Buying car insurance is more than a legal requirement—it’s a financial

safety net that protects you, your vehicle, and your assets against unforeseen

events. With the insurance industry evolving rapidly in 2026, vehicle owners

have more choices than ever before. From comprehensive coverage to personalized

add-ons, finding the ideal car insurance plan

requires research, strategy, and awareness.

This guide walks you through the essential

considerations and expert tips to help you select a car insurance plan that

meets your needs while maximizing value.

1. Assess Your Coverage Needs

The first step in choosing the ideal car

insurance plan is to understand your specific requirements:

·

Vehicle Type

and Value: Luxury cars, electric vehicles, and high-mileage vehicles

often require higher coverage limits and specialized add-ons.

·

Usage:

Personal use vs commercial use can significantly affect policy terms and

premiums.

·

Driver

Profile: Age, driving experience, and accident history play a role in

determining risk and cost.

By evaluating your needs carefully, you can

avoid paying for unnecessary coverage or being underinsured.

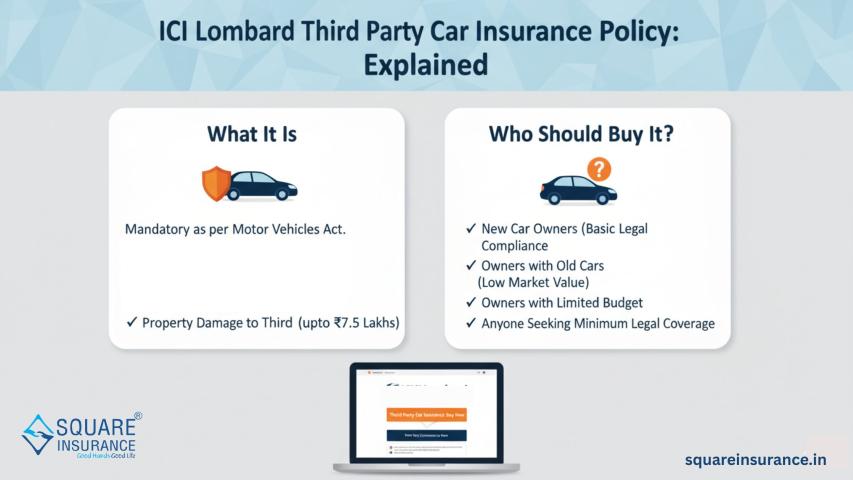

2. Choose the Right Policy Type

Car insurance generally comes in two forms:

·

Third-Party

Liability Insurance: Covers damages or injuries to other people and

their property. Mandatory under Indian law.

·

Comprehensive

Insurance: Covers third-party liabilities as well as damages to your

own vehicle due to accidents, natural disasters, fire, or theft.

For most vehicle owners, comprehensive insurance is recommended, especially for

newer or higher-value cars, as it offers broader protection.

3. Compare Premiums Across Insurers

Not all car insurance policies are created

equal. Premiums can vary significantly between providers for the same coverage.

Consider:

·

Comparing quotes online for multiple insurers.

·

Checking hidden costs, such as deductibles or

processing fees.

·

Looking at premium variations based on add-ons

and discounts.

Comparison ensures you find a policy that

balances cost with coverage effectively.

4. Evaluate Add-Ons for Maximum Protection

Modern car insurance plans allow customization

through add-ons. Some key

options to consider in 2026 include:

·

Zero

Depreciation Cover: Ensures full claim payout without depreciation

deductions.

·

Roadside

Assistance: Useful during breakdowns, flat tires, or towing

emergencies.

·

Engine

& Gearbox Protection: Covers mechanical failures beyond standard

insurance.

·

Natural

Calamity Cover: Protection against floods, storms, or earthquakes.

·

Return to

Invoice Cover: Ensures full vehicle value reimbursement in total loss

cases.

Selecting the right add-ons ensures your plan

is comprehensive and cost-effective.

5. Review the Insurer’s Claim Settlement

Record

A strong claim settlement ratio is a critical factor when

choosing a car insurance provider. Insurers with higher ratios:

·

Process claims efficiently and transparently.

·

Reduce the risk of claim denial or delays.

·

Provide peace of mind in emergencies.

In 2026, many insurers also provide digital claim processing, which speeds up verification

and approval, making the process more reliable.

6. Consider the No-Claim Bonus (NCB)

The No-Claim Bonus (NCB)

is a reward for claim-free years that offers discounts on future premiums. Key

points to note:

·

NCB increases each claim-free year, often up to

50% in some insurers.

·

Transferring your NCB to a new insurer is

usually possible.

·

Filing minor claims may reduce or eliminate your

NCB.

Maximizing your NCB can significantly reduce

long-term insurance costs.

7. Check Policy Terms and Exclusions

It’s essential to read the fine print before

buying a car insurance plan. Pay attention to:

·

Exclusions:

Circumstances where the insurer won’t pay, such as wear and tear or certain

natural disasters.

·

Deductibles:

The amount you pay before the insurer covers the remaining cost.

·

Coverage

Limits: Maximum payout for specific incidents.

Understanding these terms prevents surprises

during claims and ensures your coverage is truly comprehensive.

8. Opt for Online Purchase

Buying insurance online in 2026 has multiple

advantages:

·

Convenience:

Purchase or renew policies anytime using a smartphone or computer.

·

Instant Policy

Issuance: Get e-policy immediately after payment.

·

Discounts:

Many insurers offer online-exclusive discounts.

·

Easy

Document Submission: Upload registration and identity proofs

digitally.

Online platforms make the entire process

faster, transparent, and more efficient.

9. Reassess Your Coverage Regularly

An ideal car insurance plan isn’t static. Life

events, vehicle upgrades, and changing regulations may necessitate updates:

·

Vehicle

Upgrades: Increase coverage for new features or modifications.

·

Change in

Vehicle Usage: Personal to commercial or ride-sharing adjustments may

require policy changes.

·

Regulatory

Updates: Ensure compliance with legal requirements, such as safety

norms or environmental regulations.

Regular review ensures your coverage stays

relevant and cost-effective.

10. Seek Expert Advice When Needed

While online tools are convenient,

professional guidance can help:

·

Tailored

Recommendations: Experts suggest policies based on your vehicle type,

usage, and budget.

·

Documentation

Support: Ensures correct submission and verification.

·

Claim

Assistance: Helps navigate disputes or complex claim procedures.

Expert advice can simplify decision-making,

particularly for new vehicle owners or those upgrading their coverage.

Conclusion

Buying the ideal

car insurance plan in 2026 involves careful research,

understanding your needs, and evaluating multiple options. From selecting the

right coverage and add-ons to leveraging online tools and checking claim

records, every step contributes to securing a policy that protects both your

vehicle and finances. For reliable, customized, and hassle-free car insurance

solutions, Square Insurance offers expert guidance and convenient digital options, making it easier than

ever to choose the plan that fits your needs perfectly.

Frequently Asked Questions

1. What

type of car insurance is ideal for a new car?

Comprehensive insurance is generally recommended for new cars as it covers both

third-party liabilities and damages to your own vehicle.

2. Can I

customize my car insurance plan?

Yes, most insurers offer add-ons like zero depreciation, roadside assistance,

and natural calamity cover to enhance protection.

3. How

important is the claim settlement ratio?

A high claim settlement ratio indicates the insurer’s reliability in processing

claims efficiently and fairly.

4. What

is a No-Claim Bonus (NCB)?

NCB is a reward for claim-free years, offering discounts on renewal premiums.

Maximizing NCB reduces long-term insurance costs.

5. Is

buying car insurance online safe?

Yes, online purchases are secure, provide instant policy issuance, and often

come with exclusive discounts.

6.

Should I review my car insurance plan regularly?

Yes, periodic reviews ensure your coverage matches your vehicle’s value, usage,

and legal requirements.