Car insurance is a financial safeguard that protects you from unexpected expenses caused by accidents, theft, or damage. However, rising premiums often make car owners feel that quality coverage is out of reach when they buy car insurance. The good news is that affordable car insurance is possible when you understand how insurers calculate premiums and how small changes can lead to meaningful savings.

This article explores nine simple and effective ways to reduce your car insurance cost while maintaining the right level of protection when you buy car insurance.

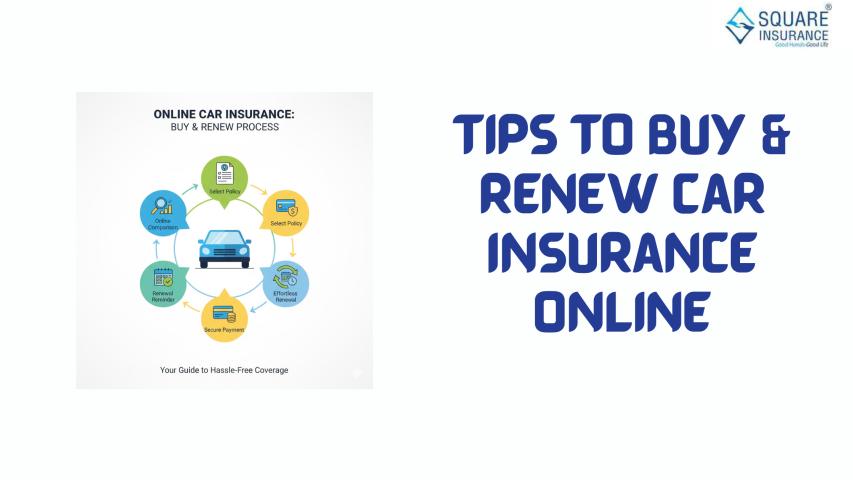

1. Compare Car Insurance Policies Before Buying

or Renewing

One of the most effective ways to find

affordable car insurance is to compare multiple policies before making a

decision. Insurance providers follow different pricing models, which means the

same coverage can cost more or less depending on the insurer.

Comparing policies helps you:

·

Identify cost-effective plans

·

Find better coverage at similar prices

·

Avoid paying for unnecessary features

Making comparisons before renewal ensures you

don’t overpay year after year.

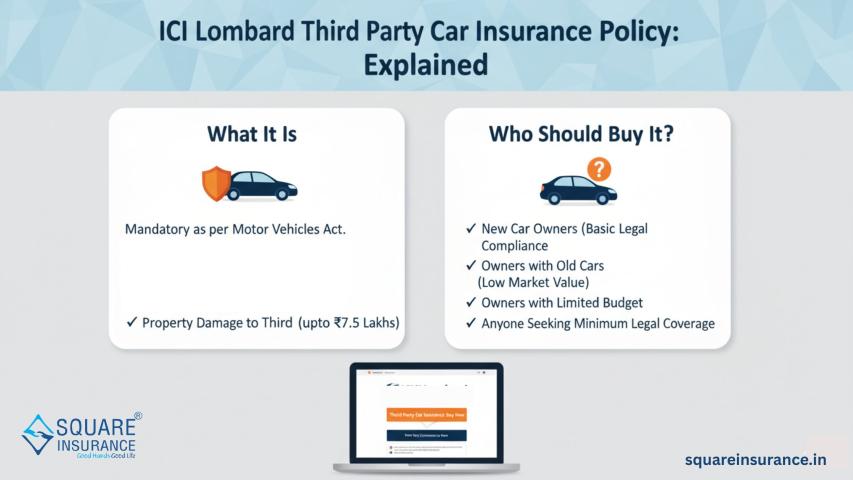

2. Select Coverage That Matches Your Actual

Needs

Choosing the most expensive policy does not

always mean better protection. Over-insuring your vehicle can significantly

increase your premium without adding real value.

For example:

·

Older vehicles may not need extensive add-ons

·

Low-usage cars may not require premium-level

coverage

Selecting coverage based on your car’s value

and usage helps keep insurance affordable.

3. Opt for a Higher Voluntary Deductible

A voluntary deductible is the amount you agree

to pay out of pocket during a claim. Increasing this amount reduces the

insurer’s liability, which lowers your premium.

This option works best if:

·

You are a careful driver

·

You rarely file claims

·

You can manage the deductible if required

It’s a practical way to reduce costs without

compromising coverage.

4. Maintain a Clean Driving Record

Insurance companies reward responsible

drivers. A clean driving history reflects lower risk, which often results in

reduced premiums.

Avoiding traffic violations and accidents:

·

Helps maintain lower insurance costs

·

Prevents penalty charges

·

Improves long-term affordability

Safe driving is one of the most reliable ways

to control insurance expenses.

5. Preserve Your No Claim Bonus (NCB)

No Claim Bonus is a discount offered for every

claim-free year. Over time, it can significantly reduce your premium.

Key benefits include:

·

Progressive discounts each year

·

Lower renewal costs

·

Transferability between insurers

Avoiding small or unnecessary claims helps

retain this valuable benefit.

6. Avoid Add-Ons That Are Not Relevant

Add-ons enhance coverage, but they also

increase the premium. Not every add-on is essential for every vehicle.

You may not need:

·

Zero depreciation for older cars

·

Engine protection for low-risk usage

·

Certain optional services rarely used

Review add-ons carefully and keep only those

that provide real value.

7. Choose Annual Premium Payment

Paying your car insurance premium annually is

often more economical than monthly or installment options, which may include

additional charges.

Benefits of annual payment:

·

Lower total premium

·

Fewer administrative fees

·

Easier policy management

If possible, annual payment is a cost-saving

choice.

8. Keep Your Details Updated and Accurate

Incorrect information can lead to higher

premiums. Always ensure your personal and vehicle details are accurate.

Check that:

·

Vehicle usage is correctly declared

·

Address and city details are up to date

·

Modifications are properly disclosed

Accurate information helps insurers price your

policy correctly.

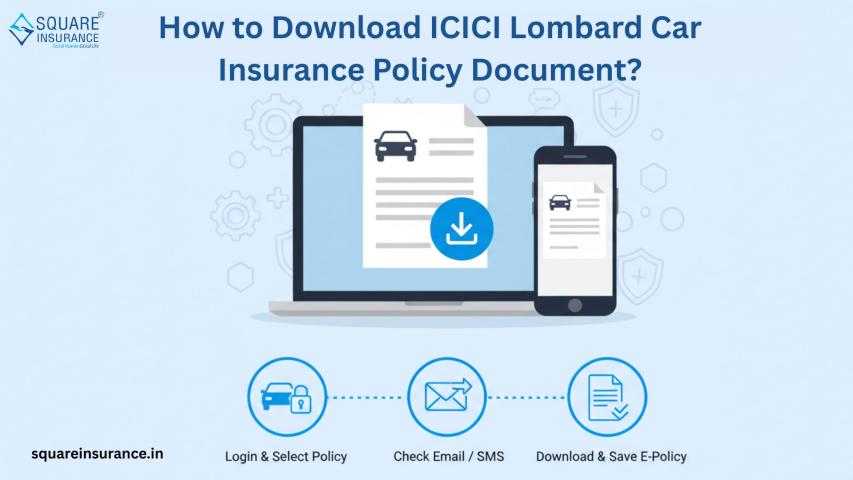

9. Opt for Digital and Paperless Policies

Digital car insurance policies often cost less

due to reduced operational expenses.

Advantages include:

·

Lower premiums

·

Instant policy issuance

·

Easy access to documents

Choosing a digital policy is both convenient

and budget-friendly.

Conclusion

Affordable car insurance is not about

sacrificing protection—it’s about making informed choices. By comparing

policies, selecting the right coverage, maintaining a good driving record, and

leveraging benefits like No Claim Bonus, car owners can significantly reduce

their insurance costs.

Services like Square Insurance help simplify the process by enabling

users to compare plans, understand coverage options, and choose policies that

align with their budget and needs. With the right approach, finding affordable

car insurance becomes straightforward and stress-free.

Frequently Asked Questions

1. How can I get cheaper car insurance?

Comparing policies, maintaining a clean

driving record, and selecting coverage based on actual needs are effective ways

to reduce costs.

2. Does a higher deductible really reduce

premium?

Yes, opting for a higher voluntary deductible

lowers the insurer’s risk, which results in a lower premium.

3. What is No Claim Bonus in car insurance?

No Claim Bonus is a discount offered for every

claim-free year and can significantly reduce renewal premiums.

4. Are online car insurance policies

reliable?

Yes, digital policies are issued by licensed

insurers and offer the same coverage as offline policies.

5. Should I remove add-ons to lower my

premium?

Remove only those add-ons that are not

relevant to your vehicle’s age, value, or usage.