Buying car insurance is an essential

part of responsible vehicle ownership. In India, the car insurance market has

grown rapidly, offering multiple options for comprehensive and third-party

coverage. However, choosing the right policy can be overwhelming due to the

number of insurers, policy types, coverage options, and add-ons available.

Making an informed decision ensures your vehicle, finances, and peace of mind

are fully protected.

This guide explores the top factors to consider before buying car insurance in India in 2026, helping you make a choice that balances

cost, coverage, and convenience.

1.

Type of Car Insurance Policy

Car insurance policies in India

mainly come in two types:

Comprehensive

Insurance

- Covers damages to your car and third-party liabilities.

- Includes protection against accidents, theft, natural

disasters, fire, and more.

- Offers higher premiums but provides broader coverage.

Third-Party

Insurance

- Mandatory by law.

- Covers only damage or injury caused to another person

or their property.

- More affordable but limited in coverage.

2.

Insured Declared Value (IDV)

The IDV is the maximum amount

your insurer will pay in case of total loss or theft.

- It depends on your car’s age, make, model, and current

market value.

- Choosing an accurate

IDV is crucial: too low may reduce claim settlement, too high

increases premiums.

Tip: Compare the IDV with your car’s current market value and

choose a policy that balances protection and affordability.

3.

Premium Amount

While it’s tempting to choose the

cheapest policy, premium cost should be weighed against coverage:

- Compare multiple quotes to get the best value.

- Look for discounts

for no-claims history, safer cars, or multiple policies.

- Avoid compromising essential coverage for lower

premiums.

4.

Add-On Covers

Add-ons enhance your basic policy

with extra protection. Popular options include:

- Zero Depreciation Cover: Ensures full claim for car parts without depreciation.

- Engine and Gearbox Protection: Covers mechanical failures not included in standard

policies.

- Roadside Assistance:

Offers emergency help during breakdowns or accidents.

- Return to Invoice Cover: Helps recover the full invoice value in case of total

loss.

Consideration: Choose add-ons based on your car’s age, usage, and personal

risk preference.

5.

Insurer’s Claim Settlement Ratio (CSR)

The Claim Settlement Ratio

reflects how efficiently an insurer settles claims:

- A higher CSR indicates reliability and faster claim

settlement.

- Check the CSR from official insurance data or annual

reports.

- Avoid insurers with consistently low CSRs, as this may

lead to delays during emergencies.

Tip: CSR is especially critical for comprehensive policies,

where claims are frequent and high in value.

6.

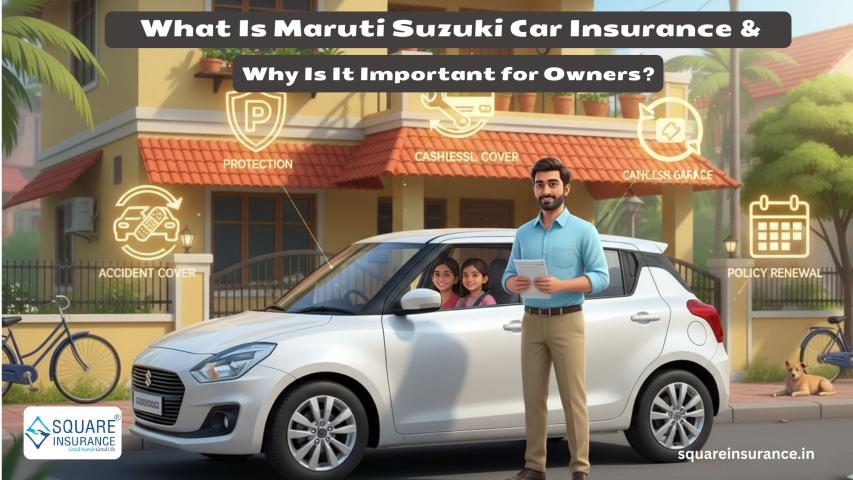

Network Garages and Cashless Facilities

Cashless service at network garages

makes claim processing smoother:

- Check the insurer’s list of authorized garages near your location.

- Ensure the network includes garages that provide quick repairs and quality service.

- Cashless facilities save time and reduce out-of-pocket

expenses during repairs.

Tip: For new cars or high-value vehicles, a broad network of

service centers is a major advantage.

7.

Policy Renewal and Customer Service

Seamless renewal and responsive

customer service are crucial:

- Check if the insurer provides online renewal and reminders.

- Look for customer support availability through phone, chat, and email.

- Read reviews for response time, claim guidance, and policy support.

8.

Coverage Exclusions

Every policy has exclusions, so it’s

important to read the fine print:

- Common exclusions include wear and tear, intentional damage, or use in races.

- Verify the exclusions to ensure your policy aligns with

your needs.

Tip: Understanding exclusions prevents surprises during claim

settlements.

9.

Discounts and Loyalty Benefits

Some insurers offer discounts for:

- No-claims bonus (NCB): Reduces premium for claim-free years.

- Multiple car policies: Discounts when insuring more than one vehicle.

- Safe driving:

Some policies track driving behavior for rewards.

Consideration: Factor these benefits into your decision to lower long-term

costs without compromising coverage.

10.

Ease of Policy Management

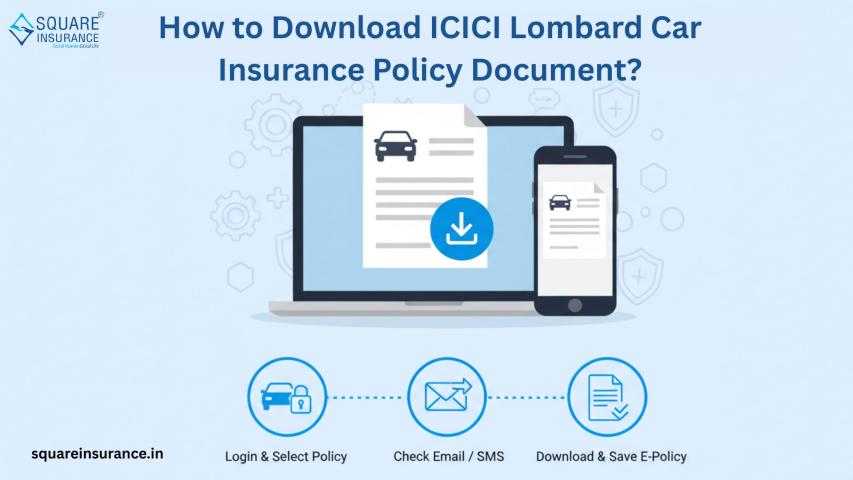

Digital tools simplify policy

management:

- Check if the insurer provides a mobile app or online portal.

- Features like policy

download, renewal reminders, claim filing, and premium payment save

time.

- Ensure secure and easy access to your insurance

documents.

Tip: For busy individuals, digital accessibility is an essential

convenience.

Conclusion

Choosing the right car insurance in

India requires careful evaluation of multiple factors, from policy type, IDV, and premiums, to claim settlement ratio, network garages,

add-ons, and digital services. Taking the time to compare and select a

suitable policy ensures that your car is protected, claims are processed

efficiently, and your finances remain secure.

Platforms like Square Insurance

simplify this process by offering a centralized

platform to compare policies, track renewals, and manage add-ons, making

it easier for vehicle owners to select the right coverage. With informed

choices, you can enjoy complete

protection, financial security, and peace of mind.

Frequently

Asked Questions

1.

What is the best type of car insurance in India?

Comprehensive insurance is

recommended for new or high-value cars, while third-party insurance meets legal

requirements at a lower cost.

2.

What is IDV in car insurance, and why is it important?

IDV (Insured Declared Value) is the

maximum claim amount for your car in case of theft or total loss. Choosing an

accurate IDV ensures proper coverage and premium balance.

3.

Should I buy add-on covers for my car insurance?

Yes, add-ons like zero depreciation,

roadside assistance, and engine protection provide additional security and

reduce out-of-pocket expenses during claims.

4.

How do I check an insurer’s reliability before buying?

Check the claim settlement ratio

(CSR), customer reviews, and network garages to evaluate reliability.

5.

Can I buy car insurance online in India?

Yes, most insurers offer online

policy purchase, renewal, and claim filing through official websites and mobile

apps.