid these common errors:

Using incorrect filing status

Forgetting additional income sources

Misclassifying personal vs business expenses

Skipping deductions due to poor record-keeping

Filing without reviewing reports

Taking time to review your QuickBooks data before submission can prevent costly mistakes.

Why Accuracy Matters in Tax Filing

Accurate filing protects you from IRS audits, penalties, and delayed refunds. QuickBooks improves accuracy by maintaining organized financial records year-round rather than scrambling during tax season.

If you’re unsure about calculations or form mapping, getting expert guidance at +1-866-500-0076 can provide peace of mind and ensure compliance.

Speed Up Your Tax Filing with Smart Practices

Here are a few tips to file faster using QuickBooks:

Update transactions weekly

Reconcile accounts monthly

Use consistent expense categories

Run tax reports early

Review data before filing

These practices reduce last-minute work and help you file your Form 1040 quickly and confidently.

Who Should Use QuickBooks for Tax Form 1040?

QuickBooks is ideal for:

Freelancers and independent contractors

Self-employed professionals

Small business owners

Gig workers

Individuals with multiple income streams

If you track income digitally, QuickBooks simplifies tax preparation significantly.

Final Thoughts

Filing taxes doesn’t have to be stressful or time-consuming. With organized financial data and the right approach, QuickBooks Tax Form 1040 filing becomes accurate, efficient, and manageable. By maintaining clean records, reviewing reports, and addressing errors early, you can file confidently and avoid unnecessary issues. If you need immediate help, experienced professionals are also available at +1-866-500-0076 to support you through every step of the process.

Read Also: QuickBooks Payroll Calculator 2026 | Accurate Payroll & Tax Estimates